Excel vs Accounting Software: When Is It Time to Switch?

Excel is often the first tool used for small business accounting. It’s familiar, flexible, and widely available, making it an accessible option when records are simple. Many people successfully use Excel spreadsheets to record income, expenses, and basic cash flow when starting.

However, Excel is not designed for bookkeeping. As records grow and requirements increase, spreadsheets become harder to manage. Understanding the differences between Excel vs accounting software can help you decide whether spreadsheets are still suitable or whether it’s time to consider another approach.

When Excel works well for Business Finances

Excel can work well for bookkeeping when records are straightforward, and activity is limited. It is often suitable when:

- Data entry volumes are low and manageable

- Records are kept up to date regularly

- You are not VAT registered

- There are no complex reporting requirements

- You are comfortable working with spreadsheets

For many people, Excel provides a low-cost and flexible way to understand basic bookkeeping principles. It allows you to see how figures are built up and gives complete control over how financial data is structured.

Using a Cash Book Template as a Starting Point

One of the most common ways small business owners use Excel for bookkeeping is with a free cash book template. This approach is popular because Excel is widely available and easy to use, making it suitable for managing straightforward day-to-day records.

Our free cash book template provides a simple structure for recording money received and money paid out over time. By keeping entries in date order, it becomes easier to track cash movement and keep records organised.

Using a cash book template allows you to:

- Record income and expenses in date order

- Track cash and bank movements clearly

- Build totals that support an income statement

- Keep all records organised in one place

Alongside a cash book, other free Excel bookkeeping templates support basic record keeping. These include expense trackers, invoice lists, cash flow forecasts, and mileage logs, which help keep different parts of your records organised as needs grow.

For basic bookkeeping, a cash book is often enough. Combined with other free Excel templates where needed, it helps establish good record-keeping habits and provides a clear overview of cash movement without unnecessary complexity.

Limitations of Excel as records grow

As activity increases, Excel spreadsheets can become harder to maintain. Common challenges include:

- Spending increasing amounts of time entering and checking financial data

- Greater risk of human error caused by manual data entry or broken formulas

- Multiple spreadsheets that don’t link together

- Difficulty tracking invoices, payments, or balances accurately

- Uncertainty around VAT figures or reporting deadlines

- Producing accurate financial statements

At this stage, Excel often feels more like an administrative burden than a helpful tool.

Excel vs accounting software: how accounting features actually work

The main difference between Excel and dedicated accounting software is not just convenience — it lies in how each handles bookkeeping tasks. Accounting software manages financial records consistently and automatically, while Excel relies on manual input and ongoing maintenance.

Our recommended accounting software packages include Sage UK, Xero or QuickBooks.

Below is a clearer explanation of the key features and how they work in practice.

Bank feeds and transaction import

In Excel, you enter bank transactions manually by downloading statements or typing figures into a spreadsheet, which can be time-consuming and increase the risk of errors.

Accounting software uses bank feeds to securely import transactions directly from your bank. The transactions appear automatically in the system, where they can be reviewed and categorised. It reduces manual data entry and helps keep records up to date throughout the year.

Transaction categorisation and coding

With Excel, you decide where each transaction goes by choosing a column or account code and entering the figures yourself. The accuracy of the data entry depends entirely on correct manual input.

Accounting software lets you code transactions to income or expense categories and remembers how similar transactions were coded previously, making the process quicker and more consistent. It helps maintain accurate records across reporting periods.

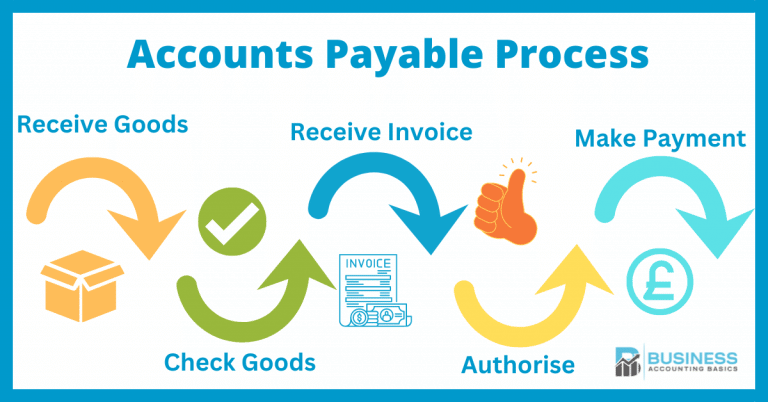

Invoicing and payment tracking

In Excel, invoices are typically created as separate documents and then manually tracked in a list or spreadsheet. In Excel, you match payments by hand, which makes it harder to see outstanding invoices.

