FREE Sales Invoice Template

Our free sales invoice template is available to download and use whenever you need it. It works with Microsoft Excel and Google Sheets. If you require any changes or colours to fit in with your business, please get in touch, as we can complete it for a small fee.

We have created two sales invoice templates, VAT and non-VAT. We have developed both in Excel; this allows for calculating the totals once the figures are entered and reduces the risk of errors.

What is a Sales Invoice?

A sales invoice is a document a business sends to a customer that acts as an official sale record. It functions as a detailed bill. Here’s a breakdown of its key features:

- Request for Payment: It asks the customer to pay for the goods or services.

- Transaction Details: It outlines what was sold, the date of the sale, and the total amount owed.

- Payment Terms specify how and when the payment is due (e.g., net 30 days).

- Legal Record: It serves as a legal transaction record for the buyer and seller.

- Accounting Purposes: An important document for a business’s accounting processes, helping track income and sales tax.

Essentially, it’s a way to ensure everyone is on the same page about what was sold, how much it costs, and when the money is due. Using a free invoice template will make the process easier.

Why use a Sales Invoice Template?

When providing a sales invoice to a client, it is essential to leave a good, lasting impression; having a well-designed invoice is one way to achieve this. Another way to get an invoice to stand out is to print it on coloured paper.

Utilising a template for your invoices eliminates the repetitive task of entering your company’s details each time you need to issue one. This saves valuable time and reduces the likelihood of errors. Additionally, a well-designed template can automatically calculate the total amount due based on your input figures. This feature ensures accuracy in your billing process.

An alternative to a template is using a duplicate book or printing a form and completing it by hand.

What are the Alternatives for Issuing Invoices?

Many accounting software packages include invoicing software. These allow you to set up sales invoice templates, upload logos, and email invoices; some have recurring invoices. The main advantage of using accounting software is that it allows you to issue commercial invoices that look professional and keep track of outstanding invoices.

Many have a built-in professional invoice template allowing you to change the colours to match the company branding. Others have a selection of sales invoice templates with different layouts. Xero allows you to download sales invoice templates, amend them in Word and upload them.

One advantage of using accounting software is that it includes payment applications. Using them often means that you will receive payment faster.

FreshBooks, QuickBooks, Xero and Sage are the best bookkeeping software to consider. If you are after free accounting software, we recommend Pandle. Check our best invoicing software options.

Best Small Business

| From £16 per month |

| Free Trial |

| Integration with apps |

| 90% Discount – 6 Months |

For Business Owners

| From £15 per month |

| Free Trial |

| Pricing by Client Number |

| 50% Discount – 3 Months |

Best Free

| From £12 per month |

| 1,000 invoices PA Free |

| Integrate with Zoho Apps |

| No Discount |

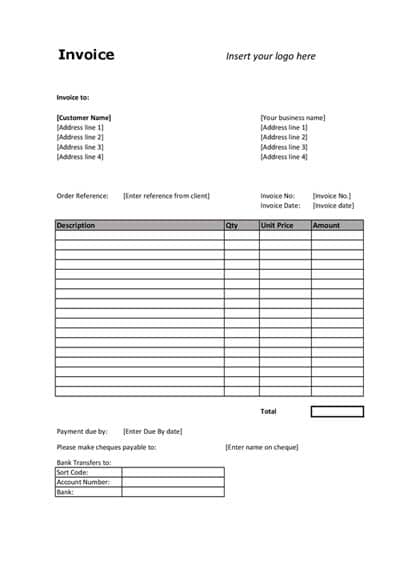

Instructions for Free Invoice Template UK

Download the invoicing spreadsheet below and choose between VAT and non-VAT. and open it up in Excel.

The first step is setting up a template for all your sales invoices. For this, you add your business details of logo, name and address:

The sheet is protected to prevent the columns with calculations from being accidentally changed. To add a company logo, the sheet needs to be unprotected first—to do this, go to file > info > protect workbook > click unprotect (password is blank). Once finished, you can protect it again using the same instructions.

You can add a logo by clicking on the area, selecting insert, a picture from a file, and choosing the correct logo. If you do not have a logo, you can delete this section. If you want a new logo, I have used Fiverr and Legiit for logos and have some great designs.

Complete the section for your company name and business address. At the bottom of making the payment, enter either your bank details or cheque payee.

Important: If you are a Limited Company, it is a legal requirement to include your company registration number, the business name on the certificate of incorporation and the registered address. There is space on the bottom two rows of the invoice template to include it.

If you are VAT registered, you must include the business’s VAT registration number and show the sales tax.

Once all the information has been entered, you will have a template that you can use repeatedly. Save this file so that you can find it easily. If you invoice a customer regularly, it may be worth setting one up for them so you do not need to enter the details each time and save it under the client’s name.

