Small Business Accounting Software

Options for your business accounting software

Finding the right accounting software can save you time, reduce stress, and help keep your business finances in order. With numerous options available, it’s essential to select a solution that aligns with your business size, budget, and workflow. Whether you’re a sole trader needing to track expenses and file VAT returns or a growing business managing payroll and invoicing, this guide will help you compare the most popular UK accounting software, like FreeAgent, QuickBooks, Xero, and Sage, so that you can make an informed decision.

In this article, we will look at the following:

- How to choose the best solution

- Different accounting features

- The most popular paid solutions include Xero, QuickBooks, Sage UK and Zoho Books.

- Free accounting software, including Pandle, Zoho and QuickFile

A good starting point may be to consult with your accountant or bookkeeper, if you have one. They may have a product that they use and can recommend. It is also worth contacting other businesses or looking on forums for recommendations. Just remember that one solution doesn’t fit all businesses, and there may be hidden fees.

Many accounting software providers offer free trials, allowing you to test their features and determine which one best suits your business needs. We offer the following discounts:

- Xero – 90% discount for 4 months – Ideal for growing businesses

- QuickBooks – 90% discount for 7 months – A fantastic solution with numerous additional features.

- Sage UK – See website for current offers – Ideal for growing businesses

- Zoho Books – Great free version for up to 1,000 invoices per year, and then plans are available for upgrade

Most accounting software options are cloud-based, though some can be installed on your computer. When choosing the right solution, consider which features your business needs most.

Read our QuickBooks vs. Xero comparison, which examines pricing and features.

Online Accounting Software Features

Below are some of the main features of accounting software along with a comparison table, which is also available as a free PDF. Good accounting software can help automate daily tasks and provide better oversight of your company’s finances.

Making Tax Digital Software

Making Tax Digital (MTD) is a government initiative from HMRC aimed at making tax reporting more accurate and efficient. Businesses over the VAT threshold are now required to keep digital records and submit VAT returns using MTD-compatible software.

From April 2026, the Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) will also apply to self-employed individuals and landlords earning over £50,000, with those earning over £30,000 joining in April 2027. This means paper records and manual submissions will no longer be accepted.

Accounting software that supports the Making Tax Digital rules helps you stay compliant by keeping digital records, automatically calculating VAT, and submitting returns directly to HMRC.

A complete list of HMRC recognised accounting software is available.

Invoicing

Issuing invoices promptly and automatic payment reminders is key to maintaining healthy cash flow. With accounting software—especially those with mobile apps—you can create and send invoices on the spot, even immediately after finishing a job.

When choosing a package, check whether it includes unlimited invoicing. Some entry-level plans limit the number of invoices or clients, which can quickly necessitate an upgrade to a more expensive plan. Most software offers customisable templates, allowing you to include your logo, payment terms, and all necessary details to get paid quickly and correctly.

Many platforms also support online payments through providers such as Stripe, PayPal, or their built-in systems. This makes it easy for customers to pay straight from the invoice. While convenient, these services typically charge a fee, so offering the option to pay by bank transfer might incur additional costs, but you could receive payment faster.

Expense Tracking and Expense Management

It’s common for bookkeepers to receive a box of receipts at year-end, which can cost your business time and money through manual data entry. Using accounting software helps you stay organised by tracking expenses as they occur, reducing administrative tasks and saving on bookkeeping fees.

Many platforms let you snap a photo of a receipt with your phone and upload it instantly. You can also import, categorise, and link receipts to specific projects or clients within some platforms, making expense management much easier.

Most accounting software includes tools for tracking bills and due dates, though some budget plans may limit these features. It’s worth checking what’s included before choosing a plan.

If you prefer to track expenses using Excel, we have expense templates available for download. It is ideal for tracking mileage and expenses paid out of your funds.

