Which Accounting Software is Best for Making Tax Digital VAT?

If you’re a small business owner, freelancer, or sole trader in the UK, you’ve likely heard about Making Tax Digital (MTD). But with so many…

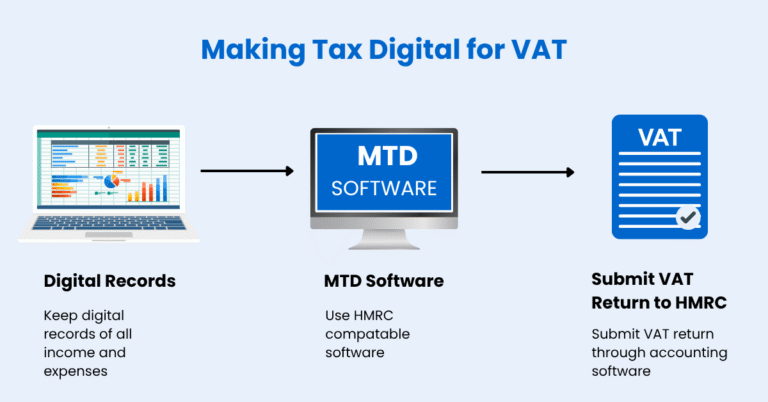

Making Tax Digital is the governments plan to improve reporting and getting tax right. Taxes are submitted digitally to HMRC.

If you’re a small business owner, freelancer, or sole trader in the UK, you’ve likely heard about Making Tax Digital (MTD). But with so many…

Making Tax Digital (MTD) is HMRC’s plan to move tax filing online. If you’re a small business owner registered for VAT, you need to understand…

If you run a small business in the UK, chances are you’ve heard of Making Tax Digital (MTD). But what does it actually mean for…

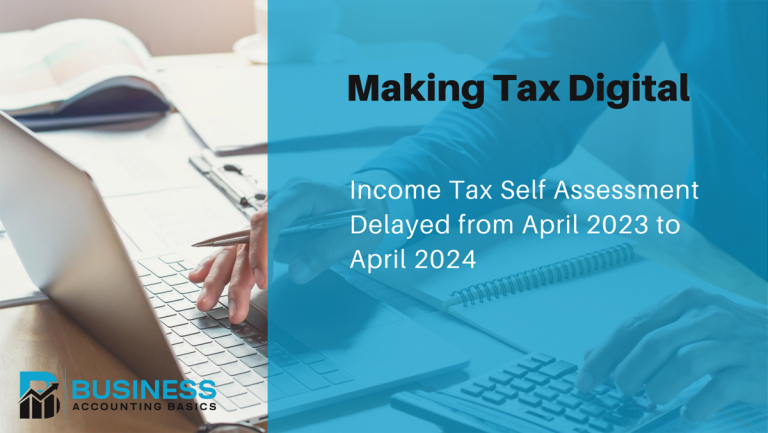

Key Dates for Making Tax Digital In a recent announcement, the government revealed revised implementation dates for Making Tax Digital for Income Tax Self-Assessment (MTD…

Tax returns for self-employed individuals are used to report income, expenditures, and other financial information to HMRC. The information collected calculates the amount of tax…

Small businesses in the UK may feel overwhelmed by the complexities of Value Added Tax (VAT). But, understanding VAT is essential if you want to…

HMRC have announced that making tax digital ITSA has been delayed to April 2026. ITSA is Income Tax Self Assessment. In this article, we will…