Cash Book for Business and Personal Use

A cash book is a financial journal or ledger used in accounting to record a business’s cash receipts and cash payments. It is a journal for chronologically recording transactions and a ledger for maintaining the cash account balance.

We will explore various types of cash books, such as single-column, double-column, single-entry, and double entry. Additionally, we will discuss the benefits of using an accounting package for your cash book management and introduce our Free cash book template.

What is a cash book?

A cash book is a comprehensive record of cash transactions in an accounting period, including receipts, payments, bank deposits, and withdrawals. It records the transactions of both bank account and cash accounts.

Key features of a cash book:

- Cash Basis Accounting: Records when the cash is received or spent.

- Chronological Record: Transactions are recorded in order, providing a clear timeline of cash activities.

- Detailed Information: Each entry typically includes the date, transaction description, amount received or paid, and the account affected.

- Dual Purpose: It functions as a journal for initial recording and a ledger for maintaining the running balance of cash.

- Multiple Formats: Cash books can be single-column (cash only), double-column (cash and bank), or triple-column (cash, bank, and discount), depending on the complexity of the business’s transactions.

If you run a small charity or record personal cash transactions, you are likely to use a single-column cash book. It will have columns for both cash receipts and cash payments.

There are several different ways of setting one up, including paper-based, excel spreadsheet or purchasing a book from a stationery supplier like Amazon.

Using accounting software automatically records your transactions in the cash and bank accounts, eliminating the need for a manual record.

Single Entry Cash Book Format

A single-entry system is in its simplest form, and you can either purchase a book from a retailer or create it in Excel. It will show cash receipts on one side and cash payments on the other. Each side will have several columns: date, details, reference, and amount.

A simple example of a single-column cash book is below.

Double Entry Cash Book Format

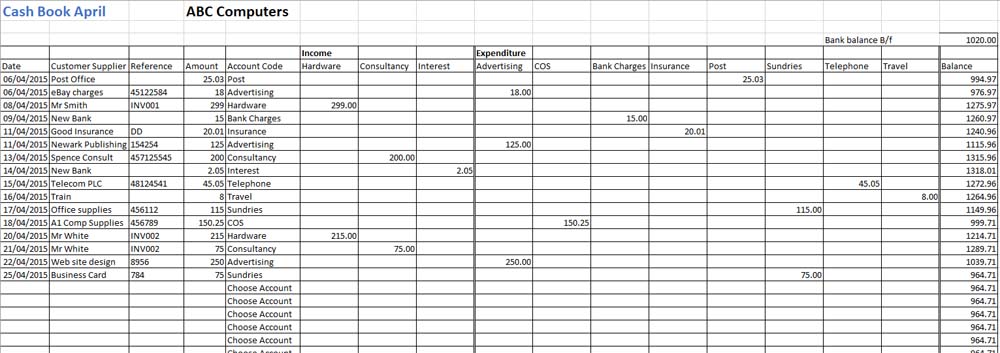

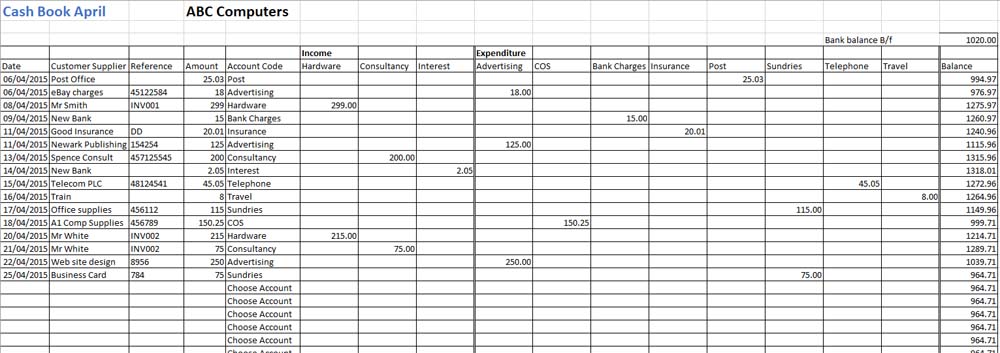

A double entry cash book is more advanced and includes an analysis of the income or expenditure. It shows the bank adjustment and the income and expenditure analysis. An example of this is a business that wants to record the payment category so that it may add columns for rent, wages, utilities, general expenses, and others. It is also the same for sales; the business may sell different services or goods.