Cash Flow

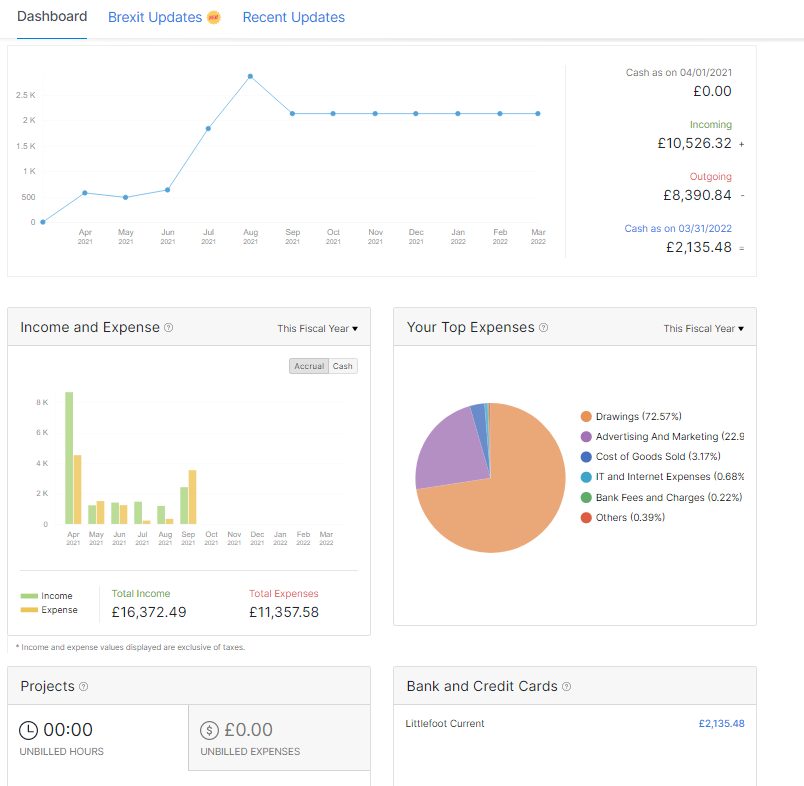

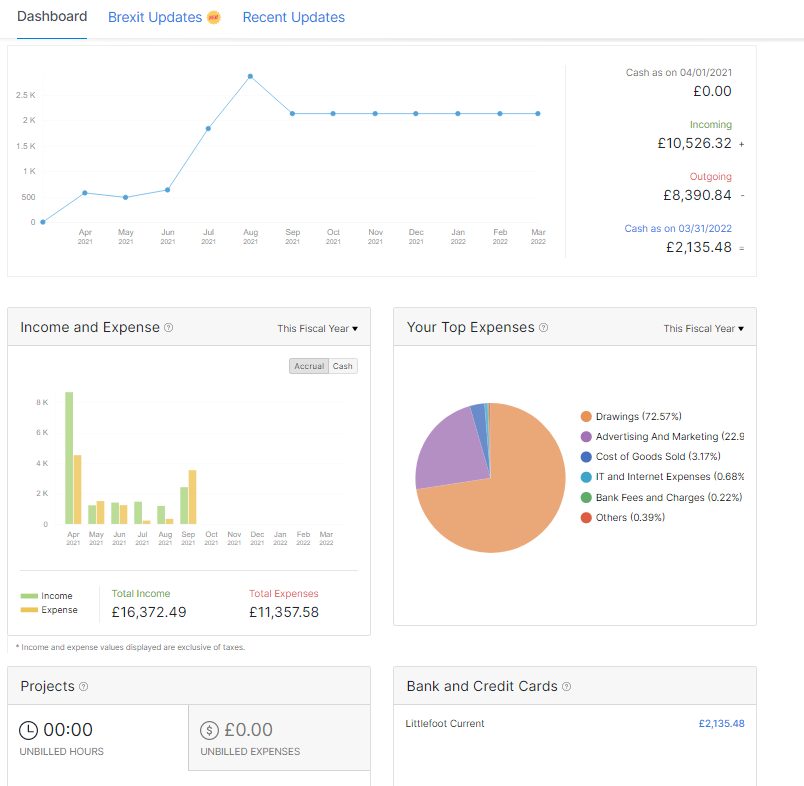

Online Accounting software helps you stay in control of your cash flow by automatically tracking your income and expenses. With real-time data, you can easily see how much money is coming in, what’s going out, and when. This visibility is crucial for avoiding cash shortages and making sure you have enough to cover bills, payroll, and other expenses.

