Is Bookkeeping Hard to Learn?

Many small business owners wonder if bookkeeping will be complicated when they start. Owners feel overwhelmed when it comes to keeping their books in order. After all, with all the other tasks involved in running a business, accounting can seem daunting and complex. But bookkeeping doesn’t have to be hard – especially if you’re prepared with some foundational knowledge!

How do you know if you will find bookkeeping hard until you try? In this blog post, we’ll look at why bookkeeping is essential for small businesses, tips on getting started, and resources that can help make managing your finances more manageable than ever. We will also look at starting your own bookkeeping business.

I started in bookkeeping by chance, I joined a youth training scheme, and part of my placement was looking after the cash. I decided that this was the job for me and then secured a position in Finance at the University of Reading. In my next job, I was offered training in my own time and completed an A level in accounting, followed by the Association of Accounting Technicians. From my experience, starting small and learning as I have gone along has been the perfect career.

Bookkeeping Training

If you are looking for bookkeeping training, several excellent options are available, depending on your circumstances. If you have recently started your own business and don’t know much about bookkeeping or accounting, consider enrolling in an introductory course. This will give you the basics of bookkeeping and provide you with a better understanding of how to manage your finances.

Online accounting courses are also available, ideal for learning bookkeeping at your own pace. These courses provide comprehensive lessons and tutorials on accounting, finance, auditing and more. For a comprehensive list, check out our bookkeeping course review.

More comprehensive bookkeeping training is available for those already working in the industry who wish to advance their qualifications. Many providers, such as The Institute of Certified Bookkeepers (ICB), offer professional certificates.

Bookkeeping Books

If you prefer to learn bookkeeping by reading, many books are available. Most will take you step by step and guide you through setting up your accounts and maintaining accurate records. They explain all the terms in an easy-to-understand way and are helpful for both those new to bookkeeping and experienced professionals.

Our top 3 Bookkeeping Books

These are books that I own and have recommended as they are easy to pick up and find the information required. They are aimed at helping people to get started with their small business accounts and bookkeeping.

Practical Accounts & Bookkeeping in easy steps

This book is well laid out, with easy-to-understand diagrams and instructions. It starts by explaining the balance sheet and goes on to record-keeping and VAT.

Bookkeeping and Accounting All-in-One For Dummies

This is a popular series on books for starters, and their bookkeeping and accounting book is a great place to start.

Accounts Demystified

Accounts Demystified explains each section in more detail about understanding limited company accounts.

For a more detailed review, read our bookkeeping books page.

Is Bookkeeping hard? Get the help of a Bookkeeper or Accountant

If bookkeeping isn’t your strong suit and you don’t have the time to devote to learning, it might be worth considering hiring a bookkeeper. A bookkeeper can help keep your financial records organised, up-to-date, and accurate so that you’re better equipped to make informed decisions about your money.

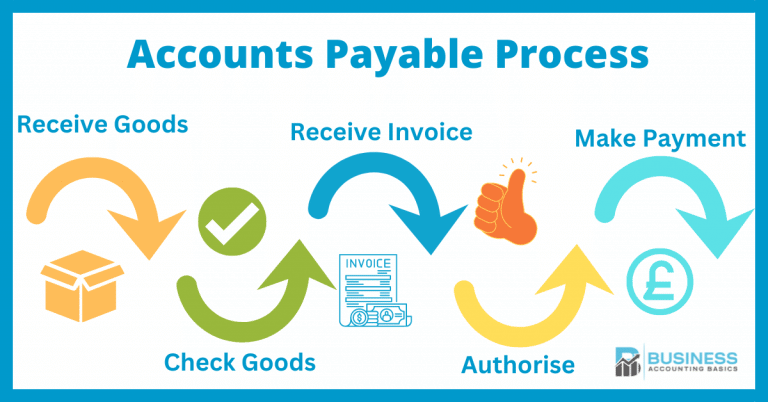

It is an expense that can save you both time and stress in the long run. The bookkeeper can help you with critical tasks such as tracking transactions, preparing invoices and payments, reconciling accounts, submitting tax documents on time, and filing essential forms.

A bookkeeper can handle many transactions and reporting; you might also need an accountant’s help as they can advise on tax planning and offer other specialist advice, including submitting accounts to Companies House.

If you are looking for bookkeeping services, a wide range of providers are available online. Make sure you compare rates, check they are insured, have anti-money laundry in place and read reviews before making your decision.

You’ll have more peace of mind knowing these activities are handled responsibly by a professional bookkeeper or accountant who takes care of all those little details for you.

