FREE Sales Invoice Template for Small Businesses

Seeking a professional and user-friendly sales invoice template? Download our free UK-ready Excel, Google Sheets, or PDF templates, available in both VAT and non-VAT formats. These templates are perfect for small business owners, freelancers, and sole traders who want to create invoices quickly and accurately without hassle.

Our templates are designed to be user-friendly, allowing you to easily edit and save your invoices on your computer or mobile device. Additionally, you can access and download your invoices in multiple formats, including PDF, making it easy to send professional bills to your clients and receive payment faster.

What is a Sales Invoice?

A sales invoice is a document that a business sends to a customer, acting as an official record of a sale. It functions as a detailed bill. Here’s a breakdown of its key features:

- Request for Payment: This request asks the customer to pay for the goods or services provided.

- Transaction Details: This outlines what was sold, the sale date, and the total amount owed.

- Payment Terms: It specifies how and when the payment is due (e.g., net 30 days).

- Legal Record: It serves as a legal record of the transaction for both the buyer and seller.

- Accounting Purposes: It’s an essential document for a business’s accounting processes, helping track income and sales tax.

In essence, it’s a way to ensure everyone is on the same page about what was sold, its cost, and when the payment is due. Using a free invoice template will make the process easier.

Why use our Professional Sales Invoice Templates?

As a small business owner providing a sales invoice to a client, it’s essential to leave a good, lasting impression. Having a well-designed invoice is one way to achieve this. Another way to get an invoice to stand out is to print it on coloured paper.

Using blank invoice templates eliminates the repetitive task of entering your company’s details each time you need to create an invoice. An alternative to using Excel invoice templates is to use a duplicate book or print a form and complete it by hand.

What are the Alternatives for Issuing Invoices?

While Excel invoice templates are an excellent starting point for small businesses, upgrading to accounting software offers a range of advantages that can streamline your invoicing process and improve your financial management. Here’s how:

1. Professional and Customisable Invoices

Modern invoicing software enables you to create professional, custom invoices featuring your logo, brand colours, and layouts. You can easily customise templates to match your business identity, presenting a consistent and trustworthy image to clients.

2. Automated Calculations and Data Entry

With built-in automation, accounting software handles all calculations for you, including subtotals, VAT, discounts, and totals. This significantly reduces the risk of errors.

3. Online Payments and Faster Cash Flow

Most platforms support online payment integration. You can include “Pay Now” buttons in your invoices using services like Stripe, PayPal, or direct bank transfers.

4. Recurring Invoices and Automation

If you bill clients regularly—weekly, monthly, or quarterly—invoicing software can automate the process by sending recurring invoices on your behalf.

5. Real-Time Tracking and Alerts

You can see when an invoice was sent, viewed, or paid. Automated email payment reminders can be sent to clients as due dates approach or if a payment becomes overdue.

6. Built-In Record Keeping and Reporting

Every invoice issued is stored securely and can be retrieved instantly. This simplifies end-of-year tax returns, allowing you to run reports on your income, outstanding payments, and client activity.

7. Multi-Currency and Tax Compliance

For businesses dealing with international clients, accounting software can manage invoices in multiple currencies and automatically apply the correct tax rules.

8. Mobile Access and Cloud Storage

With cloud-based platforms like Xero, QuickBooks, or Sage, you can issue invoices on the go from your phone or tablet.

