Sales Invoice: A Complete Guide for UK Businesses

If you’re self-employed or a small business owner, issuing sales invoices is a crucial part of getting paid and maintaining accurate accounts. But if you’re not familiar with bookkeeping, it can feel overwhelming.

This guide will walk you through everything you need to know about sales invoices in the UK — including what they are, why they’re important, what information you must include, and how to issue them.

Whether you’re just starting or want to make sure you’re doing things correctly, this page breaks it all down in plain English. You’ll also find free invoice templates, helpful tips, and software suggestions to make invoicing simple and stress-free.

What is a Sales Invoice?

A sales invoice is a document you send to a customer after you’ve sold them a product or service. It’s your formal request for payment and a record of the transaction.

It includes key details like:

- What you sold

- How it costs

- When payment is due

- Your business and customer information

In accounting, it’s called a source document, meaning it’s used to record income in your bookkeeping. Once issued, it becomes part of your business’s financial records and may be needed for tax, HMRC, or accounting purposes.

In short:

A sales invoice tells the customer what they owe you and helps you track your sales income.

What Is a Deposit Invoice?

A deposit invoice is a type of sales invoice you issue after a customer agrees to buy, but before the full job is done or the product is delivered. It requires the customer to pay a portion of the total amount upfront, often referred to as a deposit or advance payment.

Why are Sales Invoices Important?

Sales invoices are essential because they help ensure you get paid. They serve as a formal request for payment, showing your customer the amount owed, the due date, and the payment method. Invoices are a key part of your bookkeeping — they record income, track outstanding payments, and feed directly into your profit and loss reports to maintain accurate financial records. Without them, payments can be delayed, missed, or misrecorded.

Sales invoices are also a legal requirement. If you sell goods or services — especially if you’re VAT registered or dealing with other businesses — you must issue one. In addition, they create a clear paper trail that helps avoid disputes, confirms what has been sold or delivered, and supports your accounts during audits or tax returns.

In short, sales invoices help keep your business organised, compliant, and maintain a healthy cash flow.

What Information Should be on a Sales Invoice?

There are legal requirements for the type of information needed on each invoice; this depends on how your business is structured:

For all Businesses

- Your business name (and logo, if you have one)

- Your address and contact details

- The customer’s name and address

- Invoice number (unique and sequential)

- Invoice date

- Date of supply (if different from invoice date)

- Description of goods or services

- Quantity and unit price

- Total amount due

- Payment terms (e.g. “Payment due in 14 days”) and payment due date

- Accepted payment methods (e.g. bank transfer details)

Self-Employed

- Your business details as the trader

- Address where any legal documents and cheques can be posted

Limited company

- The full company name, i.e. the name which appears on your Incorporation Certificate issued by Companies House

- The business trading name if different

- Address where any legal documents can be posted

- The registration number issued by Companies House

VAT registered

If you are VAT registered, you will also need to include the following:

- VAT registration number

- VAT rate per item

- Total VAT amount

- Total invoice amount excluding VAT (Net amount)

- Each item will need an individual unit price

- If you have any items which are charged at 0% rate, these must be shown clearly

There are other items that you may want to include on a sales invoice, such as a purchase order number, customer contact information, email address, website, terms and conditions, and a returns policy.

Sales Invoice vs Purchase Invoice

Though they might look similar at first glance, sales invoices and purchase invoices serve distinct purposes in your business transactions. Essentially, they represent opposite sides of the same coin. A sales invoice is what you send to your customers when they buy goods or services from you. It’s your way of requesting payment and formally documenting the sale. On the other hand, a purchase invoice is the document you receive from your supplier when you purchase goods or services from them. It acts as a bill and a formal record of your expenses.