Here is an example of a double entry cash book.

Excel Cash Book Template

We have developed our Excel Cash Book Template, which many small businesses and charities use. All our templates are easy to use, free to download, and require no login or email. We have two spreadsheets: a standard version for small businesses and an extended version for companies that need more rows or account codes.

Below is a table showing the difference between the two cash book templates.

| Cash Book | Standard Version | Extended Version |

| Income Codes | 3 | 5 |

| Expense Codes | 8 | 13 |

| Transaction Lines | 40 | 95 |

| Charge | Free | Free |

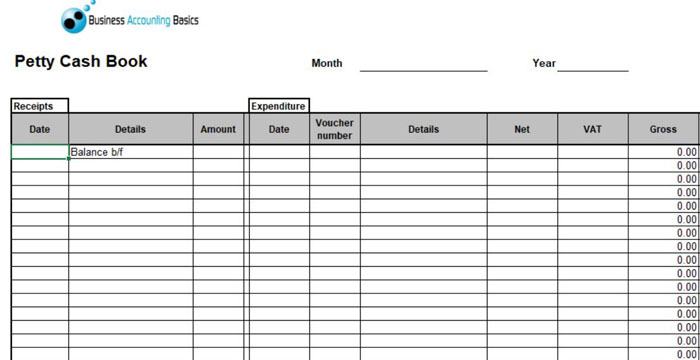

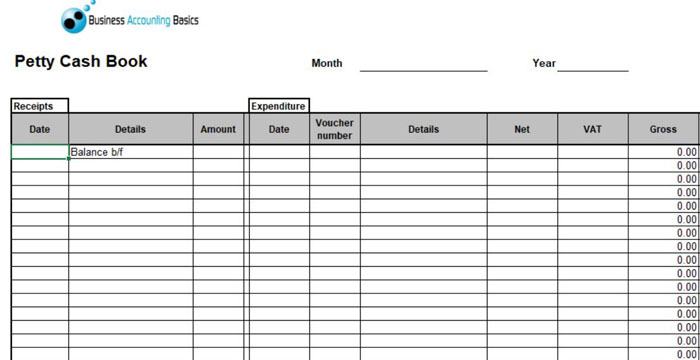

Petty Cash Book Template

We have developed a petty cash log for a business that uses petty cash. It will keep track of all the money separate from the bank account. The template includes columns for different expenditure codes. It is helpful if you are using petty cash and accounting software, as you can post the totals to the correct expenditure codes.

Accounting Software Cash Book

The simplest way to process transactions is by using accounting software. Many packages are available, most of which are online and will grow with the business. Packages include Xero, QuickBooks, Sage, and a free one called Pandle.

The advantage of using accounting software is that the bank and cash are automatically updated in the general ledger as you record each transaction.

QuickBooks – 90% Discount for 7 Months

Simple, smart accounting software for invoicing, payroll, inventory, expense tracking and producing financial reports, accessible anytime, anywhere.

Visit QuickBooks

Xero – 90% Discount for 6 Months

Xero simplifies your business finances with easy invoicing, expense tracking, payroll, bank reconciliation, and financial reporting in one secure cloud-based platform.

Visit Xero

An example is a business completing a consultancy job for a client. A sales invoice is issued for a customer, including a payment link. The client pays immediately by bank transfer, which is recorded in the software. The accounting software will complete the double entry and post it to the bank and sales accounts.

Cash Book Format

When designing an Excel template, it is vital to correct the format. On the left is the income and expenditure on the right-hand side. Both sides will have columns for date, description, reference and amount. At the bottom of the spreadsheet will have totals and a carried forward balance.