Best Small Business

| From £16 per month |

| Free Trial |

| Integration with apps |

| 90% Discount – 4 Months |

Best Free

| From £12 per month |

| 1,000 invoices PA Free |

| Integrate with Zoho Apps |

| No Discount |

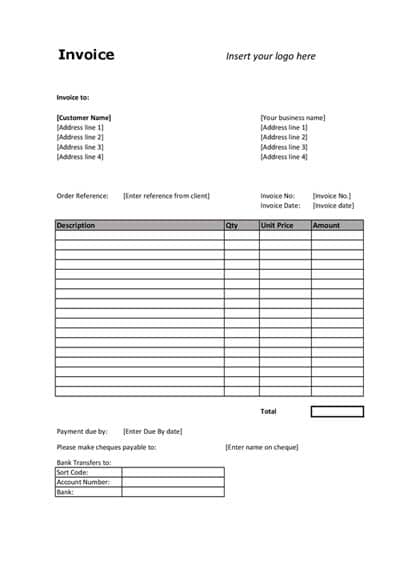

Instructions for Free Excel Invoice Template UK

Download the invoicing spreadsheet below and select either ‘VAT’ or ‘non-VAT’. Open it in Excel or Google Sheets.

The first step is setting up a template for all your sales invoices. For this, you add your contact details, including business logo, company name, address and payment details:

To add a company logo, the sheet must be unprotected first. To do this, go to File > Info > Protect Workbook and click Unprotect (the password is blank). Once finished, you can protect it again using the exact instructions.

You can add a logo by clicking on the area, selecting ‘Insert’, then choosing a picture from a file. If you do not have a logo, you can delete this section.

Complete the section for your company name and business address. At the bottom of making the payment, enter either your bank details or the cheque payee.

Important: If you are a Limited Company, it is a legal requirement to include your company registration number, the business name on the certificate of incorporation and the registered address. There is space on the bottom two rows of the invoice template for this information.

If you are VAT-registered, you must include your VAT number for the business and display the sales tax.

Once all the information has been entered, you now have a template that you can use repeatedly. Save this file so that you can find it easily.

TIP: If you invoice a customer regularly, it may be worth setting up a template for them so you don’t have to enter the details each time. You can save it under the customer name and manage multiple invoice templates to streamline your billing process efficiently.

How to Issue Sales Invoices

Complete the following information for each bill.

- Unique Invoice Number: Open your sales invoice template and assign a unique invoice number to each document

- . Avoid starting with ‘1’ as it suggests a new business.

- Invoice Details:

- Date: Include the date the invoice is created.

- Customer Reference: Add any reference provided by your customer, such as a purchase order number or contact name.

- Itemised List:

- Description: Clearly describe the service or item sold.

- Quantity: Enter the number of units sold.

- Unit Price: Indicate the price per unit.

- VAT (if applicable):

- VAT Percentage: For VAT-registered businesses, include the VAT rate for each item.

- Automatic Calculations: Our VAT template calculates VAT automatically.

- Payment Terms:

- Due Date: Specify the date payment is due based on your agreed-upon credit terms (e.g., 7, 14, or 30 days from the invoice date, or net monthly).

- Saving and Sending:

- Unique Reference: Save the document with a clear, easy-to-find reference, typically the invoice number.

- Optional Client Reference: Consider including the client name followed by the invoice number (e.g., Acme Ltd – INV-2024-001) for better organisation.

- Delivery Options:

- Email or Post: Send the invoice electronically or by mail to your client.

- Paper Records: Print a copy for your files if you maintain paper records.

For more information on what needs to be included in a sales invoice, refer to the HMRC guide.

