Beginner Bookkeeping for Business

Are you thinking of starting your own business? Congratulations! Taking the first step toward entrepreneurship is very exciting. Before you get too carried away with all of the possibilities for your new venture, though, it’s essential to get a handle on the basics of bookkeeping.

Our beginner bookkeeping guide will help you understand what you need to do to keep track of your business finances. You’ll learn about setting up a system for recording income and expenses, double entry bookkeeping and more. After reading this guide, you’ll be ready to start building a successful business!

Bookkeeping is the processing of the financial transactions that make up the accounts; these include invoices, receipts, bills, journals, and statements.

When starting, it is worth taking your time to do some research. Speak to a bookkeeper or accountant, read articles online and research software or spreadsheets.

How easy is bookkeeping?

Maintaining accurate small business bookkeeping records is critical for any business, large or small. Without a clear record of income and expenditures, it can be challenging to make sound financial decisions, manage cash flow, or even prepare tax returns. However, many business owners find bookkeeping a chore, and it can be easy to fall behind.

The good news is that several tools and resources are available to make bookkeeping easier. An online accounting system can automate many of the tasks associated with bookkeeping, and a variety of smartphone apps can help track expenses on the go. By using these tools, business owners can free up time to focus on other aspects of their business. In short, while bookkeeping may not be easy, there are several ways to simplify it.

Beginner bookkeeping – where to start

Depending on the size of the project you are working on will depend on how you complete your records; there are several different choices:

Excel templates can be an excellent way to get up and running. We have some free Excel bookkeeping templates, including a cash book and a budget template. These are suitable for personal or small businesses. All our templates are easy to use, include instructions and show examples.

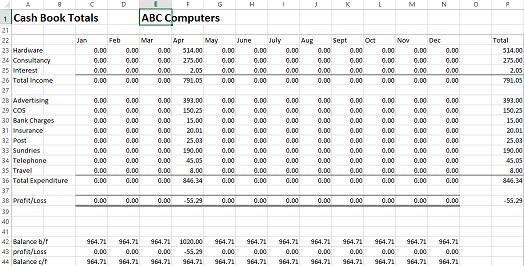

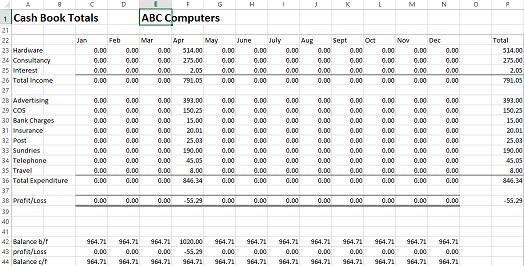

Below is an example of our simple cashbook template.

Accounting book – If you are keeping track of simple accounting, a book may be the answer. It will include columns for listing details and analysis of income and expenditure. An analysis book is a manual way of completing the records.

Accounting software – There is lots of different software available. Most are now all online, so there is no upfront fee. They range from FreeAgent and Pandle, which are free to QuickBooks, FreshBooks, Xero and Zoho Books; all have a monthly fee. Most provide a free trial; look at a few to see which best suits your small business needs.

Best Small Business

| From £16 per month |

| Free Trial |

| Integration with apps |

| 90% Discount – 6 Months |

For Business Owners

| From £15 per month |

| Free Trial |

| Pricing by Client Number |

| 50% Discount – 3 Months |

Best Free

| From £12 per month |

| 1,000 invoices PA Free |

| Integrate with Zoho Apps |

| No Discount |

The advantage of using a bookkeeping software package is that as the business grows, a good bookkeeping software will grow with it, but you may need help getting started. Read our accounting software reviews to help choose the best package.

Do I need a Bookkeeper or Accountant?

As a business owner suggest you start by speaking to a bookkeeper or accountant. This is an important first step in getting your finances in order. By getting professional help, you can ensure that your money is working for you in the most efficient way possible.

If you can complete the bookkeeping yourself, it may be that you require their services at year-end to ensure the records are correct to submit to either Companies House or HMRC for self-assessment.

You may want to use the services of a bookkeeper regularly; this will leave you more time to run your business knowing that the accounts are in safe hands.

Beginner Bookkeeping – Keeping Records

You will need to keep all your source documents for at least 6 years, from sales invoices and purchase receipts to expenses. Many payments are now online, so it is worth printing off or storing receipts electronically as you spend money.

If you store files electronically, either use the hard disc on the computer, cloud storage or documents uploaded directly to an accounting software package.

Depending on the amount of paperwork depends on the filing system needed. If there are only a few records, then a folder or you may need a lever arch file to keep the sales and purchases separately. You will need a filing system that can either be month by month are alphabetically by supplier and customer.

