What is Bookkeeping and Why Your Small Business Needs It

Does your business’s financial health feel a bit like a puzzle? Are you dreading the next tax season? If so, it might be time to get to know bookkeeping.

Bookkeeping isn’t just about numbers – it’s the foundation of your small business’s financial success. It’s about:

- Tracking your income and expenses

- Understanding your cash flow

- Making smart decisions that help your business grow

In this post, we’ll explain:

- How it can help you take charge of your finances

- What bookkeeping is, in simple terms

- Why it’s so important for your small business

Bookkeeping Definition

Bookkeeping systematically records all business financial transactions, including tracking income, expenses, assets, liabilities, and equity. It provides a comprehensive financial picture, essential for understanding a business’s profitability, cash flow, and overall financial health.

It involves invoicing, paying bills, preparing tax returns, monitoring key performance indicators, bank reconciliation, and offering advice.

Bookkeeping aims to maintain accurate records so that financial decisions can be made. This information is essential for business success. Accurate and up-to-date bookkeeping records are also necessary to file taxes, including self-assessment and VAT, apply for loans, and make sound financial decisions.

Difference Between Bookkeeping and Accounting

Bookkeeping is the essential process of meticulously recording all a business’s financial transactions. It is the day-to-day tracking of money coming in and going out, including sales, purchases, invoices, and payments. Bookkeepers focus on maintaining accurate and organised financial records, ensuring everything is categorized correctly and ready for further analysis.

Accounting, on the other hand, takes the information gathered through bookkeeping and transforms it into actionable insights. Accountants analyse the financial data, prepare financial statements, and advise business owners strategically. They help interpret the numbers, identify trends, and make informed decisions about budgeting, investments, and growth strategies.

Both bookkeeping and accounting play crucial roles in a business’s success. Bookkeeping provides the raw data, while accounting helps make sense of it all. Together, they ensure a business clearly understands its financial position and can make sound decisions for the future.

The Key Components of Bookkeeping

At its core, bookkeeping involves tracking your business’s financial ins and outs. Let’s break down the key components:

- Income and Expenses: This is the bread and butter of bookkeeping. Income represents all your business’s money from sales, services, or investments. Expenses, on the other hand, are the costs incurred to run your business – things like rent, salaries, utilities, and supplies. Keeping a close eye on both helps you gauge profitability and identify areas where you can cut costs or boost revenue.

- Accounts Receivable and Payable: Think of these as “IOUs.” Accounts Receivable track money owed to your business by customers for goods or services already delivered. Accounts Payable tracks money your business owes to suppliers or vendors for goods or services received. Managing both is key to maintaining healthy cash flow and avoiding late payments or collection issues.

- Reconciliation: This is where you compare your internal financial records with your bank statements. The goal? To ensure everything matches up. Discrepancies can arise from errors, unrecorded transactions, or even fraud. Regular reconciliation helps you catch these issues early, maintain accurate records, and clearly understand your financial position.

- Managing Payroll:

How to Get Started with Bookkeeping

Small business bookkeeping is an essential but often daunting task. You may be wondering where to start and what you need to do to keep your business finances in order. Fortunately, getting started with small business bookkeeping doesn’t have to be complicated or time-consuming. Here are a few simple steps to get you started:

1. Open a business bank account: This will help you keep track of your business income and expenses separate from your personal finances. If you are a sole trader, it is not a legal requirement but makes bookkeeping easier.

2. Set up your accounting system: There are several ways to set up your bookkeeping system, including:

Excel – If the business is simple, Excel might be a good solution. We offer lots of free bookkeeping templates to help you get started.