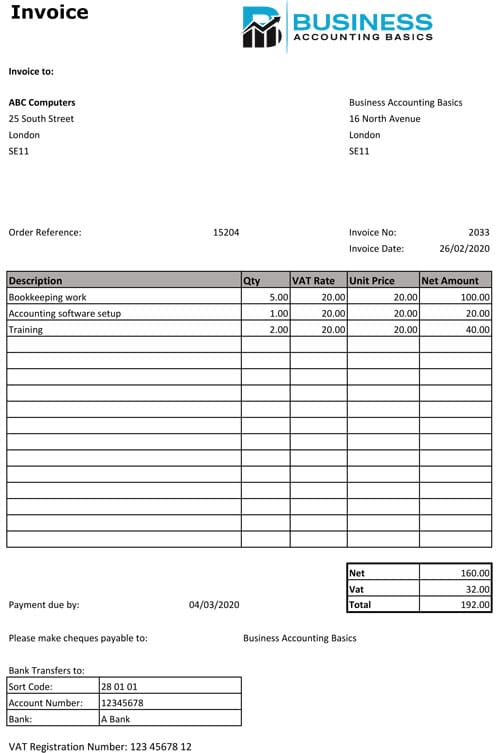

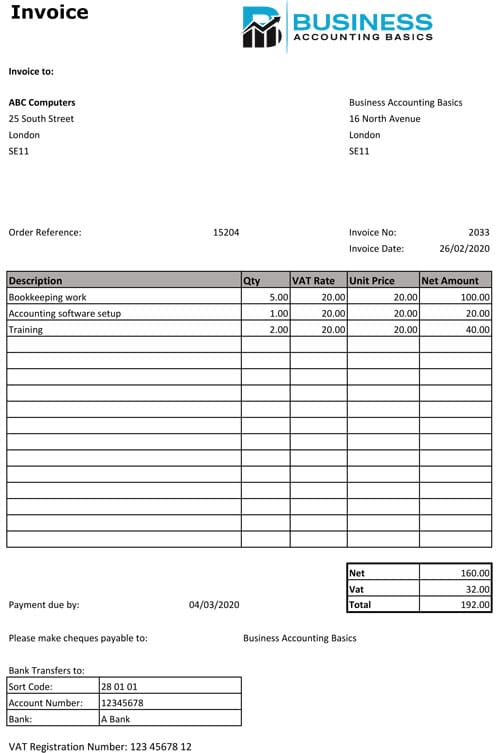

Sample of Invoice Templates UK

Below is an example of a VAT sales invoice issued to a customer for accounting services. The sales tax is calculated automatically in the template.

Keeping Track of Your Sales Invoices

One of the most effective ways to manage and track invoices is by using our sales invoice list template. This template allows you to record all your invoices in one organised document, making it easy to keep track of payments and due dates.

Excel Sales Invoice Template UK – Licence Agreement

By downloading our free invoice templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

You agree to the licence agreement by downloading the free sales invoice template by clicking on the link below. If you’re unsure which template to use, refer to the images below.

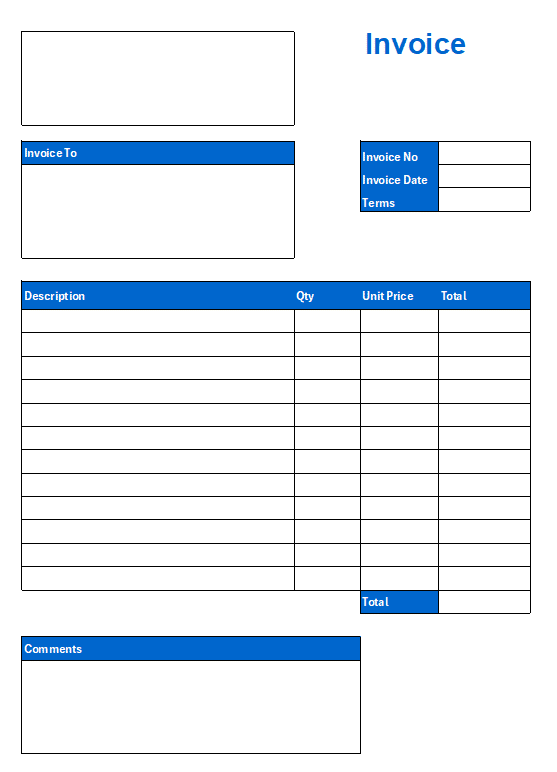

Invoice Non-VAT

Invoice VAT

Printable Invoice Template PDF

Excel Bookkeeping Templates

Check out our other Excel Bookkeeping templates, including a word receipt template, cash book, profit and loss, balance sheet and petty cash.

We also offer a proforma invoice template.

Return from sales invoice templates to the Excel Bookkeeping Templates page.