Cash Flow Forecast with FREE Template

What is Cash Flow Forecasting?

Managing cash is one of the biggest challenges small business owners face. A cash flow forecast is a financial planning tool that helps you predict how money will flow in and out of your business over the coming weeks and months. By estimating future sales, expenses, and other payments, you can see whether you’ll have enough cash to cover your bills—or if you need to plan for a shortfall.

A cash flow forecast is more than just numbers; it’s a vital tool for managing finances effectively. It helps you stay in control, avoid unexpected cash shortages, and make more informed decisions about growth, hiring, and investments. Whether you’re a new business or looking to improve your business finances, learning how to create and use a cash flow forecast can give you peace of mind and keep your business on track.

The easiest way to produce a regular forecast is to use accounting software. QuickBooks includes 24-month cash forecasting tools within its software.

In this article, we’ll look at what a cash flow forecast is, why it matters for small businesses, and provide a free template you can use to get started. The template includes instructions and examples.

Cash Flow Forecast Definition

A cash flow forecast is a financial tool that estimates the amount of money a business expects to receive and spend over a period of time. It helps small business owners plan, spot potential cash shortages, and make informed decisions about how to manage their money.

Businesses can use their cash flow forecasts to plan for their future needs, such as investing in new machinery or expanding their premises. It will also show when cash flow is short. Regularly updating and reviewing a cash flow forecast can help businesses stay on track and make informed financial decisions.

