Accounting Software for Charities

What is accounting software, and what are its benefits for non-profit organisations?

Managing finances effectively is essential for any non-profit, and accounting software for charities makes this easier than ever. It helps organisations track donations, manage restricted and unrestricted funds, record expenses, and produce clear financial reports for trustees and funders. By using the right software, charities can save time, reduce errors, and ensure transparency—allowing them to focus more on achieving their mission and less on administration.

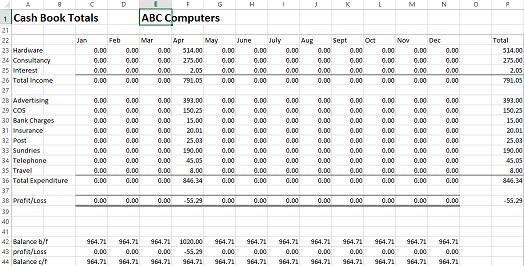

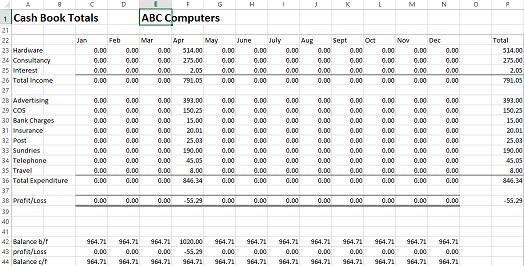

This post focuses on accounting software for non-profits, helping charities choose the right tools to manage their finances effectively. We also offer a free Excel cashbook, ideal for smaller non-profit organisations that prefer a simple way to record income and expenses. You’ll find all the details in this post.

What do Accounting Software packages offer?

Accounting software can be a beneficial resource for charities. It can help keep track of all income and expenses in one place and provide financial reports essential for making sound decisions about the charity’s future. Accounting software can also reduce the time required for bookkeeping and increase the accuracy of financial figures.

However, there are different types of accounting software, and the one you choose for your charity will depend on its size and type. In addition to standard packages available to anyone, specific packages tailored for non-profit organisations are available.

Using an off-the-shelf package can help you save time on bookkeeping activities. Bank feeds and scanning documents straight into the program are two specific features that might save time.

Growing companies

| From £18 per month |

| FREE Sole Trader & Trial |

| Sage Copilot Ai |

| 90% Discount – 6 Months |

Best Free Software

From £12 per month |

| 1,000 invoices PA Free |

| Integrate with Zoho Apps |

| No Discount |

How to choose the right accounting software for your non-profit organisation

When selecting accounting software for a non-profit organisation, it is essential to consider the specific features of your organisation. Some of the features to look for include:

- Tracking donations and expenses

- Track Gift Aid

- Restricted Funds or Fund Accounting

- Generate Reports

- Creating Invoices

- Payroll

- Receipt scanning

- Bank Feeds

- Gift Aid

You can compare different accounting software packages once you have identified your organisation’s essential features.

When choosing accounting software for charities, ease of use is one of the most critical factors. Many charities rely on volunteers or staff without formal accounting training, so the software should be intuitive, with clear dashboards and simple navigation. Look for a system that makes everyday tasks—such as recording donations, reconciling bank accounts, and generating reports—quick and straightforward. A user-friendly interface reduces errors, saves time, and helps everyone in the organisation stay confident when managing the charity’s finances.

Restricted Funds for Charities and Accounting Software

A common need for non-profit organisations is restricted funds or fund accounting. These are funds that the charity’s trustee must spend for a specific purpose, as agreed when donated.

Accounting software can help track restricted funds. Accounting software will provide accurate reports on the money donated and its use, increasing transparency for all users in the organisation.

If you are using an off-the-shelf package, it may help set up departments or classes to track the funds.

There are also specific packages for charities, making it easier to track fund accounting.

The Best Accounting Software for UK Charities in 2026

Below are our top five charities’ accounting options:

Visit FreshBooksSage Accounting Software

Sage UK is an excellent choice for non-profit organisations.

