What is an Income Statement?

Income Statement Definition, Explanation, Example and Template

An income statement is a financial document that summarises income and expenses over a certain period. It’s often referred to as an income statement or income and expense summary but can also be called a profit and loss statement (P&L).

The income statement most often used by businesses is the accrual basis income statement. It means that business records the transactions when they occur rather than when cash changes hands.

Net income equals total revenues minus total expenses during a certain period. This article will look at what income statements are and how they work in more detail.

Why is an Income Statement Important?

An income statement is an essential document for small businesses because it summarises how the company has performed over a period of time. The business can use this information to make strategic decisions about the future.

An income statement can help business owners identify areas where they are making profits and losing money. The information is useful for deciding pricing, products, and services.

An income statement can also help business owners assess their financial health. The statement shows how much revenue the business has generated and how much money it has spent on expenses. This information can be used to decide whether or not to borrow money or seek investment.

Income Statement for the Self-Employed

Income Statements are a valuable tool that self-employed individuals use to help complete income tax returns. They provide an overview of income earned and expenses incurred over the income-earning period.

The figures are recorded in the self-assessment tax return and other financial information, and the tax liability is calculated.

Income Statements for Limited Companies

The income statement is a key part of the annual accounts for limited companies. It is part of the annual accounts submitted to Companies House.

Company’s financial statements

Income Statement

The income statement is one of a company’s three main financial statements. It shows how much revenue the company earned during a specific period, and how that revenue was used to generate income. The income statement also shows the company’s net income for the period, which is calculated by subtracting total expenses from total revenue.

Balance Sheet

The balance sheet is another one of a company’s three main financial statements. It shows a company’s assets, liabilities, and shareholders’ equity as of a specific date. The report helps creditors and investors understand a company’s financial health and stability.

Cash Flow Statement

The cash flow statement is the third of a company’s main financial statements. It shows how cash flowed in and out of the company during a specific period. It indicates whether the company had more money at the end of the accounting period than when it started.

Who uses Income Statements?

Income statements are used by individuals, companies, and other entities to track their income and expenses over a specific period of time. The statement can help individuals understand how their personal finances are doing and whether they are making a profit or not.

Investors and banks are two important groups that use the income statement of a small business to make decisions. Investors can use the statement to determine whether they should invest in a company, while banks can use it to decide whether to give a business a loan. The Income Statement can provide a detailed overview of how a company is performing financially, which can be very helpful for both groups when making their decisions.

What are the Parts of the Income Statement?

The income statement has five main parts: revenues, cost of sales, gross profit, expenses, and net income.

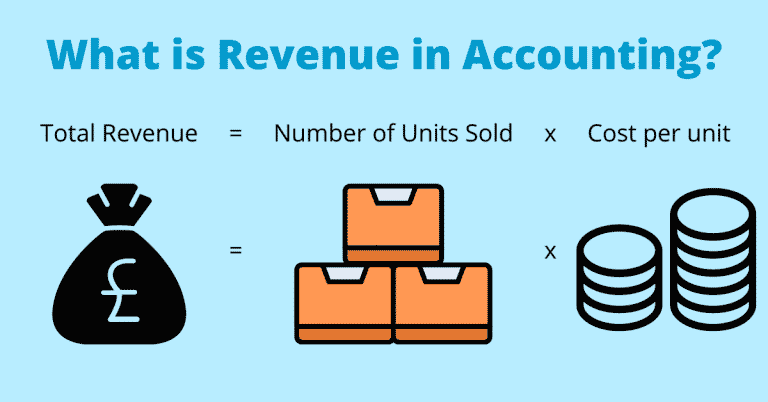

Income or Sales Revenue

Income or sales revenue is the starting point of the income statement. It is the total amount of income generated by a business during a certain period. It can include income from sales, interest, rent, and other sources.

In accruals accounting, revenue is recorded when it is earned, not when it is received. For example, if a business makes a sale on credit, the revenue would be recorded when the sale is completed, not when the customer pays their bill.