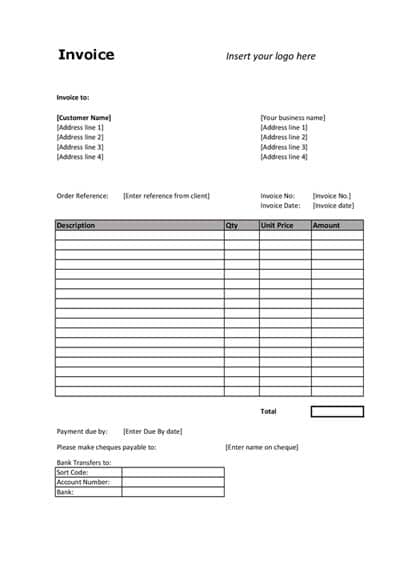

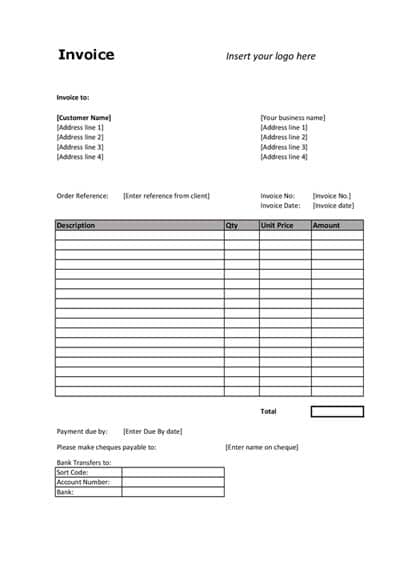

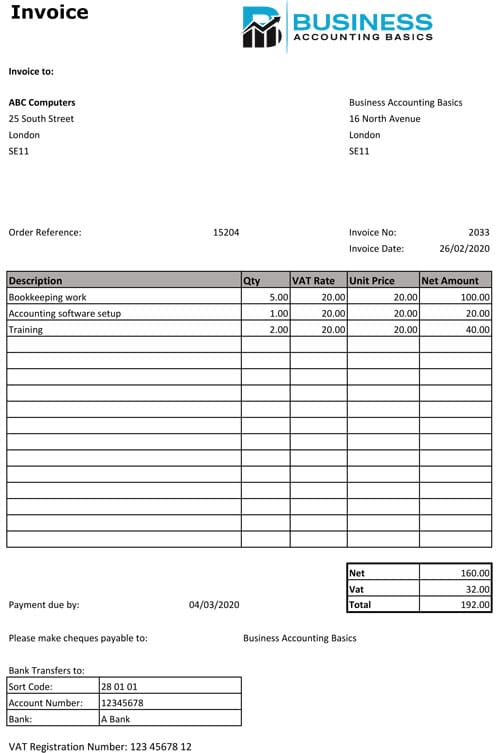

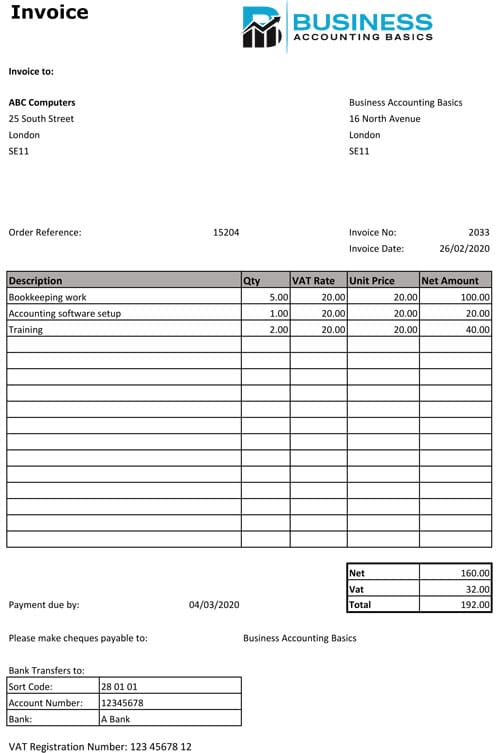

Sales Invoice Template

We’ve created two easy-to-use sales invoice templates for UK businesses — one for VAT-registered businesses and one for those that are not VAT registered. Each sales invoice template is customisable, allowing you to add your business name, logo, address, and contact details. This not only ensures you meet legal requirements but also helps your business appear professional and trustworthy to your customers.

Both templates include all the essential fields you need to issue a complete and accurate invoice, such as invoice number, date, customer details, itemised charges, and payment terms. The VAT version includes fields for VAT rates and totals, making it suitable for HMRC reporting.

Full instructions and download links are available on our dedicated Sales Invoice Template page. Select the option that best suits your business structure and start invoicing with confidence.

What is a Sales Day book?