It offers 50% off the subscription price for charities, non-profit, societies and trusts. The software is designed to help organisations manage their finances efficiently and effectively. It’s a great way to keep track of donations, expenses, and other financial information.

The online form takes just a few minutes to complete. The software is easy to use, so even those less familiar with accounting can get started quickly.

If you are a registered non-profit charity, it is worth considering Sage.

Sage Pricing

A free trial is available, so you can try it before you buy.

-The monthly subscription fees start from £18 per month or £9 for UK charities.

-The Standard accounting package is £39 per month or £19.50 for UK charities.

It’s worth looking into if you’re a UK-registered charity, as there are discounts and a trial available to test it out first.

Visit Sage UK for a 50% discount for Charities

QuickBooks Online

QuickBooks Online is cloud-based software that lets you access your accounts from anywhere with an internet connection. This option is excellent for organisations with a remote workforce or volunteers.

QuickBooks is a well-known accounting software that charities can use to manage their finances. It is easy to use and helps track income and expenses. QuickBooks can also produce financial reports to help prepare for grant applications or tax filings.

One of QuickBooks’s essential advantages is that it can help quickly set up custom reports for different purposes. This allows charities to drill down into vast amounts of data and find patterns or irregularities. The software also helps charities manage their donor information and finances in one place.

When setting up QuickBooks accounts, you can choose the charity option if you are a registered charity or non-profit. Your accounts will include the specific categories and regulations required for charitable organisations.

QuickBooks Pricing

Intuit QuickBooks has a pricing structure the will suit most non-profit organisations in the UK.

Intuit QuickBooks Pricing

Self-Employed

- Prepare Self-Assessment Tax Returns

- Get Tax Estimates

- Send Invoices

- Track Mileage

- Separate Personal Expenses

- Manage Income & Expenses

- Free Onboarding

£1 for 7 months, then £10/month

Save £63 over 7 months

Simple Start

- Tax Estimates

- MTD VAT

- Invoices paid instantly

- Manage Income & Expenses

- Telephone Support

- Single User

- Track Mileage

- Estimates & Quotes

- Free Onboarding

£1.60 for 7 months, then £16/month

Save £100.80 over 7 months

Essentials

- Everything in Simple Start

- Manage Bills

- Multi-Currency

- 3 Users

- Most Popular

- Cash Flow

- VAT Error Checker

- Track Employee Time

- Free Onboarding

£3.30 for 7 months, then £33/month

Save £207.90 over 7 months

Plus

- Everything in Essentials

- Manage Stock

- Profitability for each Project

- Set Budgets

- 5 Users

- Free Onboarding

£4.70 for 7 months, then £47/month

Save £296.10 over 7 months

The price includes free phone and online chat support, access to online tutorials, and the QuickBooks community forum.

Liberty Accounts

Liberty Accounts is an excellent piece of accounting software for small businesses, churches and charities in the UK. It offers a wide range of features, including fund accounting and Gift Aid support, that are not available in other software packages aimed at these types of organisations. It makes it an ideal choice for organisations that need to manage their accounts and payroll effectively.

Advantages of using Liberty Accounts for non-profit

- Integrated donor ledger supports gift aid

- quick and easy gift aid claims

- Fund accounting makes it easier to manage restricted funds

- Making Tax Digital for VAT returns – ideal for churches

- Payroll software

- Reports

- Support on phone and email

- Cloud Accounting Software

Pricing

Offers a free trial

-From £12.95 per month

-Scalable for larger organisations

Overall, it is an excellent tool for charities, making accounting more straightforward and efficient.

Visit the Liberty Accounts website.

Xero Accounting Software

Xero is one of the leading accounting software products in the UK.

Xero is easy to use and can help non-profit organisations save time and money. Accounting in Xero is simple, thanks to its intuitive dashboard-like interface, which lets users manage all aspects of their business in one platform.

One of the main benefits of XERO is that it comes with a host of additional apps. Apps include fundraising, donor management and marketing.

If you’re a large non-profit organisation, using the right tools and adding extra features to your software might help you manage it more efficiently.

Xero Pricing

Like most providers, Xero offers a free trial.