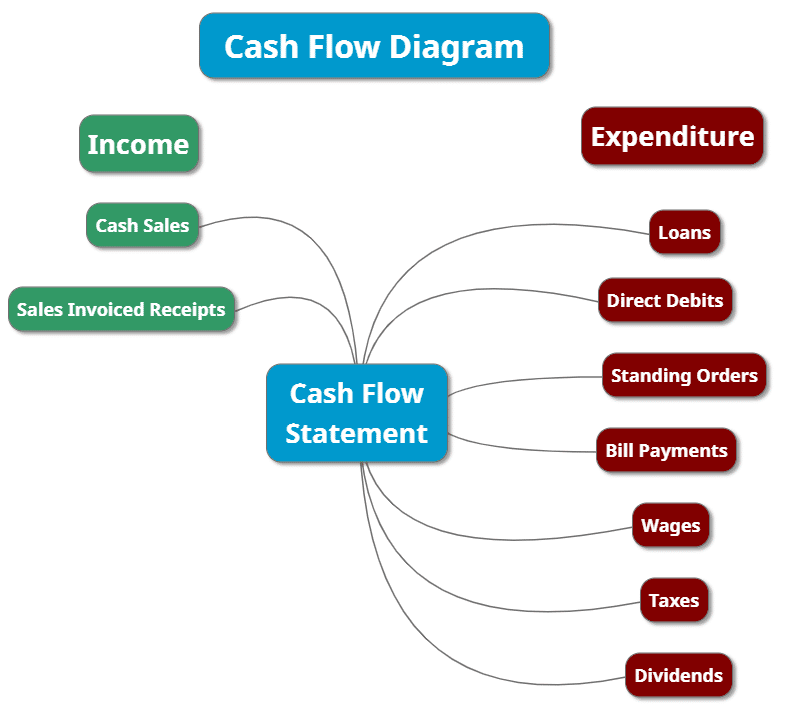

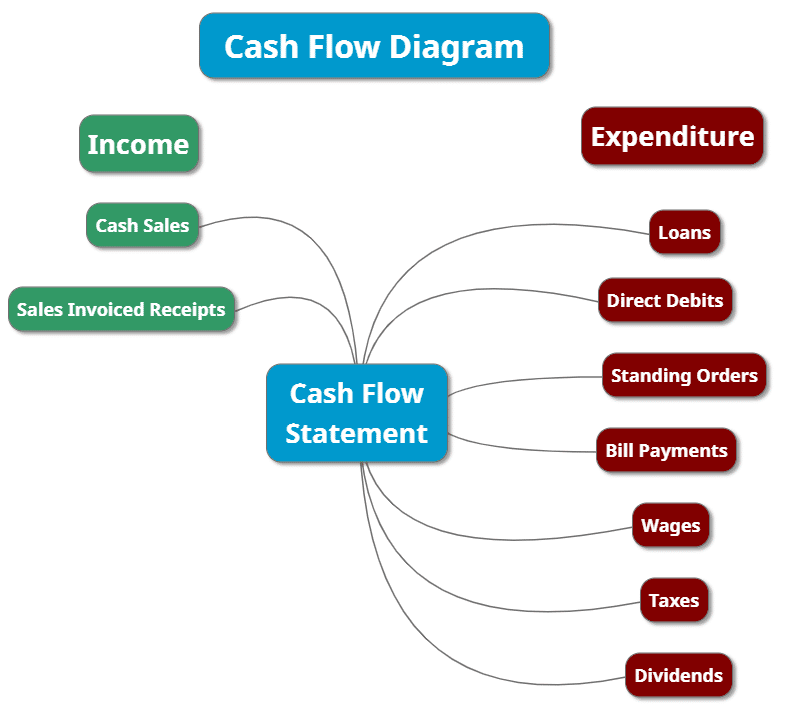

Cash Flow Diagram

Below is a cash flow diagram illustrating some transactions to be included in the report.

The left shows the cash inflows. It comprises of sales, cash receipts, interest and any other income.

The right shows all the cash outflows or expenditures, including bills, loan repayments, direct debits, wages, taxes, and dividends. The bills will include the cost of sales and most general overheads.

Why is a Cash Flow Forecast Important?

A cash flow forecast is essential because it helps small business owners maintain control over their finances. By predicting when money will come in and go out, you can:

- Avoid cash shortages – spot potential gaps before they happen.

- Growth plan – know when you’ll have enough cash to invest in new opportunities.

- Make confident decisions – from hiring staff to purchasing equipment.

- Improve financial stability – reduce stress by always knowing where your money stands.

Without a forecast, it’s easy to be caught off guard by unexpected bills or slow sales. With one, you can manage your business proactively, rather than reacting to problems after they occur.

How often should I prepare a Cash Flow Forecast?

How often you prepare a cash flow forecast depends on the size and stage of your business. For most small businesses, it’s best to update your forecast monthly to keep it accurate and reflect any changes in sales or expenses.

- Start-ups or businesses with tight net cash flow – update weekly to stay on top of fast-changing finances.

- Established businesses – monthly updates are usually enough for planning.

- Seasonal businesses – review more often during busy or slow periods to anticipate cash highs and lows.

Regular updates keep your forecast useful. The more often you review it, the more confident you’ll be about meeting your business’s financial needs.

Advantages of Forecasting Cash Flow

A cash flow forecast offers many benefits for small business owners, including:

- Reducing stress by knowing your business can cover its costs.

- Predicting cash shortages before they happen.

- Managing expenses more effectively.

- Planning for growth with confidence.

- Making better financial decisions about hiring, investments, or new projects.

- Avoiding surprises from unexpected bills or slow payments.

- Improving relationships with lenders or investors by showing you have a plan.

Disadvantages of Cash Flow Forecasts

While a cash flow forecast is a valuable tool, it does have some limitations:

- Relies on estimates – forecasts are only as accurate as the numbers you put in.

- Can change quickly – unexpected bills or late customer payments can affect accuracy.

- Takes time to maintain – regular updates are needed to keep it useful.

- May miss seasonal or one-off costs if not carefully reviewed.

- Not a guarantee – it’s a guide, not a perfect prediction of the future.

A forecast is most effective when it’s updated frequently and used in conjunction with other financial planning tools.

How to prepare Cash Flow Forecasting

When forecasting cash flow, it is essential to be as realistic as possible when estimating the figures.

You will need to know several pieces of information on the income and expenses, including:

- Opening Bank Account Balance

- Customer Receipts and Invoices

- Purchase of stock or Fixed Assets

- Business Overheads

- Staff salaries

- Dividend payments

- Tax Payments

- Loan payments

If you are VAT-registered, the amounts will include VAT, and the VAT payment will also be included.

We will examine each of these in more detail to finalise your cash flow forecast figures.

Opening Bank Balance – The opening bank account balance or cash position can be obtained from bank statements or online banking. Enter this figure as the starting point.

Customer Receipts and Invoices (Projected Income) – The first step is to forecast accounts receivable. Some figures will need estimating. It may help set up a detailed spreadsheet showing when you expect to receive cash.

A good starting point is to review the sales invoices and enter them when you expect to receive payment. It will help to look at revenue from the previous Profit and Loss (Income Statement) to track variations during the year.

Purchase of Stock or Fixed Assets. If you sell stock items, you will need to enter the cost of the stock, don’t forget any credit terms you may be offered. An example is the business purchases stock in January but pays in February. The cost is entered in February.

Forecast for any fixed asset expenses, including computers, furniture, equipment and machinery.

Business Overhead Costs– These might be easier to do as they are often paid by direct debit and are a fixed monthly amount. Fixed overheads may include rent, gas, electricity, rates and telephone.

