As a business owner, bookkeeping will become essential to running the business. Bookkeeping is complicated, so we will look at the different steps and show bookkeeping examples.

The first step is to decide how you will handle the bookkeeping. Some businesses use manual systems, such as Excel, while others opt for accounting software. Accounting software makes posting transactions easier and automates some of the tasks, saving both time and money. We recommend Sage UK, Xero or QuickBooks.

Accounting Software Best Deals

Sage UK – 90% Discount for 6 Months – FREE plan for Sole-Traders, AI tools for bookkeeping automation

XERO – 90% Discount for 6 Months + Amazon Gift Card – Cloud accounting, unlimited users, smart bank feeds

QuickBooks – 90% Discount for 7 Months – Invoicing, expense tracking, payroll, financial reports

If you are in the UK, making tax digital is in the process of being introduced. It may therefore be worthwhile setting up your bookkeeping in accounting software that will submit the accounts to HMRC in the future.

There are two methods for completing bookkeeping, single entry and double entry; this article will mainly look at the double entry bookkeeping examples. Using our cashbook template, there is also a single-entry example at the end. The double entry system means that a second equal entry is made for each entry.

In our bookkeeping examples, we will use a business called ABC Computing. We will start with some everyday transactions and then move on to more complex bookkeeping examples.

Business Investment

ABC Computing opens up the business by investing 5,000.00; the company is self-employed, so the transactions are as follows:

| Account | Debit | Credit |

|---|---|---|

| Bank Account | 5000.00 | |

| Owners Equity | 5000.00 |

Both of these accounts are on the balance sheet, so they do not affect the trading profit and loss.

Sales Invoice

The sales invoice is a transaction used by nearly every business. The sales invoice is issued to request payment of goods or services from a customer. When a sales invoice is issued in accounting software, it will have either 2 or 3 postings, depending on whether you are VAT-registered.

ABC Computing issues a sales invoice for 1000.00 plus 20% VAT. The transactions that take place in the accounts are as follows.

| Account | Debit | Credit |

|---|---|---|

| Aged Debtors | 1200.00 | |

| Vat Control Account | 200.00 | |

| Sales | 1000.00 |

The aged debtors and VAT are part of the balance sheet, while the sales are on the profit and loss account.

Debtors Receipt

When a debtor pays an invoice, the transaction is between the debtor and the bank to reduce the balance in the debtor’s bank account. Both of the transactions are on the balance sheet and do not affect the profit and loss account.

| Account | Debit | Credit |

|---|---|---|

| Bank Account / Cash | 1200.00 | |

| Aged Debtors / Trade Receivables | 1200.00 |

As you can see from the sales invoice and the invoice payment, the debtors account is now a zero balance.

Credit Note

A credit note is the opposite of a sales invoice, and therefore, the transactions are reversed. If the company issues a credit note to cancel the above invoice, the transactions will be as follows:

| Account | Debit | Credit |

|---|---|---|

| VAT Control Account | 200.00 | |

| Sales | 1000.00 | |

| Aged Debtors / Trade Receivables | 1200.00 |

Cash Sale

In the sales invoice example above, the transaction was posted to the aged debtor’s account; if it is a cash sale, it will post to the bank or cash account.

| Account | Debit | Credit |

|---|---|---|

| Cash or Bank | 1200.00 | |

| VAT Control Account | 200.00 | |

| Sales | 1000.00 |

Cash sales can happen for several reasons, especially in retail or small businesses. It is still worth issuing a receipt for the transaction.

Below is our cash receipt template, available for free download.

Purchase Invoice

A purchase invoice is received from a supplier for goods or services that you receive and will pay for in the future. It will therefore post to the creditor’s account and also be an expense to the profit and loss or balance sheet.