Cost of Sales

The cost of sales includes the costs associated with making a sale, also non as direct costs. It includes the cost of goods sold and the cost of services sold. The cost of goods sold includes the purchase price of products, direct labour and materials used in making products. The cost of services sold consists of the direct labour cost of employees involved in making the product.

Gross Profit

The gross profit equals income minus the cost of sales. This calculation gives business owners an idea of how much money is available after the cost of sales are accounted for. The result is often called the gross margin or operating income.

Non-Operating Expenses or administrative expenses

Non-Operating Expenses are subtracted from gross income to determine the net income. Non-operating expenses can include depreciation, rent, utilities, administrative expenses such as employee wages and benefits, income taxes, interest expense on money borrowed to finance operations, advertising costs and other operating expenses.

Net Income or Net Profit or Loss

Net income is calculated by subtracting expenses from gross income and will show either a profit or a loss. Use our net profit calculator to find the percentage of net profit in your accounts

How to prepare an Income Statement

To manually produce an income statement, you need to gather information from your company’s books and records. It includes revenue (sales) and expense information. You will also need to calculate the cost of goods sold (COGS).

If you use accounting software, the figures will be generated automatically by entering transactions and journals.

Once the income and expenses are entered, the program will calculate the net income or loss for the period entered. The net income or loss will be either positive or negative, depending on whether the income exceeds the expenses or not.

How to Compare Income Statements

Small businesses can improve their operations by studying and comparing income statements in order to identify areas where they are losing money. By taking a look at data over the span of an entire year, businesses can get a better understanding of their seasonal sales. This information can help businesses make changes in order to boost profitability.

Using good accounting software enables a business to compare two periods or years.

Income statement Vs Balance Sheet

The Income statement and balance sheet are two important financial statements that business owners use to track their company’s financial performance. The income statement shows how much money a company has earned over a specific period, while the balance sheet shows how much money a company has at any given moment.

– The income statement focuses on income and expenses, while the balance sheet includes all assets and liabilities

– The income statement measures a company’s financial performance over a specific period of time, while the balance sheet measures it at a single moment

