Making Tax Digital: What UK Small Businesses Need to Know

If you run a small business in the UK, chances are you’ve heard of Making Tax Digital (MTD). But what does it actually mean for you? Do you need special software? Is it just for VAT, or does it apply to Income Tax too? And when do you need to make the switch?

We’re here to answer these questions in plain English.

At Business Accounting Basics, we specialise in helping small business owners, freelancers, and landlords stay compliant while keeping things simple.

Let’s break it down.

What Is Making Tax Digital?

Making Tax Digital is a UK government initiative designed to make the tax system more efficient and easier to navigate. Instead of submitting your tax returns manually or on paper, MTD requires you to keep digital records and submit updates to HMRC using compatible software.

It started with VAT, and is being extended to Income Tax and eventually Corporation Tax. But don’t worry, we’ll explain what this means for you and how to stay on top of it.

Who Needs to Use MTD?

There are many people who may need to use MTD, such as:

Businesses Registered for VAT

If your business is VAT-registered and your taxable turnover is over £90,000, MTD is already mandatory. You must use Making Tax Digital Software to record your VAT transactions and submit VAT returns to HMRC.

This is often referred to as VAT MTD, and it’s been in place since 2019.

Businesses Below the VAT Threshold

Even if your turnover is under £90,000, you can voluntarily join MTD for VAT. This can help you simplify your record-keeping and get you ahead of the curve.

Self-Employed and Landlords

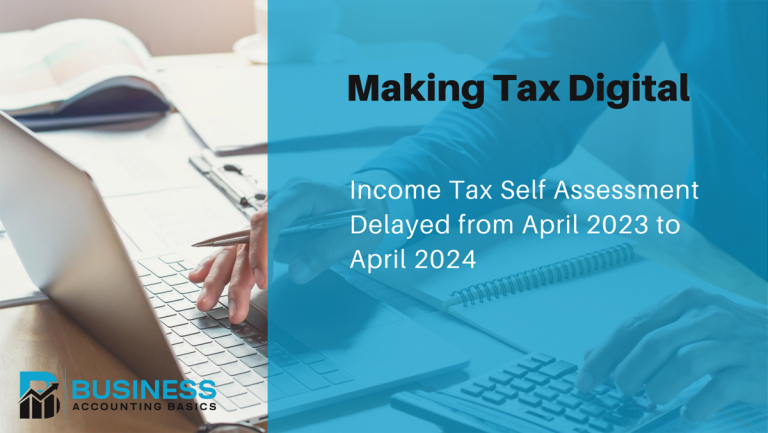

Making Tax Digital for Income Tax (also known as MTD for ITSA) is on the horizon. From April 2026, self-employed people and landlords earning over £50,000 a year will be required to follow MTD rules. Those earning over £30,000 will be added a year later.

What Records Need to Be Kept?

Under MTD, you must keep certain records digitally. These include:

- Sales and income

- Business expenses

- VAT records (if registered)

- Details of assets and purchases

- Income and expenses if you’re a landlord

You’ll need to use compatible Software for MTD to manage these records and send regular updates to HMRC. That’s where we can help.

What Is Making Tax Digital Software?

Making Tax Digital Software is an HMRC-recognised program that lets you:

- Keep digital records

- Categorise transactions

- Submit returns directly to HMRC

- Generate reports

- Stay on top of deadlines

What’s the Benefit of MTD?

You might be thinking, “Do I really need this?” The short answer is yes, if you want to stay compliant. But there are also some real benefits, including:

- Fewer mistakes – Digital records reduce the risk of manual errors

- Less stress at year-end – Regular updates mean no more last-minute panic

- Better visibility – Real-time data helps you track income and expenses

- Easier collaboration – Accountants and bookkeepers can access your data quickly

Do You Still Need an Accountant?

Absolutely! While MTD software makes record-keeping easier, it doesn’t replace expert advice.

They can help you:

- Choose the right software for your needs

- Set it up correctly

- Train your staff or sole traders on how to use it

- Review data and submit final returns

- Stay on track with deadlines

MTD is designed to simplify tax, but it still pays to have a professional who can support your business growth and help you avoid penalties.

Common Questions About Making Tax Digital

Some of the common questions we get include:

Can I keep using spreadsheets?

Yes, but only if they’re linked to MTD-compatible software. You can’t submit returns directly from Excel without a ‘bridging tool’.

Do I need to register for MTD separately?

If you’re VAT-registered, you must sign up for MTD through your Government Gateway. Your software may also guide you through this.

When do I need to start?

VAT MTD: – Already in effect

MTD for Income Tax – Starts in April 2026 for income over £50,000

Corporation Tax – Expected after 2026

Check HMRC’s MTD guidance for up-to-date timelines.

How We Can Help

At Business Accounting Basics, we’ve supported hundreds of UK small businesses, sole traders.

If you’re feeling overwhelmed by Making Tax Digital, or you’re not sure where to start, don’t panic. You don’t have to figure it all out on your own. Our tools and downloads are on hand to help.