Business Personal Budget Template Instructions

Follow the business and personal budget template instructions to set up and use your spreadsheet.

Once you have downloaded the spreadsheet, please save it to your computer twice, giving it different names; the first copy will allow you to use it for future years, and the second for the current year.

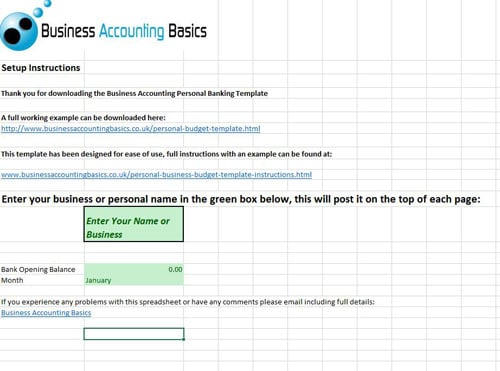

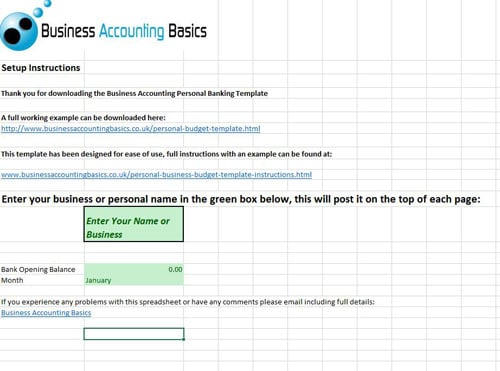

Set-up – Instructions page

There are a few simple steps that need to be followed to get started. On the instructions worksheet, you need to complete the green boxes. Add your business or personal name; this will post it to the top of each page.

Decide what date you want to start posting your bank transactions from. If it is January 1st, choose the month of January and enter the opening balance from the bank statement for January 1st.

Everything is all ready to get started.

Set-up Categories

On the Categories tab, you will find a list of 5 income codes and 13 expenditure codes. These are named income 1, income 2… And can be renamed to suit your needs. Some examples are:

| Personal | Business |

|---|---|

| Income | Income |

| Salary | Sales Hardware |

| Bank Interest | Sales Software |

| Universal Credits | Consultancy |

| Expenditure | Bank Interest |

| Rent/Mortgage | Expenditure |

| Council tax | Cost of sales |

| Insurance | Equipment |

| Utilities | Salaries |

| Loan | PAYE |

| Food | Rent |

| Car expenses | Insurance |

| Entertainment | Office Supplies |

| Pension | Business Expenses |

Personal Budget Template Instructions – Setting Budget

Setting your budget allows you to see if you are overspending or underspending during the year.

The best way to set the budget is to look at a couple of months of bank statements and take the figures from there. You may incur additional expenses during the year, such as car MOTs, car services, holidays, Christmas, Birthdays, etc. As a business, you may have some months that have fluctuations; if you know when these are, enter your expected figures.

On the left, you will see the categories that you entered previously. Enter each of your budget figures against each category for every month. If you are starting partway through the year, you only need to enter the months remaining, e.g., if starting in April only post April to December.

If you are a small business running from April, use our spreadsheet here.

Entering your Bank Figures

Once everything has been set up, you are ready to start posting your actual Amounts. Open up the tab for the month you wish to commence. At the top, you will see the bank balance brought forward; this is the balance entered on the instruction page. From now on, this will be the figure from the previous month.

Using your bank statement, enter each item on a new line. Details required are the date, customer or supplier name, any reference you want to add (can be a good reminder as to what it was for) and amount. Use the drop-down list to select the best category. The figure will post to the correct column.

IMPORTANT – as you go along, check the balance is the same as the bank statement – this ensures everything is entered.

Continue to enter your figures for the rest of the month.

Comparing Budget to Actual Figures

At any time, you can look at the comparison between the budget and actual amounts. There are a couple of places to review differences; each month, at the bottom of the worksheet, there is a total for the month, the budget and the difference.

The actual v Budget worksheet shows the whole year with the budget, actual and difference. It is easy to see whether you are overspending or saving what you have made. If you are partway through the month, the difference will show the amount of money you should have left to spend or receive.

Personal Budget Template Instructions

Adjusting your Budget

You may need to adjust your budget during the year, perhaps due to a wage increase or additional expenditure. It can be completed at any time using the budget sheet and adjusting the figures.

Personal Budget Template Licence Agreement

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

For further information on budgeting, please visit our personal budget template page.

Return from Business Personal Budget Template Instructions to Free Excel Bookkeeping Templates page.