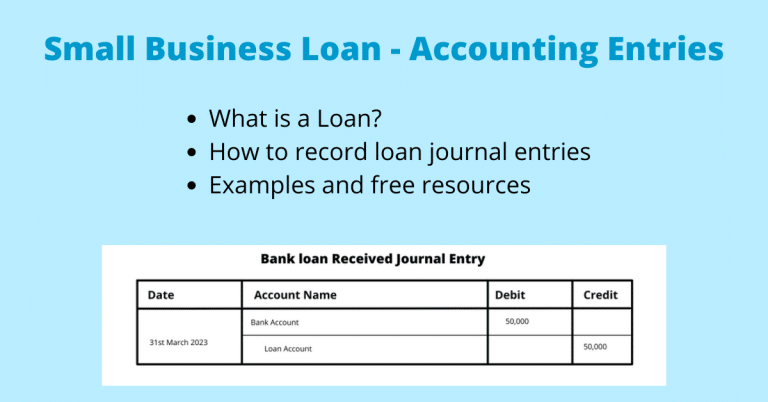

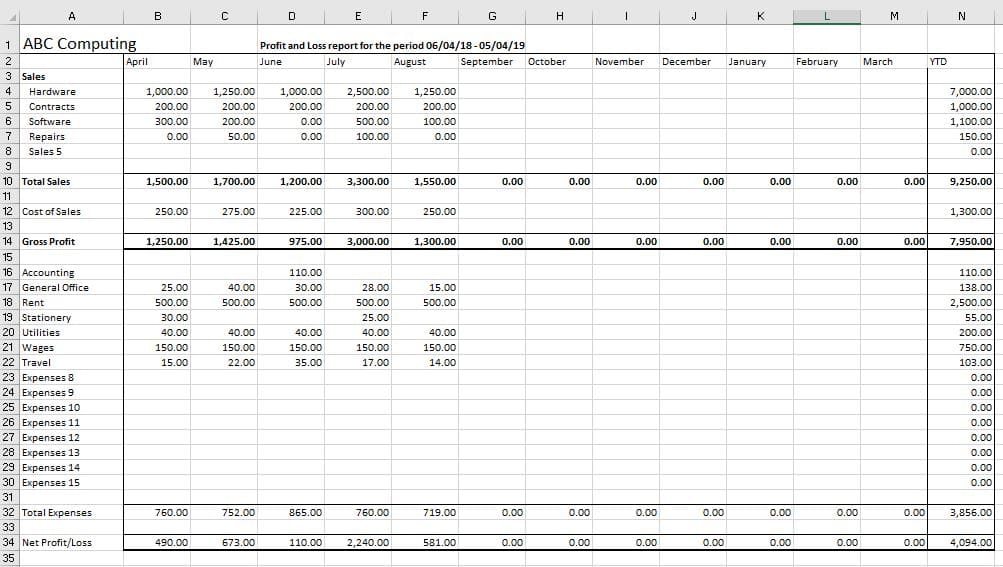

Income Statement Example

Below is an example for a company ABC computers.

It shows the following information:

- The statement is for a reporting period of a year ending March 2022

- Turnover – £37220.27

- Cost of sales, which includes cost of products and labour to produce them – £8500.89

- This leaves a gross profit of £28719.38

- Operating expenses or administration expenses £7637.86

- This leaves a net profit after taxation of £21081.52

Important Profitability Ratios

There are two very important profitability ratios on the income statement: the gross profit and net profit margin calculations.

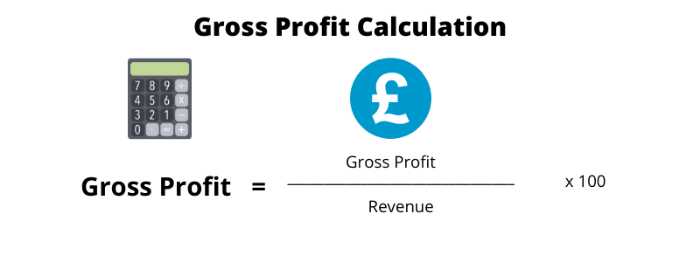

Gross Profit Margin

The gross profit margin is a measure of a company’s profitability that takes into account the cost of goods sold. It is calculated by dividing the gross profit by the net sales. A higher margin indicates that a company is more profitable since it is taking in more money on each sale after subtracting the cost of goods sold. A lower margin indicates that a company is less profitable or even unprofitable since it is taking in less money on each sale.

The calculation is as follows:

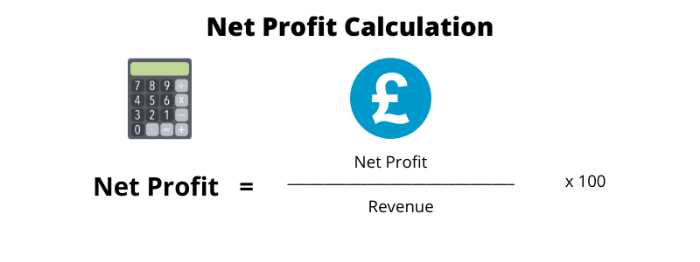

Net Profit Margin

Net profit margin is used to measure how well a company performs by comparing the net income to the total sales.

The calculation is as follows:

Below is our profit margin calculator.

Income Statement Template

There are many different ways to create an income statement, but one of the most common methods is to use Accounting Software or Excel. If you’re looking for a free income statement template that you can download and use, we’ve got you covered. Our template is easy to use and includes all the essential components of an income statement.

Download our free template and further instructions.

Income Statements Conclusion

The income statement is a financial statement that shows a business’s income and expenses over a specific period of time. The Income statement is important for businesses because it shows how much money the company has earned, and allows business owners to identify areas where they may be losing money.

Income statements can be compared over different periods of time in order to identify trends, and calculating important profitability ratios can help business owners make better decisions about their company’s future.

The income statements can be produced manually by gathering information from a company’s books and records or automatically using accounting software.