Dedicated accounting software includes built-in invoicing tools that automatically link invoices and payments, making it easier to track unpaid and overdue balances and send reminders when needed.

VAT handling and reporting

In Excel, VAT calculations rely on correct formulas and careful checking. If formulas change or transactions are entered incorrectly, errors can occur, especially as records grow.

Accounting software applies VAT rules automatically based on how transactions are coded. It generates VAT reports from the underlying data and supports submission in line with HMRC requirements, reducing the risk of calculation errors and missed figures.

Real-time balances and reports

Excel reports are only as accurate as the last update. If financial transactions haven’t been entered or checked, balances may not reflect the true position.

Accounting software updates balances continuously as transactions are added or matched. Financial statements such as profit and loss statements, balance sheets, and cash flow summaries are generated from live data, providing a snapshot of a business’s financial health at any point in time.

Error checking and consistency

Excel does not prevent incorrect entries. A figure can be entered in the wrong place or a formula overwritten without warning, which may not be noticed until much later.

Accounting software uses structured records and built-in controls to reduce errors. While mistakes can still happen, the system is designed to flag inconsistencies and maintain balanced records, particularly in double-entry bookkeeping systems.

Record keeping and audit trail

In Excel, tracking changes over time can be difficult, especially if multiple versions of a spreadsheet exist.

Accounting software keeps an audit trail, recording when transactions are added, changed, or reconciled. This can be helpful for reviewing records, working with an accountant, or responding to queries.

Inventory Management

Inventory management is essential for many businesses, but tracking stock in Excel can be time-consuming and error-prone. Accounting software automates inventory tracking, updates stock levels in real time, and reduces manual errors.

Features like reorder alerts, barcode scanning, and detailed reports help maintain accurate records and support better decision-making. For growing businesses, using accounting systems for inventory improves accuracy and efficiency compared to Excel.

Payroll Software within Accounting Software

Payroll functionality integrated within accounting software automates employee payments, tax withholdings, and compliance tasks that are often time-consuming and error-prone when managed manually in Excel. This payroll integration automatically calculates wages, manages deductions, issues payslips, and handles tax filings, ensuring accuracy and efficiency.

Ideal for small and growing businesses, payroll features within accounting software support multi-user access and stay updated with changing tax laws to reduce compliance risks. Using payroll within accounting software saves time, minimises errors, and maintains accurate employee compensation records, making it a vital component of efficient financial management.

Cloud-Based Software and Security

Cloud software offers key advantages over Excel, including secure remote data storage with automatic backups that protect against data loss. It enables real-time collaboration for multiple users, avoiding version conflicts common in Excel.

In terms of security, cloud software provides stronger protections, such as encryption, multi-factor authentication, and audit trails, that Excel lacks. This makes cloud platforms a safer and more reliable choice for managing sensitive financial data, especially as businesses grow and financial operations become more complex.

How does this compare overall?

Excel offers flexibility and control, but it requires discipline, regular maintenance, and careful checking. Accounting software replaces much of this manual work by implementing structured processes and automating tasks.

For simple records, Excel may be sufficient. As records become more detailed or compliance requirements increase, accounting software can make bookkeeping easier to manage and more reliable.

Do you need to stop using Excel Spreadsheets completely?

Not necessarily. Many people continue to use Excel alongside accounting software for specific tasks such as:

- Cash flow forecasts

- Budgets

- Scenario planning

- One-off calculations

However, once accounting software becomes the main bookkeeping system, Excel is usually no longer used to record day-to-day transactions.

How to decide which option is right

Deciding between Excel and accounting software often comes down to practicality. You may want to consider accounting software if:

- Bookkeeping is taking longer than expected

- Errors are becoming more frequent

- You need clearer or more timely reports

- VAT or MTD compliance is required

- You want a more structured system

If Excel still feels manageable and records are simple, there may be no immediate need to change.