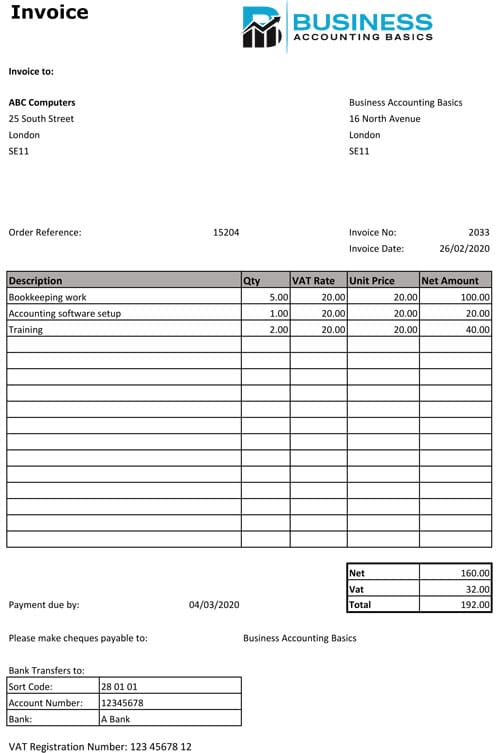

How to issue Sales Invoices

Get Started with Your Sales Invoice:

- Unique Invoice Number: Open your sales invoice template and assign a unique invoice number. Avoid starting with “1” as it suggests a new business. Consider a numbering system that incorporates the year (e.g., INV-2024-001).

- Invoice Details:

- Date: Include the date the invoice is created.

- Customer Reference: Add any reference provided by your customer, such as a purchase order number or contact name.

- Itemised List:

- Description: Clearly describe the service or item sold.

- Quantity: Enter the number of units sold.

- Unit Price: Indicate the price per unit.

- Detailed Descriptions: Provide as much detail as possible to minimize questions from the customer.

- VAT (if applicable):

- VAT Percentage: For VAT-registered businesses, include the VAT percentage for each item.

- Automatic Calculations: Most templates automatically calculate the VAT amount and total invoice amount.

- Payment Terms:

- Due Date: Specify the date payment is due based on your agreed-upon credit terms (e.g., 7, 14, or 30 days from the invoice date, or net monthly).

- Saving and Sending:

- Unique Reference: Save the document with a clear, easy-to-find reference, typically the invoice number.

- Optional Client Reference: Consider including the client name followed by the invoice number (e.g., Acme Ltd – INV-2024-001) for better organisation.

- Delivery Options:

- Email or Post: Send the invoice electronically or by mail to your client.

- Paper Records: Print a copy for your files if you maintain paper records.

Open up your sales invoice template and allocate a unique invoice number. Never start your numbering system from 1, as it will look like you are a new business. Choose a number system that fits, and maybe use the year first.

Add the sales invoice date and any reference that your customer has supplied, such as a purchase order number or contact name.

The description of the service or item sold, quantity, and unit price can then be completed. Ensure you give as much information as possible; this reduces the chances of the customer querying the document.

If using the VAT version, enter the VAT percentage on each line. The VAT and total will automatically be calculated.

Complete the due date; these are the payment terms agreed upon with the customer regarding the sale. If you offer credit, it may be 7, 14, 30 days or net monthly.

When everything is finished, save the document with a unique reference that you can find easily. In most cases, it will be the invoice number, but you may want to use the client name followed by the invoice number.

The invoice can be emailed or posted to the client. If you keep paper-based records, print or save a copy for your records.

For more information on what needs to be included in a sales invoice, read the guide on HMRC.

Sample of Invoice Templates

Below is an example of a VAT sales invoice issued to a customer for accounting services. The sales tax is calculated automatically in the template.

Keeping Track of Your Sales Invoices

One of the most effective ways to manage and track invoices is using our sales invoice list template. This template allows you to record all your invoices in one organised document, making it easy to keep track of payments and due dates. It also has a section specifically for tracking overdue invoices, ensuring no payment slips through the cracks.

Excel Sales Invoice Template UK – Licence Agreement

By downloading our free invoice templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

You agree to the licence agreement by downloading the free sales invoice template by clicking on the link.

Sales Forecasting

Sales forecasting is essential to the success of any business, as it allows you to plan for future income. Forecasting sales require a combination of market research, analysis of past performance, and understanding of customer needs. To assist, we have created a sales forecast template.

Statement of Account

Once an invoice is sent to a customer, tracking when it is due for payment and when it is paid is important. At the end of each month, it is worth sending a statement of account for each customer, read our guide and download the free spreadsheet.

Conclusion to Excel Free Sales Invoice Template

When issuing sales invoices, it’s important to include all the necessary information to avoid confusion or customer queries.

Our free Sales Invoice Template UK can help make the process quick and easy. Check out the Microsoft website if you are looking for an alternative commercial invoice template.

Excel Bookkeeping Templates

Check out our other Excel Bookkeeping templates, including word receipt template, cash book, profit and loss, balance sheet and petty cash.

We also offer a proforma invoice template.

Return from sales invoice template to Excel Bookkeeping Templates page.

Please read our guide on the best accounting software for small businesses.