Small Business Accounting Software Reviews

Finding the best accounting software for your small business owners can feel overwhelming, especially with so many options on the market. Whether a sole trader, freelancer, or running a limited company, using the right accounting software can help you manage your finances, track expenses, send invoices, and comply with HMRC requirements.

This page provides easy-to-understand reviews of the top accounting software for UK small businesses, including popular choices like QuickBooks, Xero, Sage, FreeAgent, and Zoho Books. We cover key features, pricing, pros and cons, and who each software is best suited for. From simple accounting software to complete packages with app integrations, you can find the best one to fit your needs.

We aim to help you compare accounting software options and choose the best for your business needs, saving you time and making bookkeeping more manageable. We will help you find the best small business accounting software deals with our best offers.

Why use Accounting Software?

When it comes to managing a small business, good accounting software is essential. It can help you keep track of your expenses, income, and overall financial position. This information can then be used to make informed business decisions and grow your company safely and sustainably.

Small business accounting software can also help you save time and money. By automating many of the tasks in bookkeeping, such as recording transactions and preparing invoices, you can streamline your workflow and reduce the chances of making mistakes. Many programs offer features that can help you slash your accounting costs, such as automatic billing and expense tracking.

Overall, good accounting software is essential for running a successful small business. It can take some time to get used to, but stick with it, and the benefits will soon become apparent.

Making Tax Digital (MTD) for VAT and the Self-Employed

Making Tax Digital (MTD) is a government initiative from HMRC designed to make tax reporting more efficient and accurate. It affects how businesses and self-employed individuals keep their records and submit their tax returns.

Making Tax Digital for VAT

You must follow MTD rules if your business is VAT-registered and has a taxable turnover above £85,000. This means:

- You must keep digital records of your VAT transactions.

- You must use HMRC-compatible software to submit VAT returns.

- You can no longer use the HMRC online VAT portal for quarterly returns.

Making Tax Digital for the Self-Employed

Making Tax Digital for Income Tax Self Assessment (ITSA) is being introduced for self-employed people and landlords:

- It applies to those with business or property income over £50,000 from April 2026.

- Those earning over £30,000 must follow the rules from April 2027.

You’ll need to:

- Keep digital business records.

- Submit quarterly updates to HMRC using Making Tax Digital compatible software.

- Send an end-of-period statement and final declaration each year.

Read more on Making Tax Digital for Income Tax.

What to Look for In Accounting Software

When choosing accounting software for your small business, ease of use is among the most critical factors. Look for software with a clean, simple interface that doesn’t require an accounting background. A mobile app is also helpful for managing your finances on the go.

Consider the key features you need. Most small businesses benefit from tools for creating and sending invoices, tracking expenses, linking bank accounts, and generating reports like profit and loss or cash flow statements. If your business is VAT-registered, ensure the software supports VAT returns and complies with Making Tax Digital (MTD).

Accounting software cost is another factor. Many platforms offer a range of pricing plans depending on your needs. Look for software that fits your budget but still includes essential features. A free trial or free version can help you test it before committing. We offer discounts on some of the popular platforms.

Good customer support is also crucial. Choose accounting software that offers help through live chat, phone, or email, along with tutorials, guides, and community forums to answer common questions. Also, check with your accountant or bookkeeper about their software. They might be able to help get you started and offer support.

Think about integration options too. The best accounting software will connect with other tools you use, like PayPal, e-commerce platforms, or CRM systems. Bank integrations are beneficial for keeping your records up to date automatically.

Security should never be overlooked. Ensure the software stores your data safely in the cloud, has regular backups, and offers features like two-factor authentication to protect your account.

Take the time to read reviews of accounting software providers and ask for recommendations. Real user feedback can give insight into how well the software works for small businesses like yours, and whether it’s reliable and user-friendly.

Cloud Accounting Software

All of the recommended accounting software packages are cloud-based, and for good reason. Cloud accounting software allows small business owners to access their financial data anytime, anywhere, from any device with an internet connection. It offers automatic backups, real-time updates, feeds with your business bank account and better collaboration with accountants or team members. Most importantly, cloud software ensures you always use the latest version, which is essential for staying compliant with UK tax laws like Making Tax Digital (MTD).