How often should I complete Accounts? How frequently you complete the accounting records depends on the size of the information you are recording.

A large business will need information daily and will have a team to do the work. A small business may only have a few records and needs to get the figures for the year-end. Most require the information on a weekly or monthly basis.

Accounts each year will have to be submitted to either Companies House for Limited Companies or HMRC if you are self-employed.

Beginner Bookkeeping – Single Entry or Double Entry Bookkeeping

A single-entry system is a simple record of your income and expenses shown in a book or spreadsheet. The single-entry system is used mainly for very small businesses, charities or personal use.

Double entry is more complicated and records transactions twice in the system. A couple of examples are that you purchase some stationery; the transactions will post to both the expenses and bank balance. The double entry will produce a Profit and Loss account and Balance sheet, which most businesses will need.

If you use a double entry system, it is easier to use accounting software, which will post the double entry. An example is the business issuing a sales invoice; the amount will be posted to both the sales on the profit and loss and the debtors on the balance sheet.

Further information is available on this site to help get you started; take a look at our bookkeeping basics for further details.

Cash Basis vs. Accrual Accounting

There are two different methods for producing accounts, cash basis and accrual. While cash-based accounting focuses on actual cash flow, accrual accounting records income when it’s earned and expenses when they’re incurred, regardless of when money changes hands. For example, if you invoice a client in December but receive payment in January, with cash basis accounting, you’d record the income in January. With accrual accounting, you’d record it in December.

Financial Statements

The financial statements are prepared once all the financial transactions are posted for a period. Below is a short introduction to each one:

Profit and Loss or Income Statement

A profit and loss statement (P&L) is a financial report summarising the income, costs, and expenses incurred during a specific period, usually a month, quarter or year.

The income statement is one of the most important tools in business, as it provides insights into a company’s overall financial health. By carefully analyzing the P&L statement regularly, businesses can ensure that they are making sound financial decisions.

Balance Sheet

A balance sheet is a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Its main purpose is to give shareholders and other interested parties an idea of the company’s financial health.

The assets section includes everything from cash and investments to inventory and property. The liabilities section includes things like accounts payable and loans. The shareholder’s equity section represents the amount of money invested in the business.

Cash Flow Forecast

A cash flow forecast is a tool for predicting a company’s future cash flow. The forecast is based on past cash flow data, as well as current and expected economic conditions.

The goal of the cash flow forecast is to provide a company with an estimation of its future cash needs so that it can plan accordingly. The forecast can also be used to identify potential problems that may arise in the future and to make decisions about how best to use the company’s resources.

Beginner Bookkeeping – Bookkeeping Terms

One of the things that business owners find difficult when starting bookkeeping and accounting are the terms used. Below are a few of the most common terms, but we have a complete list.

Accounts Receivable – Also known as the sales ledger, it shows how much money is owed by customers.

Accounts Payable – Also known as the purchase ledger, shows all the bills a small business owes to a supplier.

Balance Sheet – A balance sheet shows a snapshot of the business’s finances.

Chart of Accounts – These are the codes used in accounting software. They consist of assets, liabilities, equity, sales and expenses.

Profit and Loss – A report to show income and expenditure for a period.

Double Entry Bookkeeping – A transaction always has two entries that are equal a debit and credit.

Basic Accounting Equation – The image below shows the basic accounting equation.

[maxbutton id=”4″ url=”https://www.businessaccountingbasics.co.uk/bookkeeping-terms/” text=”Bookkeeping Terms” ]

Beginner Bookkeeping Frequently Asked Questions

Can I do Bookkeeping Myself?

You may wonder if you can do your own bookkeeping if you’re a small business owner. The answer is that it depends. If you have a very small business with few transactions, you may be able to get away with doing your own bookkeeping.

However, if you have a larger business or more complex financial transactions, hiring a professional bookkeeper is probably best. Professional bookkeepers are trained to keep track of all your financial information and ensure it’s accurate.

How Do You Do Basic Bookkeeping?

The easiest way is to use accounting software to track your financial transactions. This will help you keep track of your income and expenses and give you a clear picture of your financial situation.

If you are uncomfortable using accounting software, you can use Excel spreadsheets or a ledger book.

Are there any online courses?

The Internet has many free online courses to help business owners learn bookkeeping. At Business Accounting Basics, we have lots of information; using the search at the top will find the best articles.

We have also written a post with the best free online courses, including a brief description.

Beginner Bookkeeping Conclusion

When starting the bookkeeping journey, take your time making the right choices for the business. Look at storage and software options to determine which is best.

If you need assistance, speak to an accountant or bookkeeper; they might even save you money in the long run.

Return from Beginner Bookkeeping to Business Accounting Basics Page.

accounts receivable,