Add any variable expenses, including salary, stationery, business expenses, pensions, advertising and general business expenses. Don’t forget to record any cash payments.

Dividend Payments – If you are a Limited Company, you might pay shareholders dividends, either monthly or annually. Post the transactions when you expect to make them.

Tax Payments – There are several taxes a business might need to pay, including Corporation Tax, PAYE, NI, and VAT. Enter the estimated figures when they are due.

Loan Repayments and Finance Costs – If you have a loan, enter the monthly loan payment amount. If you want to take out a loan during the cash flow forecast, enter this figure and any repayments due.

The easiest way to calculate most figures is to look at the bank statements, Profit and Loss and Balance sheet. A good accounting package will help obtain the figures, especially for money owed by customers.

It is worth taking a look at the following packages:

Growing companies

| From £18 per month |

| FREE Sole Trader & Trial |

| Sage Copilot Ai |

| 90% Discount – 6 Months |

Best Free Software

From £12 per month |

| 1,000 invoices PA Free |

| Integrate with Zoho Apps |

| No Discount |

Sample Cash Flow Forecasting Projection for 12 months.

The sample cash flow forecast shows the company started with £10,000 of investment. At year-end, £ 5,030 will be in the bank. Therefore, if the company hits all its targets within the first year, a small amount will be available in the bank.

It is worth spending time each month looking at the forecast and comparing it to the actual cash. You can spot differences and adjust any necessary future figures.

12-Month Simple Cash Flow Forecast Template UK

Our cash flow forecasting template is divided into three sections: total income, total expenses, and net cash flow.

Income – Expenses = Net cash flow

The download for our easy-to-use 12-month cash flow forecast template is at the end of this page. It is easy to use by following the instructions below.

Instructions for Use – Forecasting Process

Open the cash flow forecast template and update the “1 year” to the year you are completing; you may also wish to add the business name. An example is the Cash Flow Forecast 2025/26 for ABC Computers.

The next task is to change the months. If you plan to complete the template for the 12 months, start with the first month. You can either continue typing each month in the row, or click the first month and drag the bottom-right corner of the cell to the last month. It will automatically change each heading.

Add the week commencing dates in each column if you require a weekly cash flow forecast template.

To set up the chart of accounts, change the income 1, 2, and 3.. to suit your business, for example, sales of hardware, Consultancy, Computer repairs, etc. This is all the revenue accounts.

Next, update the expenses – Exp 1, 2, 3.. to your expenditure, for example, wages, loans, utilities, cost of sales and general overheads.

In cell C32, enter the opening bank balance.

You are then ready to start adding the weekly or monthly figures. Remember to add the revenue or expenditure for the week or month in which you expect it to occur.

For example, the business issues a sales invoice in January, but the customer is a slow payer and expects it in the bank in March. Therefore, enter the figure in March.

Your monthly balances are automatically calculated for you. When you’re finished, double-check the numbers to ensure they’re accurate for your business. Pay special attention to any months with negative cash flow, as these are warning signs that you may need to cut costs, boost sales, or plan for extra funding.

Cashflow Forecasting Software

Before using a cash flow prediction template, check the accounting software you use to see if it is included. Some accounting packages include cash flow reporting software. It might save a lot of time, as it will utilise the figures from the accounts. There is also advanced cash flow projection software available for larger businesses.

Accounting Software Best Deals

Sage UK – 90% for 6 Months – FREE plan for Sole-Traders, AI tools for bookkeeping automation

QuickBooks – 90% Discount for 7 Months – Invoicing, expense tracking, payroll, financial reports

XERO – 90% Discount for 6 Months – Cloud accounting, unlimited users, smart bank feeds

Download the Free Cash Flow Forecast Template

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way. Download the cash flow template UK below.

Cash Flow Forecasting Tools Conclusion

A cash flow forecast is one of the most valuable tools a small business can have. It helps you see what money is coming in, what’s going out, and whether you’ll have enough to cover your expenses. By regularly updating it, you can avoid cash shortages, plan for future growth, and make more informed financial decisions with confidence.

Don’t forget—you can download our free cash flow forecast template to get started today and take control of your business finances.

If you are creating a financial report for investors or a bank, it is advisable to seek the advice of an accountant.

Further information on start-up loans is available.

Other useful Excel Bookkeeping Templates

Business Accounting Basics has created over 25 useful Excel Bookkeeping templates to help you manage your business finances. Our templates are designed to be easy to use and are all available for free download. The templates include:

Return from Cash Flow Forecast template to Accounting Basics Page.