How to Catch up on Bookkeeping

Falling behind on bookkeeping is extremely common for small business owners. When you’re busy serving customers, chasing payments, and running day-to-day operations, bookkeeping is often the job that gets pushed aside.

Catch-up bookkeeping is the process of entering transactions or financial data that is missing for prior months or years to bring your books current and ensure your financial records are reliable.

The good news is that catching up is usually much easier than people expect. However, overdue bookkeeping can negatively impact your company’s financial health and tax compliance, making it harder to manage cash flow and increasing the risk of penalties.

This guide explains how to catch up on bookkeeping with a step-by-step guide, even if you have little or no bookkeeping experience. Without accurate bookkeeping, tax compliance becomes a guessing game.

What does Catch Up Bookkeeping Really Mean

Catch-up bookkeeping doesn’t mean going back and creating complicated accounts. It simply means:

- Recording the money coming into your business

- Recording the money going out

- Making sure everything matches your bank statements

- Ending up with figures you can rely on

- Produce accurate financial reports and make informed business decisions

Catch-up work involves entering missing transactions from prior months or fiscal years to ensure your books are current.

Once your financial records are up to date, everything else becomes easier — from managing cash flow to preparing your tax return.

Step One: Gather all Your Documents

Start by collecting the information you already hold. Most businesses have more records than they realise. It’s essential to gather all existing data and existing records, including both digital and paper documents, to ensure nothing is overlooked.

Look for:

- Business bank statements

- credit card statements

- Sales invoices

- Receipts and purchase invoices

- Online payment reports (PayPal, Stripe, card machines, etc.)

- Payroll records

Be sure to collect supporting documentation, such as receipts and invoices, to verify transactions and ensure accuracy and audit readiness. Missing receipts and undocumented cash transactions can create gaps in your audit trail and make it harder to justify tax deductions.

Don’t worry if some items are missing. It’s normal, and bank statements usually provide enough information to get started.

Step Two: Set up a Accounting System

When starting or resetting your bookkeeping, the most important decision is choosing a bookkeeping system that fits your business. This doesn’t need to be complicated. The aim is simply to record income and expenses consistently so you always know where your business stands.

There are two main choices to make at the beginning:

- Whether to use a cash book or accounting software, we look at these in detail later, along with a Free cash book template.

- Whether to keep records on a cash basis or an accruals basis

Cash Basis or Accruals Basis — What’s the Difference?

Cash Basis Accounting

Under the cash basis, income and expenses are recorded when money actually moves in or out of the bank.

For example:

- A sale is recorded when the customer pays you

- An expense is recorded when you pay the supplier

This method is simpler and commonly used by businesses because it closely mirrors the bank account.

Cash basis accounting is often suitable if:

- You have simple transactions

- You are not holding large amounts of stock

- You want bookkeeping to remain straightforward

Accruals Accounting

Under the accrual basis, income and expenses are recorded when they relate to the business activity, not when payment is made.

For example:

- A sale is recorded when the invoice is issued

- An expense is recorded when the bill is received

This provides a more accurate view of profit for each period but requires slightly more bookkeeping expertise.

Accruals accounting is more common if:

- You invoice customers regularly

- You have supplier credit accounts

- Your business is growing or becoming more complex

Step Three: Posting Transactions

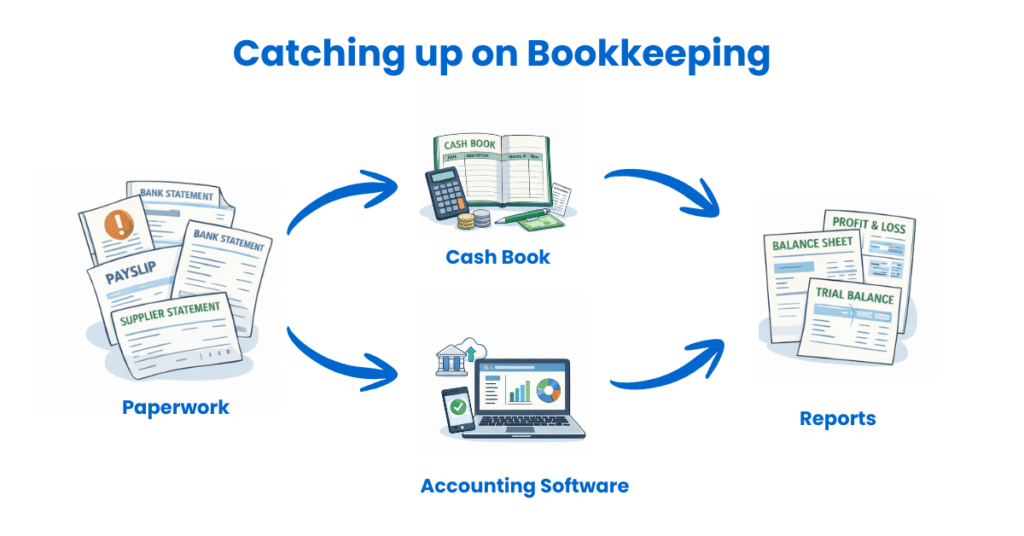

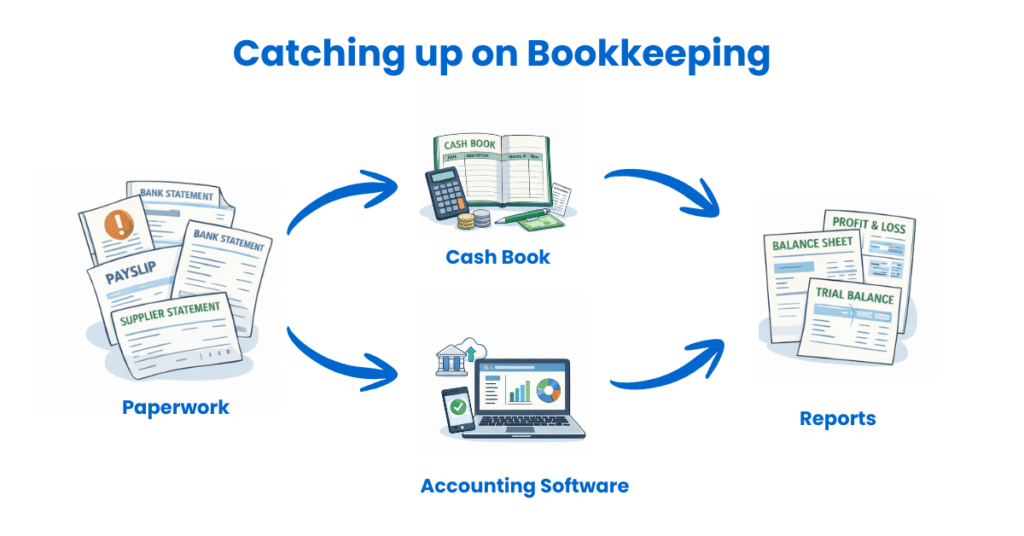

Once you have gathered your paperwork and chosen your bookkeeping system, the next step is posting transactions. This simply means entering each income and expense item into your cash book or accounting package to keep your records up to date.

Posting transactions regularly is what turns paperwork into useful financial information.

Where to Start

The easiest approach is to use your bank statement as your starting point. Work through it line by line and post each transaction in order.

For example:

- Customer payments recorded as income

- Supplier payments recorded as expenses

- Bank charges are recorded as bank costs

- Payroll payments recorded as wages

Working this way helps ensure nothing is missed.

Step Four: Checking Supplier Statements

When catching up on bookkeeping, one area that is often overlooked is supplier statements. Checking these helps against your accounts payable will ensure you haven’t missed expenses and that your records match what your suppliers believe you owe.

A supplier statement is a summary sent by a supplier that shows all invoices, payments received, and the outstanding balance over a period.

Step Five: Updating Your Payroll Records

If you employ staff, catching up on bookkeeping also means making sure your payroll records are up to date. Payroll affects your wage costs, tax liabilities, and what you owe to HMRC, so it’s important that it matches your bookkeeping records.

Even if payroll is run through software or handled by an accountant, you still need to make sure the figures are recorded correctly in your accounts.

Step Six – Generate financial reports

Once you’ve caught up on entering income, expenses, supplier invoices, and payroll, the next step is to check that everything makes sense. The easiest way to do this is by generating simple financial reports.

Financial reports help you see whether your bookkeeping is complete and whether anything looks unusual before accounts or tax returns are prepared.

The Main Financial Statements to Review

You don’t need complicated management accounts. Most small businesses only need to check a few key reports.

Profit and Loss Report

This shows your income and expenses over a period.

When reviewing it, ask yourself:

- Does the income look roughly what you expected?

- Are any expenses unusually high or low?

- Are there any months with no recorded costs?

Large differences on a profit and loss statement often indicate missing entries or incorrect categorisation.

Balance Sheet

The balance sheet shows what the business owns and what it owes at a specific point in time. This includes:

- Bank balances

- Money owed by customers

- Equipment or assets

- Loans and credit cards

- Taxes owed to HMRC

When catching up on bookkeeping, the balance sheet helps you confirm that:

- Bank balances agree with real accounts

- Loans and credit cards show realistic balances

- There are no old or unexplained amounts carried forward

If figures on the balance sheet don’t look familiar, it’s often a sign that something has been missed or recorded incorrectly.

Step Seven: Making Adjustments Using a Journal

Once your bookkeeping is up to date and you’ve reviewed your reports, you may find small corrections are needed. These are usually made using a journal entry.