Many tools connect directly to your business bank account, allowing transactions to be updated automatically. You can generate cash flow reports, set alerts for low balances, and even forecast future cash flow based on trends. By identifying issues early and planning, accounting software enables you to make more informed financial decisions and maintain a smooth business operation.

Bank Accounts

One of the most useful time-saving features in accounting software is the bank feed. It automatically imports transactions from your bank accounts—including current, savings, and credit card accounts—directly into your software.

Using secure Open Banking connections, your transactions are downloaded daily, so you always have up-to-date financial records. Once imported, you can review and match each transaction to invoices, bills, or expenses, or post them directly into your accounts.

To speed things up even more, many platforms let you set up rules—for example, automatically categorising recurring payments, such as software subscriptions or supplier bills. This means future transactions can be reconciled with just one click.

Inventory Management or Stock

If your business holds stock, tracking inventory accurately is essential. It helps you avoid overstocking, prevent shortages, and maintain a healthy cash flow.

Popular accounting software, such as Xero, QuickBooks, and Sage, includes built-in inventory tracking features. Zoho Books also offers inventory management through a separate app, making it a flexible option for growing businesses.

Key inventory features to look for include stock levels, reorder points, stock valuation, and tracking work-in-progress. If your accounting software doesn’t offer the level of detail you need, there are dedicated inventory management systems that can integrate with your accounting software or operate alongside it.

Payroll

Many accounting software packages offer built-in payroll or integrate with payroll add-ons, making it easier to pay your staff correctly and on time. With payroll features, you can automatically calculate wages, tax, National Insurance, and pension contributions while staying compliant with HMRC’s Real Time Information (RTI) requirements.

Some systems also allow employees to access payslips online and track leave and holidays. Be aware that payroll is often an additional paid service; therefore, check what is included in your chosen plan.

Time Tracking

If your small business offers services, time tracking can be a valuable tool. It allows you to record time in real-time or log hours worked later, helping ensure accurate billing. Software like Zoho Books and QuickBooks includes time tracking features in their mobile apps, making it easy to track hours on the go. Time entries can be linked to specific projects or clients, streamlining the invoicing process and helping you get paid for all billable work.

Mobile App

Many accounting software providers offer mobile apps, providing you with the flexibility to manage your finances from anywhere. With a mobile app, you can send professional invoices, capture expense receipts, track time, view reports, and even reconcile bank transactions—all from your phone or tablet.

This is especially useful for business owners who are often on the move, such as tradespeople, consultants, or freelancers. Apps from providers like QuickBooks, Xero, Zoho Books, and FreeAgent offer a wide range of features to keep your accounts up to date and your business running smoothly, regardless of your location.

Reports

Financial reports are a crucial component in understanding your business’s performance. Most online accounting software includes a variety of built-in reports, such as profit and loss statements, balance sheets, cash flow statements, and tax summaries. These reports provide a clear picture of your business’s performance, enabling you to make more informed financial decisions.

With just a few clicks, you can generate reports to track income, monitor expenses, review outstanding payments, and prepare for tax deadlines. Many tools also let you customise reports or filter by date, project, or customer, giving you the insights you need to stay in control of your finances.

Customer Support

Customer support is typically included but may be accessed via online chat, email, telephone, or accountants. Some offer support as part of their monthly subscription, while others may charge an additional fee.