10 Top Bookkeeping Tips

To help guide you through the bookkeeping process, here are our top 10 bookkeeping tips for small business owners.

- Set aside time for bookkeeping. Dedicating a few hours each week to complete your bookkeeping can save you time and stress.

- Set up an accounting system. Choose a system that fits the size and complexity of your business, such as Excel templates, an accounting ledger or cloud-based bookkeeping software.

- Have a separate business bank account. Keeping your business and personal finances separate will make it easier to keep track of everything.

- Make sure to save all of your receipts and invoices. HMRC requires all paperwork for the accounts to be kept for a minimum of 6 years.

- Organise a filing system. Keep all documents and receipts easily accessible in one place. You can use paper-based, cloud-based or upload documents to accounting software.

- Keep up with payments. Paying bills on time will help to build the credibility of your business and help you maintain good relationships with suppliers.

- Record all transactions accurately in the correct accounts. Ensure you use the right account codes or categories for incoming and outgoing transactions.

- Complete bank reconciliations regularly. Reconciling your bank accounts confirms that your records reflect the correct balances in your financial statements.

- Invest in bookkeeping training or hire a professional bookkeeper if needed. Bookkeeping training will help you develop your skills and understand bookkeeping principles.

- Stay on top of deadlines for filing taxes. Ensure you know important tax deadlines, such as submitting your VAT return and year-end accounts.

Accounting and Bookkeeping Tasks

There are lots of bookkeeping tasks to keep your financial data in order. As a small business owner, you should be aware of the accounting and bookkeeping tasks required to complete your accounts. The tasks include the following:

- Setting up the chart of accounts. This is a list of all the financial categories used to classify transactions in your accounting system, including assets, liabilities, equity, income and expenses.

- Recording transactions. You’ll need to record all payments made and received into your accounts and any other relevant information, such as invoices and receipts related to those transactions.

- Reconciling bank statements with bookkeeping records. Ensure that all debits or credits from your bank account match the records in your books.

- Preparing monthly financial statements. This includes balance sheets, profit and loss statements, cash flow statements and other essential reports.

- Analysing financial data. Look at your financial reports and see if they are what you expect. If you are making a loss, take a look at ways you can improve it. It might include reducing costs, increasing pricing or having a sale to reduce your stock amount.

- Filing tax returns accurately and on time. Keeping up with deadlines for filing taxes is essential as mistakes can be costly, so make sure you know when payments are due and keep accurate records of all transactions.

- Making payments correctly to suppliers and employees. Ensure payments are accurate and on time, as this can reduce additional fees and keep both staff and suppliers happy.

Financial Transactions and Reports

Every business’s financial transactions should be tracked in its accounting books and reflected in financial reports. These transactions include sales, purchases, expenses and payments made or received by the business. If you need to change the financial records, you will need to enter a journal.

An accounting journal will move figures from one account to another. Journals always have to balance the debits and credits.

Financial Statements

Financial reporting provides an overview of the financial performance of a business. These statements include the balance sheet, profit and loss, and cash flow statement. Here is a brief outline of each financial report. A business owner needs to understand these reports.

Profit and Loss or Income Statement

A profit and loss P&L report provides a detailed overview of the profit and expenses of a business over a given period. The P&L report contains all revenues, costs, and expenses associated with running a company and helps owners measure financial performance.

It can help you identify where costs might have been higher than expected, or unexpected losses were made. Knowing this information allows you to make informed decisions that will help the business succeed in the long term. Understanding and accurately interpreting profit and loss reports are vital for a successful business.

Balance Sheet

The balance sheet is a snapshot of a company’s financial position at a given time. It shows assets, liabilities, and equity levels over the period. A balance sheet informs you of the resources owned by the business (assets) and how they were financed (liabilities and equity).

It helps to assess the overall solvency of a business as well as identify any potential risks. It can also be helpful in understanding how much the company owes creditors and what assets it owns that could help pay those debts.

Cash Flow Statement

The cash flow statement provides an overview of all incoming and outgoing money sources over a given period. It helps to track changes in the company’s financial position from one month to the next. An accurate cash flow statement helps you manage your finances and plan for the future.

It can also be helpful if you are looking to secure loans or investments from outside sources, as it allows potential investors to get an idea of how much money is available and how it is being used.

These financial documents all provide essential information on a company’s financial health and can help inform decisions that will impact its success. Keeping accurate records and ensuring all reports are up to date is essential for any business.

How to complete Bookkeeping

Depending on the size of your business will depend on the type of bookkeeping you need to do. Generally, small businesses can use manual bookkeeping methods where the owner or a team member manually records transactions in the accounting books.