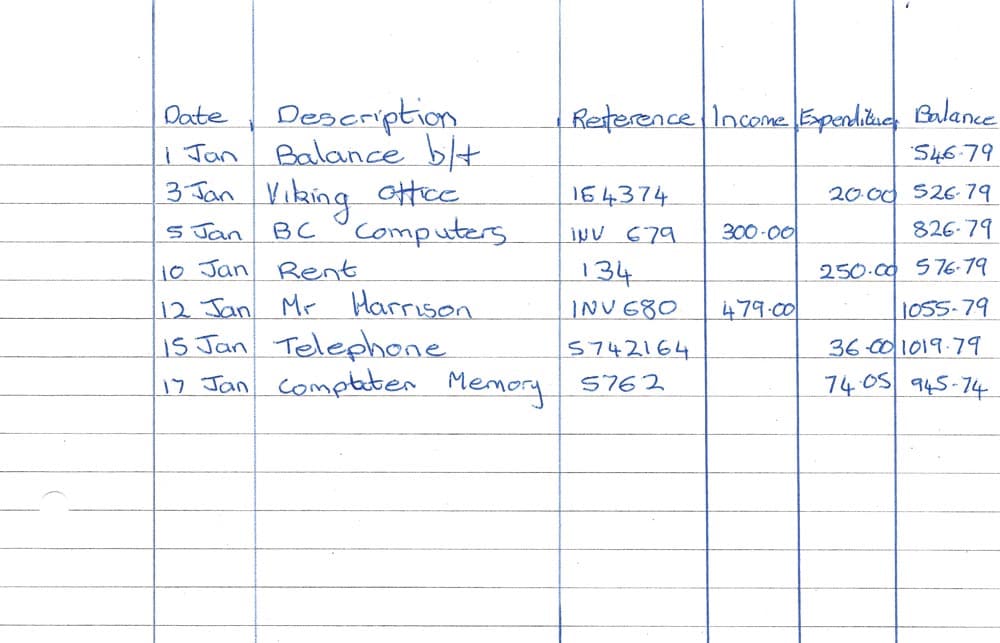

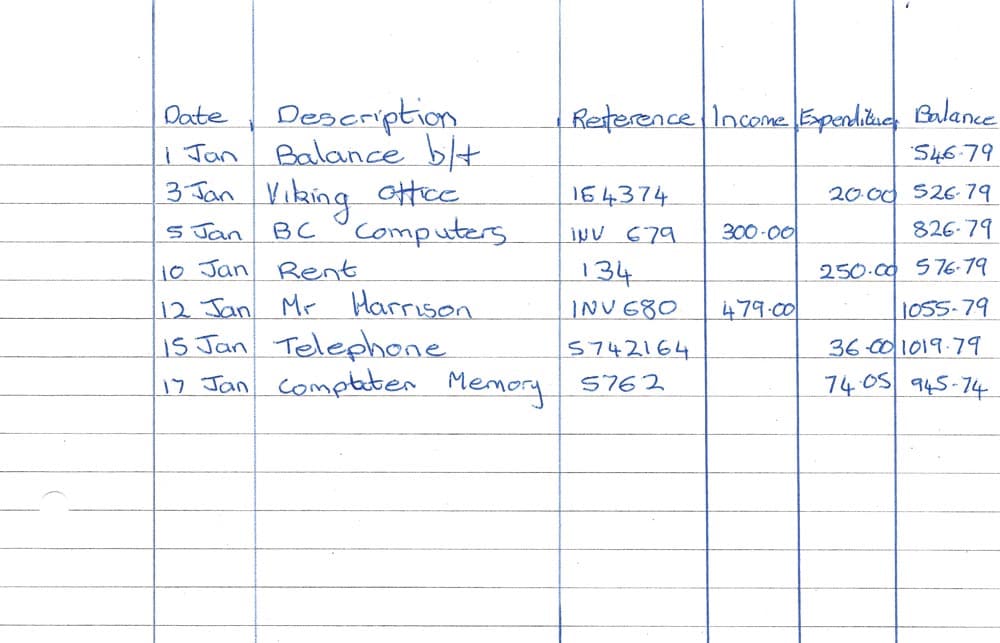

Bookkeeping Ledger Book – These are books with columns to record your financial transactions. This method is only suitable for very small businesses or charities with very few transactions.