Small Businesses Free Accounting Software

There are a few free accounting software options on the market. These can be a great way to start without making a significant investment. However, they may not have all of the features you need as your business grows and may not be making tax digital compliant.

I have also known providers who state they will always be free, then change to paid plans, and the user is locked into using the software. A couple of options worth looking at are FreeAgent and Zoho Books.

Accounting Software Quick List

We will now look at some of the best small business accounting software packages available in the UK:

- QuickBooks – Popular and user-friendly with strong invoicing, bank feeds, and excellent MTD support for VAT. Best for self-employed.

- Xero – Great for growing businesses with powerful features, real-time reporting, and seamless integrations.

- Sage – Trusted UK brand offering solid payroll, VAT, and cash flow tools tailored for compliance.

- Zoho Books – Affordable and feature-rich, ideal for freelancers and small businesses needing automation and customisation.

- FreeAgent – Simple, HMRC-recognised software perfect for UK freelancers, contractors, and sole traders. Free for some UK banks.

- FreshBooks – Best for service-based businesses with easy time tracking, invoicing, and client communication.

- Accounts Portal – Clean and affordable option with strong invoicing, reporting, and multi-currency support.

- Ember – A modern UK platform with automation and real accountants included, ideal for tech-savvy businesses.

These are all MTD compatible accounting software for the UK market.

We do not give ratings, as each accounting software offers different features and a package that is a good fit for one business might not work for another. The best place to check for reviews is Trustpilot.

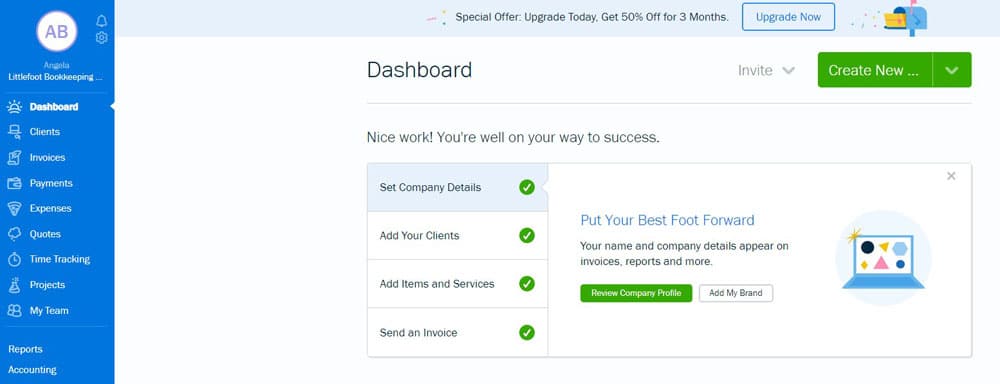

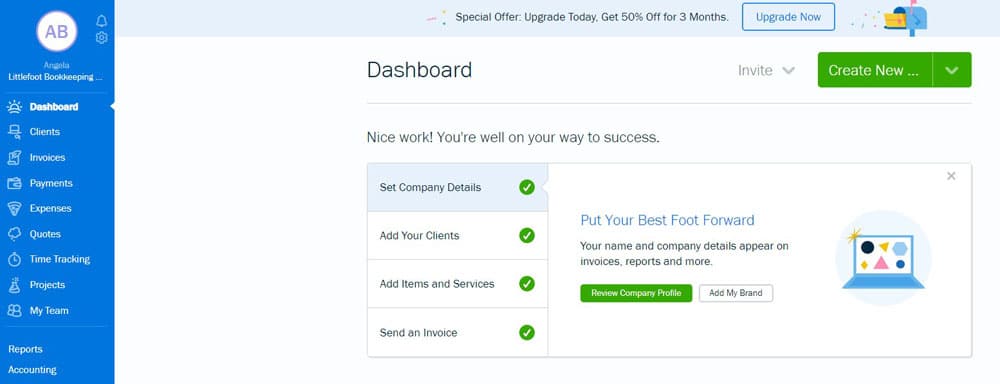

QuickBooks Online Accounting Software Review

QuickBooks is one of the most popular cloud accounting software providers for UK small businesses, and for good reason. It offers a user-friendly interface, strong invoicing tools, and automated bank feeds that simplify bookkeeping. It’s compliant with Making Tax Digital (MTD), making it ideal for VAT-registered businesses.