For larger businesses, more sophisticated methods are needed. This includes using accounting software such as QuickBooks and Xero to update financial records automatically. Accounting software is essential for submitting your VAT return if you are registered in the UK or can use bridging software.

Here are the different options for Bookkeeping:

Manual Bookkeeping

A few businesses use manual bookkeeping with only a few transactions. This involves manually recording every transaction in a journal or ledger and calculating totals and subtotals. There are analysis books available to help make it easier.

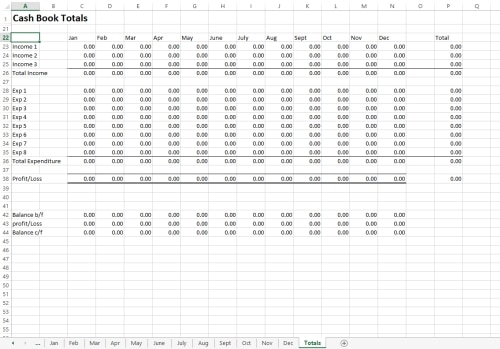

Excel Bookkeeping Templates

Using Excel bookkeeping templates can be helpful for small businesses. This is a great way to record transactions, generate reports and analyse financial data. At Business Accounting Basics, we have created over 25 different templates for free download.

These templates include cash book, profit and loss, balance sheet, petty cash, debtors and creditors.

Accounting and Bookkeeping Software

Bookkeeping software is very popular among small businesses because it helps automate the bookkeeping process. It simplifies the entire process by automatically updating records when a financial transaction is posted.

Issuing invoices using bookkeeping software makes the business look professional and can even provide a link for payments online.

Bookkeeping software is updated regularly for new accounting standards and regulations. It also includes some automated processes, including importing bank transactions and setting up rules, and with good software, it can extract information from bills.

Starting a Bookkeeping Business

So far, we have looked at whether is bookkeeping hard for small businesses, but what about starting your own bookkeeping business? Is it hard to get started and find new customers?

You must be well-organised and understand accounting and bookkeeping principles for a successful bookkeeping business. You will also need to be able to create reports, use software, and provide advice.

As a bookkeeping business, there are several things you need to do before starting.

Insurance

As a bookkeeper, you will need professional indemnity insurance to protect your business from potential claims. They might offer a discount if you are part of a professional body.

Anti-money Laundry

Bookkeepers should always comply with anti-money laundering regulations. Anti-money laundry is offered directly through HMRC or with accounting bodies.

Engagement Letter

When starting a bookkeeping business, it is essential to have an engagement letter and terms and conditions in place. This outlines the services you will provide, how much you will charge and any other requirements.

A business plan is also good, as it can help you understand your goals and target the right customers. You should also consider joining a professional body or association, as this will help.

It can take some time to build a client base and establish yourself in the bookkeeping industry, but you will benefit from regular and reliable income once you do.

Virtual Bookkeeping Business

Many people set up as a virtual bookkeeping business, as this is cost-effective and can help you find new customers from further afield. You can advertise your services online and build an online portfolio, or use a professional website builder to design your own bookkeeping website.

As a virtual bookkeeping business, you will receive any documents through the post, email or uploaded to accounting software. You may never meet your client in person, but you can use online meetings like Zoom.

Read our guide on starting your bookkeeping business to find out if it is hard.

Is it Stressful to be a Bookkeeper?

It can be stressful because bookkeeping involves managing a small business’s finances. Bookkeepers are responsible for ensuring that all financial data is accurate and up-to-date.

Bookkeepers need to understand complex financial regulations and manage large amounts of paperwork. It is crucial to stay on top of changes in legislation and make sure the business complies.

Good organisation skills are essential, and bookkeepers should develop processes to ensure accuracy, timely manner and compliance.

Overall, it is not a stressful job if you have the right skills and experience and provide accurate data. However, it can be challenging if you don’t stay on top of changes in legislation.

Is Bookkeeping hard to Do? – Conclusion

Many small businesses decide to complete their accounts but are unsure how hard bookkeeping is. The answer to this question depends on your experience and understanding of accounting principles, tax knowledge and the complexity of your business’s finances.

If you find that you are out of your depth, there are several options, including books, online training and using a bookkeeping firm.

Starting a bookkeeping business can take some time, but it is possible with the right skills and knowledge. It’s essential to set up an engagement letter, join professional bodies and get insurance before beginning. Running a virtual bookkeeping firm is becoming popular as they allow you to reach out to new customers.