Below is a quick breakdown of the top software applications.

| With integrations | Best For | MTD Compliant | Payroll | Time Tracking | Free Version | Integrations | Users |

|---|---|---|---|---|---|---|---|

| Xero | Small to medium businesses needing robust features | Yes | Add-on | Yes | No – from £16 | 1000+ apps | Unlimited |

| QuickBooks | Sole traders and small businesses wanting ease of use | Yes | Add-on | Yes | No – £10 for sole trader, £16 small business | 750+ apps | Essentials up to 3 users, Pro 5 users |

| Sage UK | Growing businesses | Yes | Add-on | With Sage HR | No – form £18 | 150+ for Sage Accounting | Unlimited |

| Zoho Books | Service-based businesses requiring app integration | Yes | No – UK | Additional App | Yes, up to 1,000 invoices per year | Zoho apps + 2000 extensions | Standard up to 3 users |

| QuickFile | Small businesses | Yes | No | No | Yes up to 1,000 ledger entries | 3 with the free plan, 400 with the paid plan | Unlimited |

Cloud Accounting Software

Cloud-based accounting software is an online solution that enables you to manage your business finances from anywhere, using a PC, tablet, or smartphone. Instead of installing software on a single device, your data is stored securely on remote servers and backed up automatically, eliminating the need for manual backups or data loss concerns.

You pay a fixed monthly fee, which usually includes updates and customer support. One significant benefit is that multiple users—such as your accountant or bookkeeper—can access the system simultaneously, making collaboration easy and efficient.

Comprehensive View of Your Business

Understanding your finances is crucial for making informed decisions and growing your business. Good accounting software gives you real-time access to cash flow, expenses, income tax, and VAT returns—so you always know where you stand.

With cloud-based tools, you can securely manage your accounts from any device, whether you’re in the office or on the move.

Online accounting software also helps you spot trends, create custom reports, and stay compliant with HMRC’s Making Tax Digital (MTD) rules.

Having a clear, up-to-date view of your finances allows you to save time, avoid mistakes, and focus on running and growing your business.

Best Accounting Software for Small Business

With numerous options available, selecting the right accounting software can be a challenging task. The best solution depends on your business size, budget, and the features you need, such as invoicing, VAT filing, payroll, or time tracking. Remember, most people will have a steep learning curve when they start. Below is a brief overview of five popular accounting software options used by small businesses in the UK.

QuickBooks Online

QuickBooks Online is a popular choice for sole traders and small businesses due to its ease of use and strong mobile app. It includes essential features like professional invoices, expense tracking, VAT submission (MTD-compliant), mileage tracking, and time tracking. A dedicated Sole Trader plan is available at a lower cost, offering streamlined tools for self-employed users and income tax estimates.

QuickBooks also allows multi-user access, but adding extra users requires an upgrade to a higher plan, which can increase monthly costs. Payroll is available as a paid add-on, and the software integrates with hundreds of apps and UK banks. Overall, it’s a flexible and scalable solution, but be mindful of plan limitations if your business grows.

Xero Business Accounting Software

Xero is a powerful and flexible cloud-based accounting platform, ideal for small to medium-sized businesses. It offers a wide range of features, including invoicing, online payments, bank reconciliation, expense tracking, MTD VAT submissions, payroll (as an add-on), and inventory management.

Xero’s clean interface and customisable dashboard make it user-friendly, even for those with little accounting experience. It also integrates with over 1,000 apps, covering a wide range of functions, from CRM and e-commerce to time tracking and project management. Xero is well-suited for businesses that need robust features and room to grow.

Sage

Sage Business Cloud Accounting is a UK-focused software package renowned for its robust compliance features and comprehensive support. It covers invoicing, bank reconciliation, cash flow forecasting, and MTD VAT returns. Sage also offers optional payroll and Construction Industry Scheme (CIS) features, making it a solid choice for businesses in the trades or construction industry. The interface is slightly more traditional compared to others, but Sage is highly reliable, with good customer support and scalable solutions for growing businesses. It’s particularly appealing to users who prefer a mix of cloud and desktop options.