Features like income tracking, receipt capture, CIS and customisable reports help business owners stay on top of their finances. With flexible pricing plans and a handy mobile app, QuickBooks is a reliable all-rounder for sole traders, freelancers, and growing businesses.

There are many different add-ons, so you should be able to tailor the software to meet your needs.

QuickBooks Online offers a free trial and a 90% discount for 7 months. Please read our full QuickBooks Review and our comparison of QuickBooks vs Xero.

Intuit QuickBooks Pricing

Self-Employed

- Prepare Self-Assessment Tax Returns

- Get Tax Estimates

- Send Invoices

- Track Mileage

- Separate Personal Expenses

- Manage Income & Expenses

- Free Onboarding

£1 for 7 months, then £10/month

Save £63 over 7 months

Simple Start

- Tax Estimates

- MTD VAT

- Invoices paid instantly

- Manage Income & Expenses

- Telephone Support

- Single User

- Track Mileage

- Estimates & Quotes

- Free Onboarding

£1.60 for 7 months, then £16/month

Save £100.80 over 7 months

Essentials

- Everything in Simple Start

- Manage Bills

- Multi-Currency

- 3 Users

- Most Popular

- Cash Flow

- VAT Error Checker

- Track Employee Time

- Free Onboarding

£3.30 for 7 months, then £33/month

Save £207.90 over 7 months

Plus

- Everything in Essentials

- Manage Stock

- Profitability for each Project

- Set Budgets

- 5 Users

- Free Onboarding

£4.70 for 7 months, then £47/month

Save £296.10 over 7 months

Xero Accounts Review

I have used XERO for several clients and found it among the best packages. Xero is a cloud-based accounting platform popular with UK small businesses, especially those that are growing or need to collaborate with others. It has a clean interface, powerful features, and the ability to integrate with over 1,000 third-party apps, including payment processors, e-commerce platforms, and inventory tools.

Xero makes everyday tasks simple—sending professional invoices, reconciling bank transactions, and managing bills. Its real-time dashboard provides a clear view of your financial position at a glance, which is especially useful for business owners who want to stay in control without digging into spreadsheets.

The software is fully compliant with Making Tax Digital (MTD), making it a safe choice for VAT-registered businesses. It also includes multi-currency support, project tracking, and payroll (as an add-on), which are ideal for businesses with growing or more complex needs.

Overall, Xero is best for small to medium-sized businesses that want professional, flexible accounting software with room to grow.

Xero Pricing

Xero offers a free trial. The Ignite plan is £16 per month, while the Grow plan is £33 per month. We offer a 90% discount for 4 months.

Sage Accounting Software

Sage is one of the most established names in UK accounting software, offering trusted solutions for small businesses, sole traders, and growing companies. Known for its reliability and local compliance, Sage Business Cloud Accounting provides a solid range of tools for managing day-to-day finances.

Sage’s features include invoicing, bank reconciliation, VAT returns, and detailed financial reporting. It’s MaIt’s Tax Digital (MTD) compliant, allowing users to submit VAT returns directly to HMRC. For businesses that also run payroll, Sage offers an integrated payroll module that meets UK legal requirements, including automatic pension calculations and payslip generation.

The platform is user-friendly, though slightly more traditional in layout than newer tools. It’s designed to keep small business owners in mind, but it appeals to bookkeepers and accountants who want more detailed controls.

Sage includes automatic bank feeds, cash flow forecasting, and mobile access through the Sage Accounting app. It’s useful for businesses that want clear cash flow insights and good support, with access to UK-based customer service and resources.

With competitive pricing and a 30-day free trial, Sage is a dependable choice for small businesses that want straightforward, compliant software with room to grow.

Zoho Books

Zoho Books is cloud-based accounting software that is easy to use and helps you manage your finances. With Zoho Books, you can create invoices, track expenses, and monitor your business performance. You can also connect your bank and PayPal accounts to download transactions automatically.

