Personal Budget Template (Excel & Google Sheets)

Are you looking for a simple way to manage your money? Our free personal budget template makes it easy to see exactly what you earn, spend, and save each month. Whether you’re new to budgeting or want a ready-made tool, this template is quick to set up and works in both Excel and Google Sheets.

Download it today and take the first step toward clearer finances and better money habits.

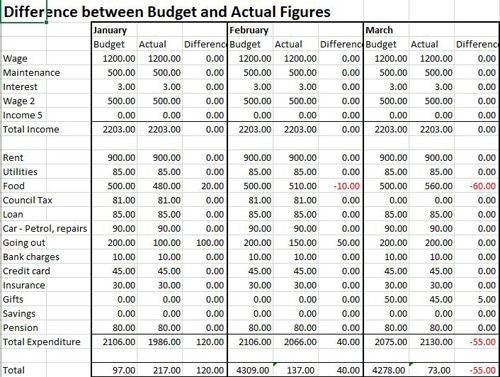

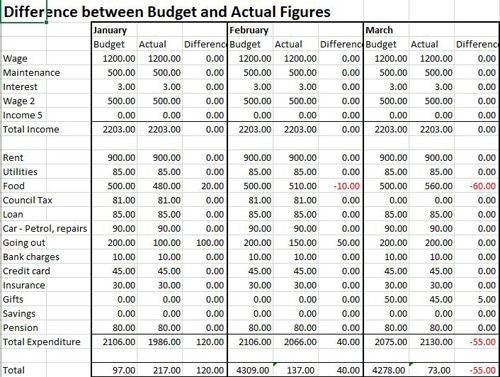

Not only can you set up a budget on one page for the year, but by adding your actual banking for income and expenses month by month, you can compare your budgeting with actual figures.

Keeping costs down can be critical, especially if finances are tight, saving for something or paying off debt. Seeing your accounts on one page can help to achieve this. It can assist in finding where savings can be made; lots of useful websites can show you the best way to reduce your outgoings; one of our favourites is Money Saving Expert.

Why Create a Personal Budgeting?

A personal budget is one of the easiest ways to take control of your money. Instead of wondering where your income goes each month, a budget shows you exactly what you earn, spend, and save.

With a clear plan, you can:

- Stay in control of spending – avoid overspending by setting limits.

- Reduce financial stress – know what bills are covered and what’s left over.

- Planning for the future – save for holidays, a new car, or build an emergency fund.

- Spot bad habits – quickly see where money is being wasted.

Creating a budget doesn’t need to be complicated. With our free template, you can start in just a few minutes.

Setting up a Personal Budget

When setting up your personal budget template, be realistic about your expenses and review your costs regularly. It will include things like car servicing, a cup of coffee while you are out, and clothes shopping.

Start by reviewing your previous year’s figures and determining if they will change this year. Some entries are easy to post and are the same each month, like monthly direct debits. Other costs will vary, especially for Birthdays, holidays, Christmas and any exceptional circumstances. It is always worth being realistic about the figures posted for your personal expenses.

When looking at your income, don’t forget to include salary increases, overtime and bonuses.

Full instructions are available on how to set up the personal budgeting Template in Excel.

Features of Personal Budget Template

- The personal budget spreadsheet includes the posting of actual bank figures

- Free to download and use – No catches and no adverts

- Easy to use – set up and run in 5 minutes

- Budget for the year entered on one page

- Income and expenditure categories can be named to suit your needs, e.g. salary, rent, and utilities.

- There are five income codes and thirteen expenditure codes

- The Budget and Banking worksheets for the year are printed on one page

- If your circumstances change, your figures can be updated at any time

- Differences between budget and actual figures are seen each month, and a total page for the year

Personal Budget Template Example

We have set up an example so that you can see how it works. Download the sample, which will give you the chance to experiment by adding entries and changing figures.

Entering the costs for the whole year, along with an annual budget. It allows you to see how the spreadsheet may be of use with your personal accounts.

Business Accounts Budgets

If you run your own small business, then this budget spreadsheet UK will work just as well to keep track of your company finances, and further information is available in our templates section.

Licence Agreement

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

Budget Template Instructions

Personal Budget Template FAQ

Do I need to use Excel?

No, our spreadsheet will work with other compatible spreadsheet software, including Google Sheets.

How often should I update my Personal Budget?

If finances are tight, it is worth reviewing your budget monthly and posting your actual figures to ensure you are spending within your budget. Otherwise, you may want to set a budget on a quarterly or annual basis.

Personal Budgeting Conclusion

A personal budget is the easiest way to stay on top of your finances and plan for the future. With our free budget template, you don’t need complicated software or accounting knowledge—enter your personal income and expenses, and the spreadsheet does the rest.

Start now by downloading the free template and begin building better money habits today.