FreeAgent

FreeAgent is built specifically for freelancers, contractors, and small business owners in the UK. It simplifies everyday tasks like invoicing, expense tracking, bank feeds, VAT returns, and Self-Assessment. FreeAgent is fully compliant with HMRC’s Making Tax Digital requirements and is often praised for its clear, friendly interface.

One of its most significant selling points is that it’s entirely free for customers with business current accounts from NatWest, Royal Bank of Scotland, Ulster Bank or one transaction per month with Mettle. It’s beneficial for sole traders and small limited companies that want simple, hassle-free accounting.

Zoho Books

Zoho Books, an online accounting software, is a powerful and affordable option for service-based businesses and freelancers. It includes features like invoicing, expense tracking, time tracking, project management, and bank reconciliation.

A free plan is available, limited by the number of invoices you can send—ideal for businesses with light invoicing needs. Paid plans unlock more advanced tools like recurring invoices, automation, and custom reports.

While Zoho Books supports MTD VAT filing and integrates well with the wider Zoho suite, UK payroll is not available, which may be a drawback for employers.

Free Accounting Software

Several free accounting software options are available. They are limited in features but might be suitable. They are great for small business owners starting, and many of these free options are designed explicitly with UK businesses in mind, making them especially relevant to local needs. However, it is worth checking if they will grow with the business.

QuickFile

QuickFile is a UK-designed cloud accounting software that’s 100% free for small to medium-sized businesses with fewer than 1,000 ledger entries, making it a cost-effective yet feature-packed solution. Pricing for over 1,000 ledger entries is then £60 for 1 year. Bank feeds are £15 per month.

Pandle

Pandle is a free cloud accounting software designed for UK small businesses and freelancers. It offers features like invoicing, bank feeds, expense tracking, and VAT support. With a clean interface and easy-to-use tools, it’s an excellent choice for those new to accounting or working with a tight budget.

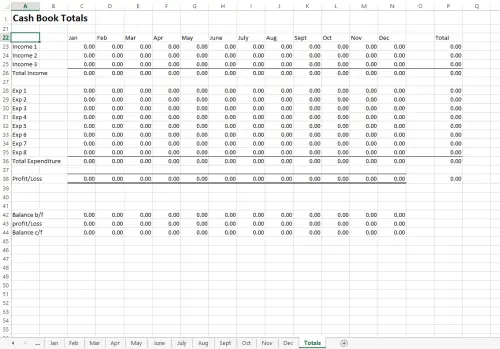

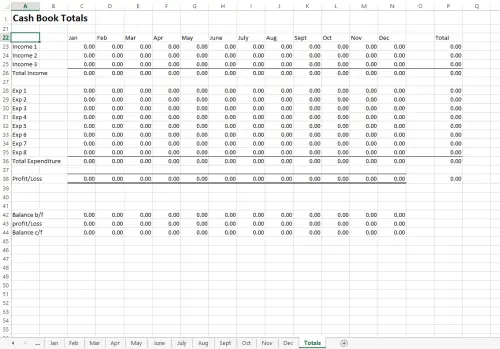

Free Microsoft Excel Templates

We’ve created a range of free Excel bookkeeping templates to help small businesses manage their finances. They’re simple to use and come with clear instructions. Templates include a cashbook for profit & loss, bank reconciliation, business expenses, and petty cash.

These templates are a great starting point, especially if you’re comfortable with Excel. However, please note that they are not suitable for Making Tax Digital (MTD) submissions. As your business grows or if you need to comply with MTD, upgrading to accounting software is the best way forward.

Free Excel Bookkeeping Templates

Small Business Accounting Software – Conclusion

Selecting the right online accounting software is a crucial step in managing your business finances effectively. Whether you start with a simple Excel template or invest in cloud-based software, having the right tools can save you time, reduce errors, and give you a clearer picture of your financial health.

As your business grows, features such as invoicing, bank feeds, VAT filing, and reporting become essential, and the right software can handle all of these tasks with ease. Take advantage of free trials, compare features, and choose a system that fits your business needs and budget. Staying organised with the right tools puts you in control and helps your business run smoothly.