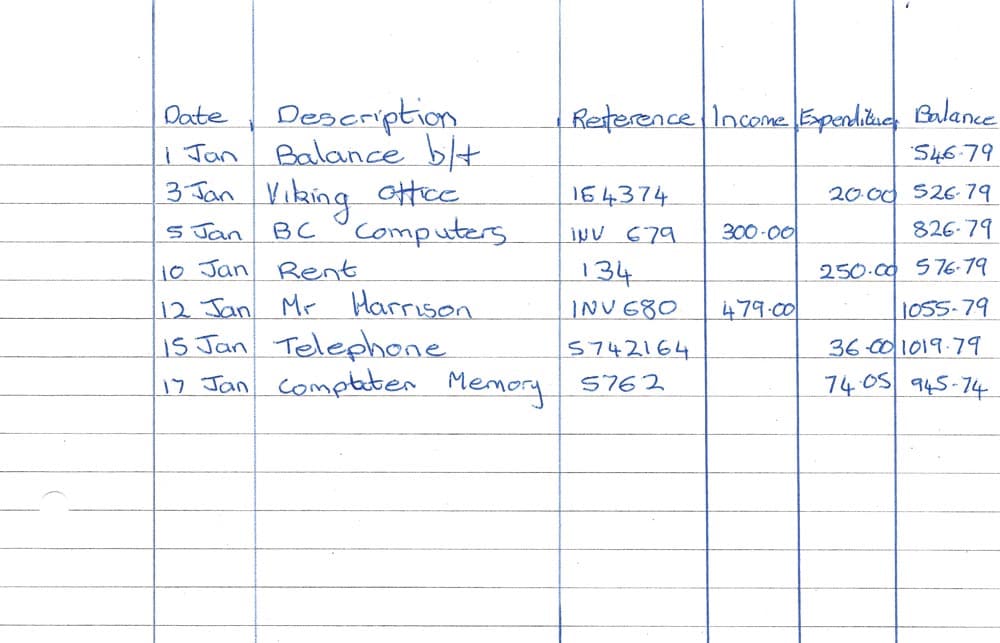

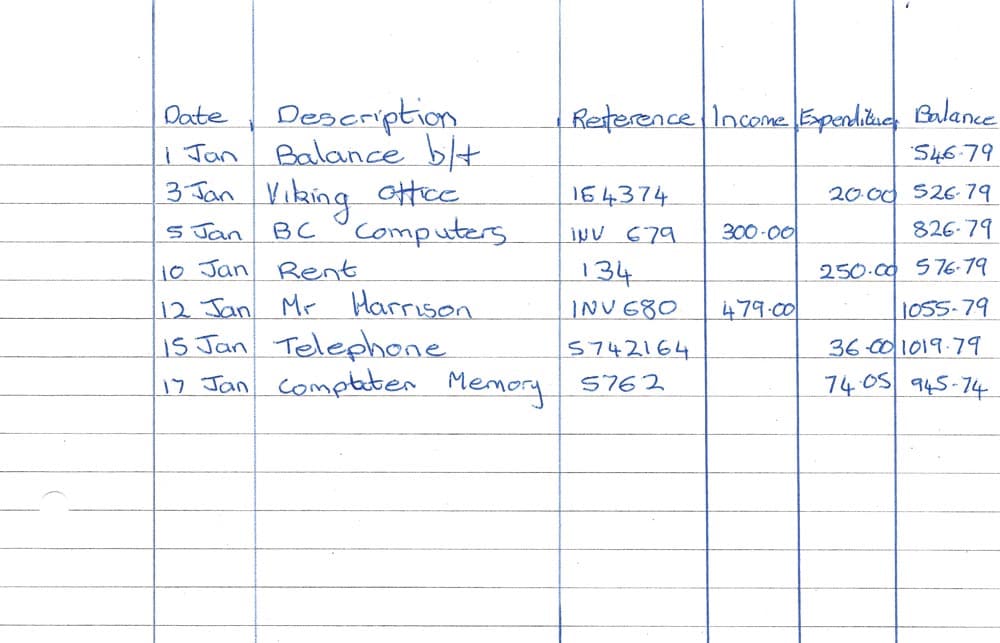

For a paper-based format, you may find it easier to have the following columns: date, description, reference, income, expenditure and balance. It allows for a bank’s running balance and ensures no mistakes in the figures if you complete a bank reconciliation.

Below is an example of a paper-based cash book using a standard A4 lined pad.

Double Column Cash Book

So far, we have looked at the single-column cash book, but there are a couple of other versions: double and triple-column.

The double-column cash book records both cash and bank transactions. The left shows income for cash and bank, and the right shows expenditures for both.

Triple Column Cash Books

A triple-column cash book (also known as a three-column) includes cash, bank and an additional column for discounts. The discounts are for both received and given.

Below is the difference between the 3 different cash book formats:

Cash Book Conclusion

Cash books are essential tools for tracking money. They provide a clear picture of income and expenses, helping you understand your spending habits and make informed financial decisions. Whether you prefer a traditional ledger or modern accounting software, maintaining accurate cash records is crucial for success in both personal and business finances.