Excel vs Accounting Software: Feature Comparison

| Feature | Excel Spreadsheets | Accounting Software |

|---|---|---|

| Data entry | Manual data entry only | Automatic bank feeds + manual |

| Bank transaction import | ❌ | ✅ |

| Transaction coding | Manual | Suggested & remembered |

| Invoicing | Separate spreadsheet or document | Built-in invoicing |

| Payment tracking | Manual | Automatic matching |

| VAT calculations | Manual formulas | Automatic VAT handling |

| MTD for VAT | ❌ | ✅ |

| Real-time balances | ❌ | ✅ |

| Financial reports | Manual setup | Built-in reports |

| Double-entry bookkeeping | Manual | Built-in |

| Audit trail | ❌ | ✅ |

| Ease of use for beginners | Medium (spreadsheet skills needed) | High, but help available with online guides |

| Best suited for | Very simple records | Growing records |

Dedicated accounting software Solutions available in the UK

There are several accounting systems available in the UK, each designed to support bookkeeping in slightly different ways. While the core features are similar, the way each system approaches bookkeeping, reporting, and compliance can suit different needs.

Below is an overview of the most commonly used UK accounting systems and how they are typically used in practice.

Accounting Software Best Deals

Sage UK – 90% for 6 Months – FREE plan for Sole-Traders, AI tools for bookkeeping automation

XERO – 90% Discount for 6 Months – Cloud accounting, unlimited users, smart bank feeds

QuickBooks – 90% Discount for 7 Months – Invoicing, expense tracking, payroll, financial reports

Xero

Xero is widely used by sole traders and small organisations that want automated bookkeeping with minimal manual input. It is known for its strong bank functionality and clear reporting.

Xero allows bank data to be imported automatically and matched to income or expense categories. Invoices, bills, and payments are all recorded in the same system, helping keep balances up to date in real time.

It supports VAT reporting and Making Tax Digital (MTD) and is often used where regular transaction volumes make spreadsheet bookkeeping time-consuming.

QuickBooks

QuickBooks is another commonly used option in the UK and offers similar core functionality to Xero, including bank feeds, invoicing, expense tracking, and VAT reporting.

It is often chosen by users who want flexibility in how records are entered and reviewed. QuickBooks provides tools to categorise transactions, track invoices, and generate standard financial reports such as profit and loss and balance sheets.

Like other UK accounting software, it supports Making Tax Digital for VAT submissions.

Sage

Sage UK is a long-established accounting software provider in the UK and offers a range of products designed for different record-keeping needs.

Sage offers a free Making Tax Digital (MTD) plan for sole traders that meets HMRC digital submission requirements at no additional cost. People typically use this option for MTD compliance rather than for full day-to-day bookkeeping.

Sage UK also provides more comprehensive products that include invoicing, bank feeds, VAT handling, and reporting. These options suit situations where structured record keeping and compliance are a priority.

Other UK accounting software options

In addition to the leading platforms above, other UK-based accounting software options may suit certain situations:

- FreeAgent – often used by contractors and freelancers, particularly where accounts are linked to a business bank account for a free option

- KashFlow – designed for straightforward bookkeeping and invoicing

- Clear Books – offers cloud-based bookkeeping with a focus on UK compliance

Each of these platforms supports double-entry bookkeeping and VAT reporting, but the user experience and feature emphasis can differ.

Getting help with the transition

If you’re unsure whether to move from Excel to accounting software, a bookkeeper or accountant can help review your current setup. They can advise on whether a change is needed and assist with moving records across if required.

Getting advice early can help avoid issues later and ensure records remain accurate.

FAQ

Is Excel enough for bookkeeping?

Yes, Excel can be enough for bookkeeping when records are simple, transaction volumes are low, and figures are kept up to date. People commonly use Excel to record income, expenses, and basic cash flow. As records grow, Excel becomes harder to manage.

When is Microsoft Excel no longer enough for bookkeeping?

Excel is often no longer enough when bookkeeping takes too much time, errors become more common, or records are difficult to keep up to date. This usually happens as transaction volumes increase or VAT requirements apply.

Do I need accounting software if I am VAT registered?

You do not legally need accounting software to be VAT registered, but most UK accounting software supports HMRC MTD. This can make VAT calculations and submissions easier and reduce the risk of errors. You can use Excel with Bridging software.

Is accounting software hard to learn?

Most modern accounting software is user-friendly. Platforms such as Xero, QuickBooks, and Sage provide guided setup and standard reports to help users get started.

Summary: Excel vs Accounting Software

Excel is a valuable and flexible tool for basic accounting, particularly when used with a cash book template. It works well when records are simple and carefully maintained.

As records grow and requirements increase, accounting software may provide a more efficient and reliable way to manage bookkeeping. The right choice depends on the complexity of your records, the time required for bookkeeping, and the level of automation you need.