A journal is simply a way of adjusting figures in your bookkeeping without recording money coming in or out of the bank. It allows you to correct or move amounts so your records reflect the true position of the business.

Work One Month at a Time

Trying to fix all your accounting records at once is the quickest way to feel stuck. Instead, focus on one month at a time. Monthly bookkeeping and reconciliations are an effective way to catch up on bookkeeping, as they help you stay organised and ensure accuracy.

For each month:

- Use your bank account statement as your starting point

- Reconcile bank and credit card statements first to identify missing transactions and errors

- Record each payment in or out in your cash book

- Add a simple description, so you know what it relates to

Once the financial records for a month are complete, proceed to the next month. Most business owners find that momentum builds quickly once they get started.

Start With a Simple Cash Book

If bookkeeping feels overwhelming, the simplest place to begin is with a cash book.

A cash book is a list of cash inflows and outflows, recorded in date order. It helps you organise transactions clearly without needing accounting knowledge. Using a cash book is essential for recording transactions accurately and makes it easier to spot missing entries when reconciling your financial documents.

Our cash book template is designed for small business owners who want a straightforward way to get their records up to date. It allows you to:

- Record income and expenses in one place

- Work through transactions in order

- See quickly how much money is coming in and going out

When catching up, it’s usually easiest to start with the oldest missing month and move forward from there.

When Accounting Software Can Make Life Easier

While a cash book is ideal for catching up, bookkeeping software, especially cloud-based tools like Sage UK, Xero or QuickBooks, can help manage bookkeeping backlogs efficiently and save time going forward.

Cloud bookkeeping software connects directly to your bank account and automatically imports transactions. This reduces manual work and helps keep records up to date. AI-powered tools within these platforms can also automate data extraction from receipts and invoices using optical character recognition (OCR).

Advantages include:

- Automatic bank feeds (can reduce manual data entry by up to 70%)

- Less data entry

- Clear reports showing profit and expenses

- Easier sharing of information with your accountant

For many businesses, software becomes valuable as the business grows or bookkeeping becomes more regular.

Cash Book or Accounting Software — Which Is Right for You?

There isn’t a single correct answer. The best choice depends on your business and your confidence with bookkeeping.

A cash book template is often best if:

- You are new to bookkeeping

- Your business has a low number of transactions

- You want a simple, low-cost solution

Bookkeeping software may be better if:

- You want to save time long-term

- Your business is growing

- You are VAT registered or planning to be

Many businesses start with a cash book and later move to software.

Common Mistakes to Avoid When Catching Up

A few common problems slow people down unnecessarily:

- Trying to complete everything in one sitting

- Ignoring bookkeeping because it feels too big a task

- Guessing figures instead of using bank records

- Leaving it until just before a tax deadline

Small, consistent progress is far more effective than waiting for the perfect time.

When to Use Bookkeeping Services

Sometimes it makes sense to engage a bookkeeper or accountant, especially if records are several years behind or the business has become more complex. Bookkeeping services and catch-up services are available for businesses that have fallen behind, offering specialised solutions to update and enter missing financial data so your books are current.

Hiring professional bookkeeping services ensures compliance with tax regulations and deadlines, helps avoid penalties for inaccurate or late tax filings, and provides clarity about your cash flow and overall financial health.

Outsourcing bookkeeping allows business owners to focus on growth rather than bookkeeping and can help identify opportunities for tax deductions and better expense control.

The key point is that organised records — whether in a cash book or accounting software — reduce professional costs and make the process much smoother.

Catch up Bookkeeping FAQ

How far back should I catch up bookkeeping?

You will need to bring your accounting records up to date from the start of the business or from the last recorded transaction.

What if I’m missing receipts or invoices?

This is very common. Bank statements can usually be used to identify most transactions. If something is unclear, make a note of what the payment was for as accurately as possible.

What if my bank balance doesn’t match my records?

Complete the bank reconciliation to ensure all transactions are recorded. Differences are often caused by missed transactions, duplicated entries, or timing differences. Working through one month at a time usually helps identify the problem.

How do I stop falling behind again?

Keep bookkeeping simple and consistent. Update records weekly or monthly, check supplier statements regularly, and record payroll at the time it is run. Using accounting software with bank feeds can also reduce the amount of manual work required.

Take the First Step Toward Accurate Financial Reports Today

Catching up on bookkeeping doesn’t require specialist knowledge. It just requires a starting point.

Begin with one month, use a simple system, and build from there. Once your records are up to date, staying on top of bookkeeping becomes much easier, especially for tax season.

If you’re not sure where to begin, our cash book template is designed to help small business owners quickly and confidently organise their records. Remember, if you need help, seek the help of bookkeeping services.

Related articles

Bookkeeping tasks – a complete list of all the bookkeeping tasks

Beginner Bookkeeping – A guide to help get you started