Bookkeeping Software – Many bookkeeping systems, including free software, are available. Although bookkeeping software may have a learning curve in the long run, it might save lots of time. It is a double entry system, which means the accounts will always balance.

3. Keep track of your income and expenses: This includes income from sales and any expenses incurred.

4. Set up a filing system – HMRC requires paperwork to be kept for six years. Several options, including paper files and saving everything to the cloud or within the accounting software.

4. Hire a bookkeeper or accountant: If bookkeeping feels like too much of a daunting task, consider hiring a professional to help you out. If you are a limited company using an accountant to submit year-end financial records to Companies House is the best solution to ensure that they are correct.

What is Bookkeeping – Recording Financial Transactions

The entries are recorded in your accounting system when a business transaction occurs.

The entries might include sales invoices, business expenses, adjusting journals, bank payments and bank receipts.

The transactions in an accounting system can provide valuable insight into a company’s financial performance. Financial reports can help business owners make informed decisions about their business.

What are the Main Financial Reports?

Financial reporting is communicating financial information about a business to shareholders, creditors and other interested parties. The reports include the profit and loss, balance sheet and cash flow forecast.

Financial reporting is used to make financial decisions, assess performance, and measure financial risks. Financial ratios are often used in financial reports to compare a company’s financial performance with that of other companies in its industry or for previous periods.

We will now take a brief look at the three main reports.

Profit and Loss or Income Statement

A profit and loss statement (P&L) is a document that shows the financial position and how much money a company has earned over a specific period. Profit and Loss statements are divided into two parts: revenue and expenses.

Balance Sheet

A balance sheet is a financial statement showing a company’s assets, liabilities, and shareholders’ equity at a specific time. The assets are the things that the company owns, such as cash, property, and equipment.

Cash Flow Forecast

A cash flow forecast is a document that shows how much money a company expects to receive and spend over a specific period. A forecast is a helpful tool to see when to reinvest money back into the business, pay off debts, or make new investments. It can also help track trends and see where the company is making and losing money.

The Different Types of Bookkeeping Software Available

There are many options for different accounting packages, and it is difficult for business owners to choose the right one.

A few things to look for when choosing the best option are:

- Price – Small sole traders may not want to pay, but free options are available.

- Features – It is essential to choose a package with the required features, including professional invoices, inventory or stock management and payroll.

- Making Tax Digital – HMRC is introducing making tax digital (MTD). It means that businesses will need to use software to keep their records and submit tax returns. Ensure that the software you use is MTD compliant.

- Ease of use – The software needs to be easy to use. Check out the dashboard and how easy it is to add new transactions.

Free Accounting Software

Free accounting software is available and can save businesses considerable money. Free accounting software typically offers reduced features than paid options. Some do not provide an option to produce a sales invoice and have limited reports available.

Best Bookkeeping Software

Anyone who has ever tried to do their taxes knows that it can be daunting. Luckily, some paid accounting software programs can make the process much easier. It is worth looking at Xero, QuickBooks and FreshBooks

These programs provide users with professional invoices and financial statements, and they also use a double entry system to help ensure accuracy. In addition, many accounting software programs offer additional features such as tracking expenses and creating budgets.

Paying accounting software is well worth the investment for anyone who wants to take the hassle out of managing their finances.

Tips for Staying Organised while Keeping Your Books

When it comes to bookkeeping, staying organised is vital. There are a lot of small details that go into tracking your finances, and if you’re not careful, it can be easy to lose track of where you stand. That’s why it’s essential to have a system to organise your books and stick to it.

Here are a few tips to help you get organised:

Set up a bookkeeping process – The first step to staying organised is having a bookkeeping system. It will help you keep track of your finances and ensure that all of your records are included.