Zoho Books also offers a mobile app that allows you to manage your finances on the go. You can also create and send invoices from your phone.

Zoho Books is an excellent option for small businesses that need simple and easy-to-use accounting software. Zoho Books also integrates 40 apps, allowing companies to expand their operations.

Zoho Books Pricing

FreeAgent Accounting Software – FREE for some bank account holders

FreeAgent is a UK-based accounting software for freelancers, contractors, and small business owners. It’s known for its simplicity and clear, jargon-free interface, making it ideal for people who aren’t experts.

FreeAgent covers all the basics: invoicing, expense tracking, bank reconciliation, time tracking, and mileage. It’s MaIt’s Tax Digital (MTD) compliant, allowing users to submit VAT and Self Assessment tax returns directly to HMRC. For sole traders, it can even calculate your tax bill automatically.

One standout feature is the free version available to NatWest, Royal Bank of Scotland, and Mettle business account holders. This full-featured version gives you everything FreeAgent offers at no cost, making it one of the best-value options on the market if you bank with one of these providers.

The mobile app is also convenient, allowing you to snap receipts, log expenses, send invoices, and track time wherever you are.

FreshBooks Review

FreshBooks is an easy-to-use accounting tool built for service-based businesses, freelancers, and consultants. It shines regarding time tracking, invoicing, and managing client projects, making it a favourite for creatives and professionals who bill by the hour.

The interface is clean and intuitive, including features like automated payment reminders, expense tracking, and financial reports.

FreshBooks also includes a mobile app, excellent customer support, and integrations with popular tools like Stripe and PayPal, making it a practical choice for those focused on client work and cash flow.

FreshBooks Pricing

Accounts Portal Review

Accounts Portal is a straightforward, cloud-based accounting solution ideal for small businesses looking for essential features without the complexity. It offers reliable tools for invoicing, bank reconciliation, VAT returns, and financial reporting.

A standout feature is its ability to manage departments or divisions, allowing you to split income and expenses by business area. This is particularly useful for companies that want to track performance across multiple teams, services, or locations without needing separate accounts.

While it’s not as flashy as some newer tools, Accounts Portal is clean, affordable, and gets the job done—perfect for small businesses that value simplicity and solid reporting.

Accounts Portal Pricing

They have a simple pricing plan of £10 per month for everything. There is also a free 30-day trial.

Ember Accounting Software Reviews

Ember Accounting Software is a company that provides accounting software and a team of accountants who offer support for their software. The accountants can help with any questions or problems that users may have.

The software includes the following features: mobile app, incorporation of limited companies, multi-currency and tax estimates.

Ember Pricing

Ember is a cloud-based accounting software solution with a fixed price of £59 per month for essentials, £89 for essentials plus year-end filings, or £159 for a dedicated accountant.

Compare Accounting Software

Use our free tool to compare accounting software. Choosing the best package for the business can take some time. You need to ensure that it includes all the required features and is user-friendly.

Best Accounting Software

Read our best accounting software for small business. Our guide includes the best packages for products and service businesses, the easiest to use, the best for startups and free packages. We have included the pros, cons and pricing for each, making it easier to see how they compare.

Cloud Accounting Free Software Trials

Most now offer a free trial, generally for 30 days. It is worth trialling a few to see which suits your business the best. Most now provide automatic bank downloads; check if they include your bank. It will also allow you to look at their sales invoice designs and see their suitability. Before the trial ends, decide on the best package for your business.

Small Business Accounting Software Conclusion

Choosing the right accounting software depends on your business size, needs, and budget. Whether you’re a freelancer looking for simplicity, a VAT-registered business needing MTD compliance, or a growing company that wants advanced features, there’s a solution to fit.

QuickBooks, Xero, and Sage offer powerful features for most UK small businesses. FreeAgent is ideal for freelancers, especially if you bank with NatWest or Mettle. Zoho Books and Accounts Portal provide great value, while Ember adds automation with accountant support.

Take advantage of free trials where available, and consider what features matter most, like invoicing, reporting, mobile access, or tax compliance. The right software can save time, reduce stress, and give you better control over your finances.

Return from Accounting software reviews to the accounting basics page.