A sales daybook is a list of all the sales invoices your business issues, typically recorded in the order they are created. It’s useful because it gives you a clear overview of your sales activity, helps you stay organised, and makes it easier to track totals and prepare accounts.

Free Sales Day Book Template

To make things easier, we’ve created a free Sales Day Book Template in Excel. It’s ready to use and includes columns for all the key details. Just fill it in each time you raise a new invoice.

Terms and Conditions of Sale

Your customer should have a copy of your terms and conditions of sale. Many businesses include a printed copy of their terms and conditions of sale with invoices.

The document will include payment terms, details for returns and warranties, as well as provisions for breach of contract.

How to Raise a Sales Invoice

There are several ways to raise a sales invoice, depending on how you run your business. Here are the most common methods:

The above invoice was issued for Zoho Books.

Accounting Software (e.g. QuickBooks, Xero, Sage)

Accounting software is the easiest and most professional way to create and send invoices.

With tools like QuickBooks, Xero, or Sage, you can:

- Create customised invoices with your logo and business details

- Email invoices directly to customers

- Automatically track who has paid and who hasn’t

- Set up reminders for overdue payments

- Record the sale in your accounts instantly

- Pre-built sales invoice templates are available

- Most paid plans include unlimited invoices

This option is ideal if you want to save time, maintain accurate records, and present a professional appearance. See our top recommendations for sales invoice software.

Free Sales Invoice Template

If you don’t use software, you can still create professional-looking invoices using a template in Excel or Google Sheets.

We offer two free UK Sales Invoice Templates (for VAT and non-VAT businesses) in Excel and Word formats.

You can:

- Fill in your details manually

- Save or print as needed

- Add your logo, payment terms, and contact info

Invoice Duplicate Book (Paper-Based)

For very small or manual businesses, an invoice duplicate book is a simple option.

You write the invoice by hand and keep a carbon copy for your records.

This method is helpful if:

- You don’t have access to a computer

- You issue invoices on the go (e.g. at a customer’s location)

Be sure to keep the copies organised and numbered to help with your record-keeping.

Invoicing Service

Some companies will raise sales invoices for you. If you use a bookkeeper, check that it is part of their service.

What is the Difference Between a Sales Invoice and a Receipt?

A sales invoice is a payment request, and a receipt is proof of payment.

A receipt confirms that a customer paid for goods or services. A receipt does not require as much detail as an invoice and can be generated from a till or an invoice that has been marked as paid.

Storing and Organising Sales Invoices

Keeping your sales invoices organised is essential for good bookkeeping and for meeting HMRC requirements.

How Long to Keep Sales Invoices

You must retain copies of all sales invoices for a minimum of 6 years. They may be needed for:

- HMRC checks or audits

- Preparing your tax return or year-end accounts

- Resolving any customer or payment issues

Where to Store Sales Invoices

1. Stored Automatically in Accounting Software

If you use accounting software like QuickBooks, Xero, or Sage, your invoices are saved automatically within the system. This helps track income and payments.

However, it’s a good idea to keep a backup copy, especially if you ever switch to a different software or lose access to it. You can do this by downloading invoices as PDFs and storing them in a secure folder.

2. Digital Filing (Recommended for All Invoices)

Even if you’re not using software, store digital copies:

- In cloud storage (e.g. Google Drive, OneDrive, Dropbox)

- Organised by year/month or customer name

- With clear file names like

2025_Invoice_001_JSmith.pdf

3. Paper Filing (for handwritten or printed invoices)

If you use an invoice duplicate book or print your invoices:

- File them by invoice number or date

- Keep the most recent on top

- Store in a safe, dry place

Why Good Organisation Matters

- Speeds up tax returns and accounting

- Makes tracking unpaid invoices easier

- Supports you in case of audits or disputes

- Helps you run your business professionally

Conclusion

Sales invoices are a vital part of running any business — they help you get paid, stay legally compliant, and keep your bookkeeping in order. Whether you’re self-employed or managing a small business, understanding how to raise, store, and organise your invoices makes day-to-day admin much easier.

With the right tools — like accounting software or our free sales invoice template — you can create professional invoices that reflect your business and encourage faster payments. Keeping good records also saves time at year-end and helps you stay in control of your cash flow.