Keep proper financial records – To stay organised, you need to keep accurate records. This means recording all of your income and expenses and any other transactions that you incur.

Stay up to date – One of the essential aspects of bookkeeping is staying up to date. This means regularly reviewing your records and ensuring that all of your information is accurate. Nothing is worse than having to rush your accounts.

Accounts Payable – Accounts payable is one area where things can quickly get out of control. To stay organised, you need to have a system for tracking your expenses and ensuring that you pay them on time.

Sales Ledger – The sales ledger is another area where things can get complicated. To stay organised, you need to keep track of your sales and ensure that they are paid on time.

Common Mistakes Made in Bookkeeping and How to Avoid Them

If bookkeeping isn’t done correctly, it can lead to serious problems. Here are some common mistakes that are made in bookkeeping and how to avoid them:

Not keeping accurate records – This is one of the most common mistakes made in bookkeeping. If mistakes happen, it is possible to correct them by recording journal entries.

Not reviewing bank statements – This can lead to discrepancies and problems with your records. Always take the time to review and complete a bank reconciliation.

Failing to reconcile accounts – Reconciling your accounts in the general ledger is one of the most important aspects of bookkeeping. By failing to do this, you could end up with inaccurate records.

Not having a system – One of the best ways to stay organised is to have a bookkeeping system. This will help you keep track of your finances and ensure that all of your records are included

Leaving everything to the last minute – One of the worst things you can do is leave everything to the last minute, especially at the financial year-end. This will only lead to rushed work and inaccurate records. It’s important to take your time and double-check your work.

Mixing personal and business records – This is a mistake that can have serious implications. It’s important to keep personal and business transactions separate to avoid confusion.

Single Entry Bookkeeping

Single-entry bookkeeping is the most basic form of record-keeping for businesses. Under this system, each transaction is recorded only once, either as a debit entry or as a credit entry. It means that there is only one entry in the books for each transaction.

While single-entry bookkeeping is relatively simple, it can be time-consuming and leaves room for error. As a result, most businesses opt for double entry bookkeeping, which is a more sophisticated system. However, it can still be used effectively for small businesses and personal finances.

Double Entry Bookkeeping

Double entry bookkeeping is a system of accounting that ensures accuracy and allows for easy audits. Under this system, every financial transaction is recorded in at least two accounts. This will enable businesses to track both the inflow and outflow of funds, as well as to double-check their records for accuracy.

The double entry bookkeeping system has been used for centuries and is still the preferred method for many businesses today. While it may seem complicated at first, double entry bookkeeping is quite simple once you get the hang of it. With a bit of practice, you’ll be able to keep your books organised and error-free.

What is Financial Data

Source documents are the data that bookkeepers use to record transactions. The documents can include receipts, invoices, statements, and credit card statements. Source documents must be accurate and complete to provide an accurate record of a company’s financial activity.

What are Bookkeeping Services?

Many business owners find that bookkeeping services are a valuable asset. Outsourcing this task can save time and money while ensuring that their accounting practices are up to date. In addition, bookkeeping services can provide peace of mind and allow business owners to concentrate on running their businesses.

It is essential to find a reputable and reliable service for bookkeeping service. However, the benefits of doing so are well worth the effort. By outsourcing this important task, business owners can free up time and energy to focus on what they do best: running their businesses.

Bookkeeping Terms

Knowing bookkeeping terms is helpful whether you are handling your finances or someone else’s. We provide a comprehensive list of bookkeeping terms and their definitions. The bookkeeping terms listed on this site are presented in alphabetical order.

Conclusion to What is Bookkeeping

Bookkeeping is the process of recording financial transactions for a business. It can be done in various ways, but the most common is double entry bookkeeping. This system ensures accuracy and allows firms to track both the inflow and outflow of funds. By outsourcing this task to a professional bookkeeping service, business owners can save time and money while ensuring that their accounting practices are up to date.

Further Reading

For further information on bookkeeping, read the following articles: