Understanding Self-Employed Tax: A Clear Guide for the Self-Employed

Navigating self-employed tax can often feel overwhelming. Whether you are newly self-employed or have been working for yourself for years, understanding your responsibilities is essential to avoid costly mistakes and to ensure you are keeping on top of your finances.

At Business Accounting Basics, we make it our mission to provide clear, straightforward advice that helps you stay organised, compliant and confident in managing your accounts.

So what are the essentials of self-employed tax? How can our self-employed calculator make the process simpler? And how can accounting software such as QuickBooks and Xero help you manage your finances more effectively? Let’s find out.

What is Self-Employed Tax?

When you are self-employed, you are responsible for paying your own tax and National Insurance contributions, rather than having them deducted automatically by an employer.

This means registering with HMRC as self-employed, completing a Self Assessment tax return each year and paying the correct amount of Income Tax and National Insurance based on your profits.

Unlike employed workers who are paid through PAYE, the responsibility for calculating, declaring and paying your tax rests entirely with you. Understanding this obligation is the first step in staying on top of your finances.

Why a Self-Employed Calculator is Useful

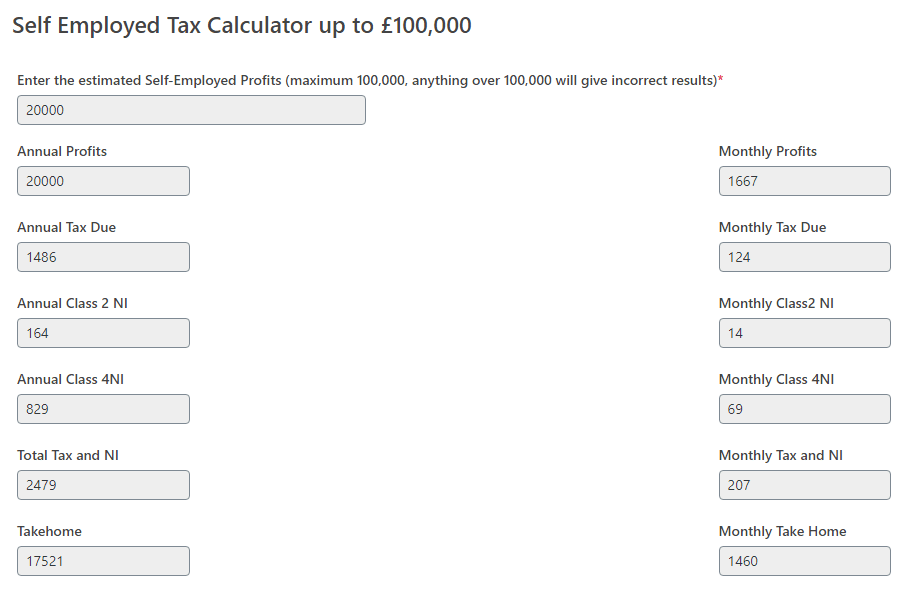

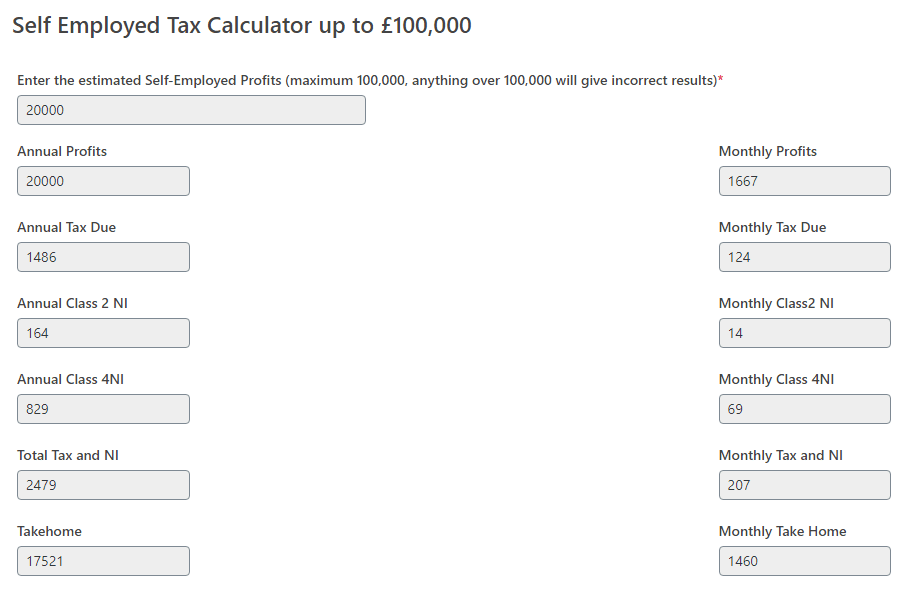

Keeping track of what you owe to HMRC throughout the year can be difficult, especially if your income fluctuates. Our self-employed calculator takes the guesswork out of the process by giving you an estimate of how much tax and National Insurance you are likely to pay.

By entering your income and expenses, you can quickly see what you should be putting aside. This makes it far easier to plan ahead and set aside enough money to cover your tax bill, to avoid unpleasant surprises when deadlines approach and to manage your cash flow effectively so that you balance business costs with personal commitments.

The Importance of Record Keeping

Accurate record keeping is vital for anyone who is self-employed. HMRC requires evidence of both your income and expenses, and keeping everything organised will make completing your Self Assessment far simpler. Good record-keeping also ensures that you can claim every legitimate business expense, understand how your business is performing, and make informed decisions about its future. For these reasons, we always recommend using accounting software, which makes the whole process of managing records smoother and less time-consuming.

Recommended Accounting Software

We work with trusted partners to provide tools that make managing your accounts and tax responsibilities easier.

QuickBooks offers an intuitive platform that tracks your income, expenses and invoices in real time and it can integrate with your bank account to save you time on manual entry.

Xero, on the other hand, is a popular choice for small businesses because it offers cloud-based access to your accounts, the ability to collaborate with your accountant in real time and clear reporting features to help you see exactly how your business is performing.

Both options link seamlessly with your tax return and make financial management far less daunting.

Common Expenses You Can Claim

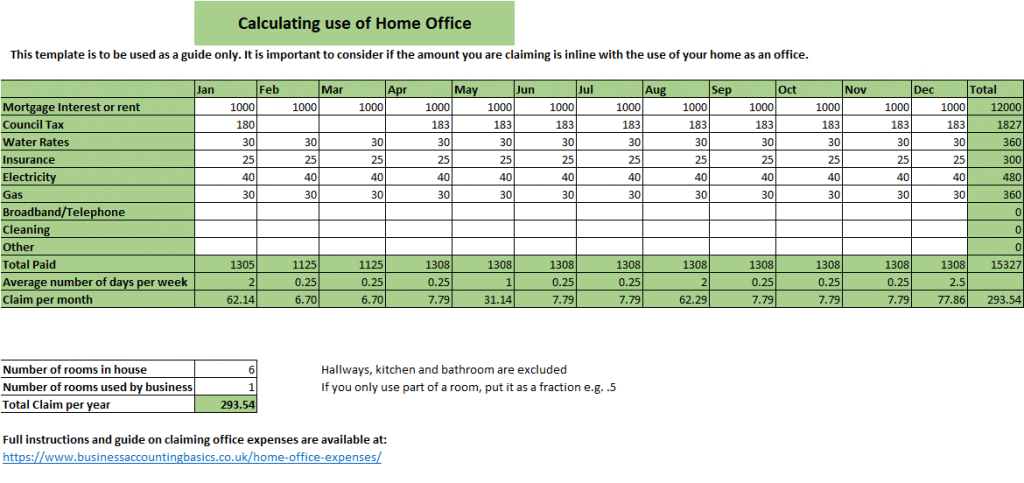

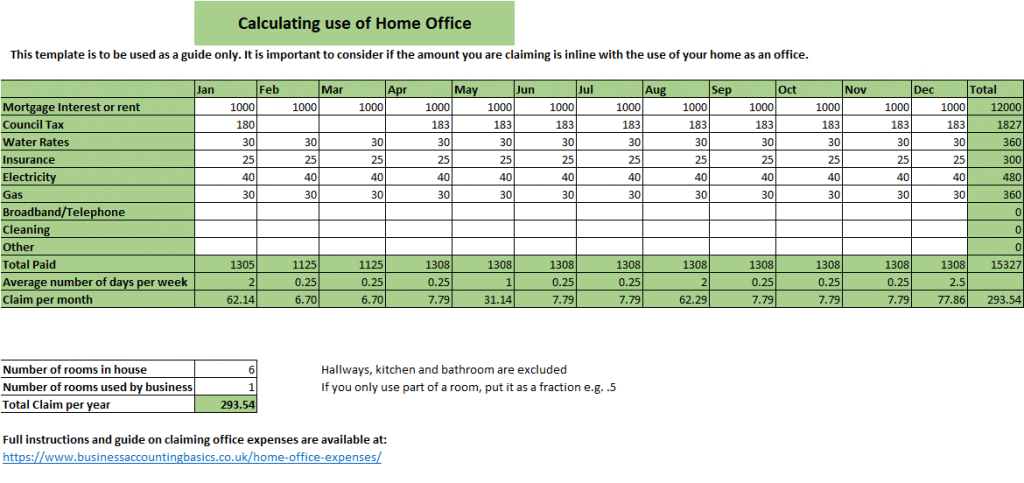

A significant way to reduce your tax bill is by claiming allowable expenses. Many people miss out simply because they do not keep adequate records or are unsure of what qualifies.

Everyday costs such as office supplies, professional services like accountancy fees or business insurance can all be claimed. Additionally, if you travel for work, those costs may also be deductible. Even working from home can allow you to claim either simplified expenses or a proportion of household bills such as heating, electricity and internet. By keeping clear records and using software to track expenses, you ensure you never miss a legitimate deduction.

Staying Ahead of Deadlines

One of the most stressful parts of being self-employed is facing the looming tax return deadline. HMRC requires Self Assessment returns to be submitted by 31 January each year for the previous tax year and late filing or payment often results in penalties and interest charges. By using our self-employed calculator alongside accounting software such as QuickBooks or Xero, you can stay prepared well in advance.

How Business Accounting Basics Can Help

At Business Accounting Basics, we are dedicated to providing the tools and resources you need to take control of your finances. Our free calculators, including the self employed calculator, are designed to give you clarity and confidence, we provide clear guides written without jargon so you can understand every aspect of self-employed accounting and we recommend reliable software solutions that simplify the way you manage your business.

Our practical advice is tailored to the unique needs of those who work for themselves, ensuring you can focus on running your business while knowing your tax affairs are in safe hands.

Managing your self-employed tax does not need to be daunting. With the right tools, good habits and reliable support you can keep your finances in order and stay ahead of HMRC requirements.