In this example, the purchase invoice is for goods purchased on credit.

| Account | Debit | Credit |

|---|---|---|

| Cost of Goods Sold on the Profit and Loss or Stock on the Balance Sheet | 500.00 | |

| VAT Control Account | 100.00 | |

| Aged Creditors / Accounts Payable | 600.00 |

Creditors Payment

When the purchase invoice is paid, the accounting transactions are between the bank and the aged creditor’s account.

| Account | Debit | Credit |

|---|---|---|

| Aged Creditors | 600.00 | |

| Bank | 600.00 |

Accrual Bookkeeping Examples

Accruals are created by posting an accounting journal entry to the accounts. Businesses create accruals to account for invoices and paperwork not received by the end of an accounting period.

An example of an accrual is when a business has purchased and received stock, but the purchase invoice is not yet available.

| Account | Debit | Credit |

|---|---|---|

| Stock | 500.00 | |

| Accruals | 500.00 |

Both of the transactions are on the balance sheet as stock is an asset to the business.

Prepayment Example

A prepayment is when you pay or receive an invoice for something over a period longer than the report covers. An example is receiving an invoice for a year’s insurance, but the accounting period it covers is six months. You therefore want to add the remaining 6 months to the prepayments on the balance sheet.

Insurance is 1000.00 for May to April, but the annual accounts are year-end October. You would leave 500.00 in insurance as an expense on the profit and loss account and journal 500.00 to prepayment.

The journal is shown here:

| Account | Debit | Credit |

|---|---|---|

| Prepayment | 500.00 | |

| Insurance | 500.00 |

Depreciation

Depreciation is an accounting method for reducing the value of an asset over time. There are two main depreciation methods the straight line and the reducing balance method.

Business ABC computers purchases a laptop for 600.00; they estimate that it will have a useful life of three years. The depreciation will therefore be 200.00 per year.

The first journal shows the purchase of the laptop.

| Account | Debit | Credit |

|---|---|---|

| Fixed Asset | 600.00 | |

| Bank | 600.00 |

The second journal shows depreciation each year

| Account | Debit | Credit |

|---|---|---|

| Depreciation (expense on P&L) | 200.00 | |

| Accumulated Depreciation B/S | 200.00 |

The balance sheet at the end of the first year would show:

| Balance Sheet | ||

|---|---|---|

| Fixed Assets | 600.00 | |

| Accumulated Depreciation | 200.00 | |

| Value of Fixed Assets | 400.00 |

Bookkeeping Examples in Excel

All the bookkeeping examples above are for double entry bookkeeping. In this section, we are looking at single-entry bookkeeping using the free cash book available on this site.

Single-entry bookkeeping is the simplest form of bookkeeping, and many small businesses prefer it.

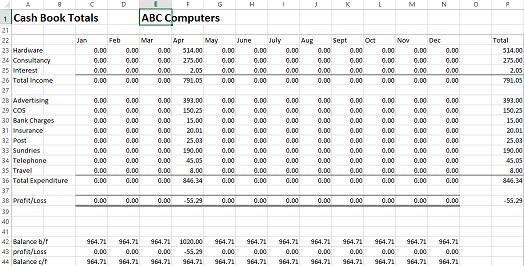

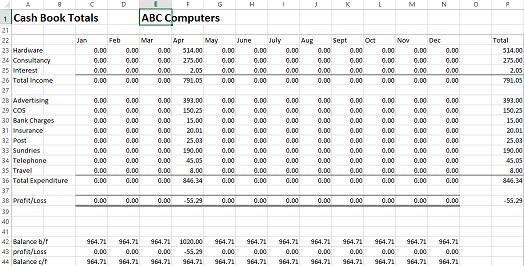

Below is a sample bank statement for ABC Computers:

Each row of the statement is entered into the cashbook, allocating the amounts to the appropriate account codes. It allows the business to see the profit and loss for each month.

Using our spreadsheet is quick to set up and simple to use. Download the full example to see how it works:

Further bookkeeping examples are available on the Wall Street Mojo Website.

Return from bookkeeping examples to bookkeeping basics page.