Read our review on Xero and also our comparison of QuickBooks vs Xero.

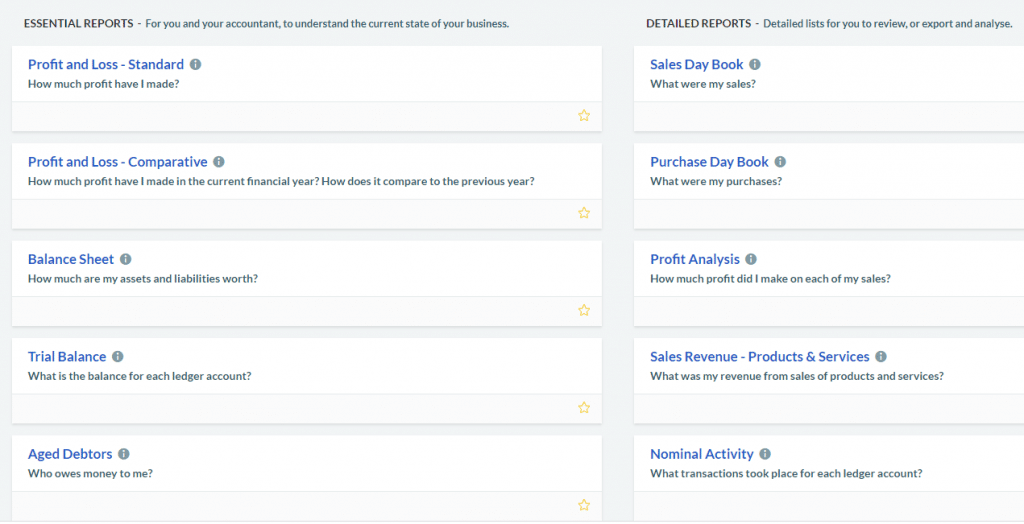

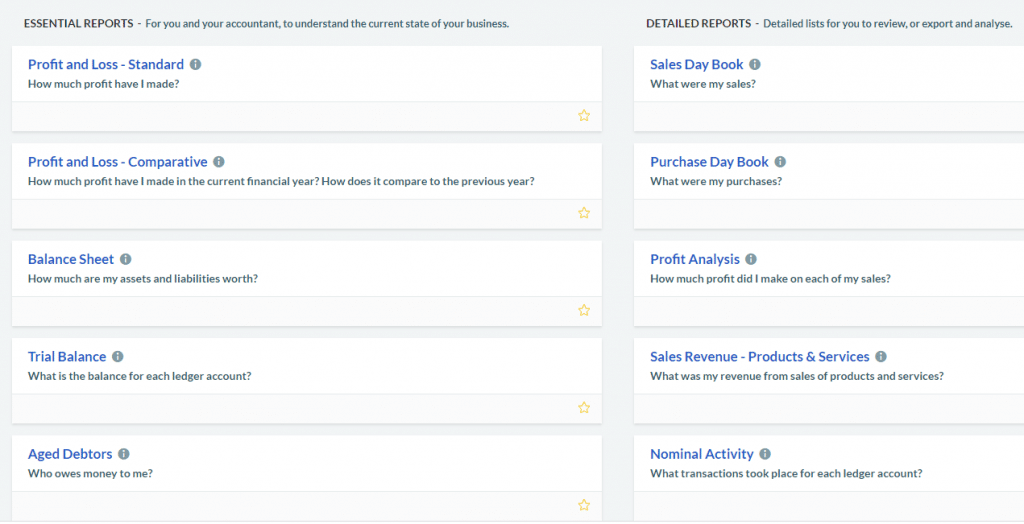

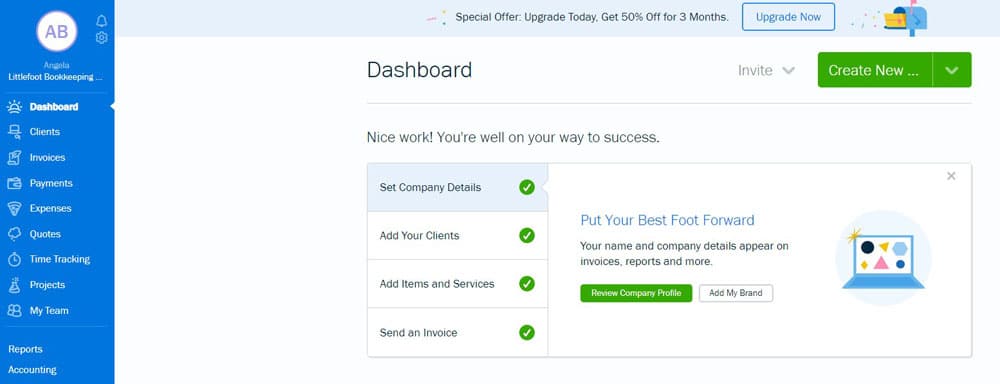

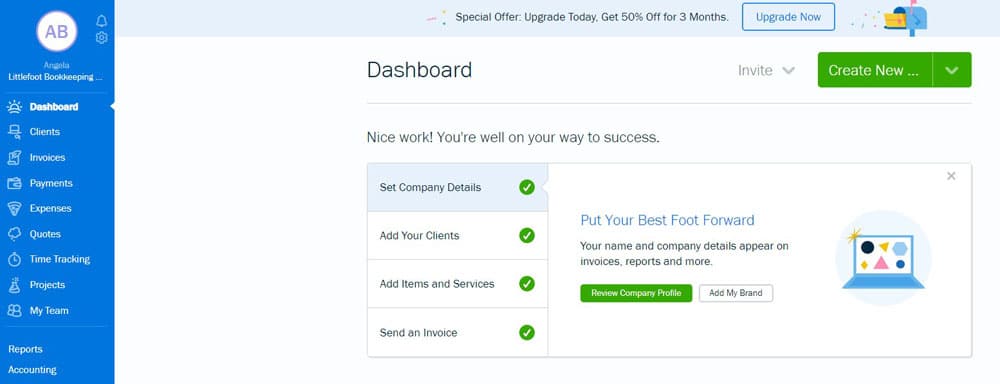

FreshBooks

For non-profits without an accounting system, Freshbooks helps monitor expenses, create invoices, generate financial reports and track projects.

Time tracking helps identify how much time was spent on a project, which can be used for billing or other reporting purposes. Management tools help track and monitor a project’s progress so that any potential issues can be addressed early on.

Advantages

- Cloud-based accounting software

- Send Invoices

- User-friendly interface

- Expense reports

- Mileage Tracking

- Support through online chat

- Up-to-date view of financial activities

- Detailed Reports

Pricing

FreshBooks offers a free trial for new users. There is a monthly subscription fee, but the price depends on how many people you invoice. If you’re based in the UK, here are the prices for you:

– Up to 5 clients: £15 per month

– 50 clients: £25 per month

– Unlimited clients: £35 per month

Prices are for single users, with £8 for each additional user.

Charity accounting template: receipts and payments accounts

If you’re a small non-profit organisation, Excel templates are an excellent option instead of accounting software. We’ve developed a completely free cashbook template that allows you to input all of the income and expenses for the year and generate the figures required.

It can be a great way to keep track of your finances and ensure that your charity is on track financially.

To hire or outsource for Nonprofit Accounting software

There are a few options to consider when accounting for a non-profit organisation. One option is to hire a bookkeeper to manage the books and keep track of everything. It can be a great option if you have the budget for it, as it can take much of the burden off you and allow you to focus on your core mission. However, not all organisations have the budget for a full-time bookkeeper.

Some bookkeepers will volunteer their time for free or at a reduced cost to charitable organisations, especially if they are close to their hearts. I volunteer as a bookkeeper for a local charity.

Conclusion about Accounting Software for Charities

Accounting software for nonprofits can be an excellent way for charities to manage their finances more efficiently. There are several different providers, and most offer free trials, so you can try them before you buy. The pricing is affordable, and the software is easy to use. If you’re looking for accounting software for your charity, be sure to check out the available options.