10 Easy Bookkeeping Tips for Small Business Owners

Did you know that many small businesses fail within their first few years? While many factors contribute to this, poor bookkeeping is often a major…

Did you know that many small businesses fail within their first few years? While many factors contribute to this, poor bookkeeping is often a major…

Businesses may need to increase their business profitability to stay afloat. Rising costs have hit businesses hard; many struggle to keep up and may even…

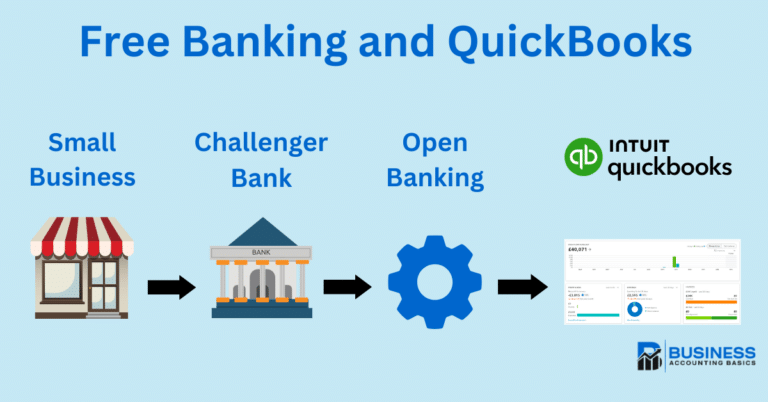

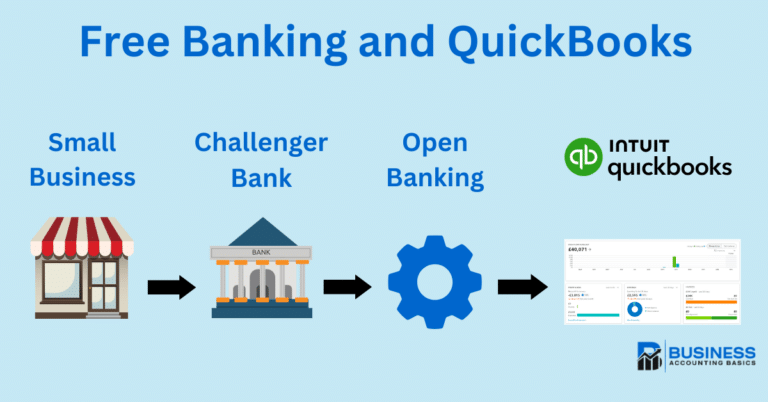

Intuit QuickBooks is one of the leading accounting software providers in the UK, and that is why we have teamed up with them to offer…

Introduction to CRM software Building strong customer relationships is the key to unlocking sustainable growth in the bustling world of small business. But with limited…

Keeping track of your business finances can be a real challenge. That’s where control accounts come in. So, what is a control account? It is…

![QuickBooks vs Xero UK: Accounting Software Comparison [year] QuickBooks vs Xero Comparison](https://www.businessaccountingbasics.co.uk/wp-content/uploads/QB-vs-Xero-768x402.png)

![QuickBooks vs Xero UK: Accounting Software Comparison [year] QuickBooks vs Xero Comparison](https://www.businessaccountingbasics.co.uk/wp-content/uploads/QB-vs-Xero-768x402.png)

Two names often come up when choosing the right cloud-based accounting software: QuickBooks and Xero. Both are designed to be user-friendly, especially for new users…

Becoming a sole trader might be the perfect fit if you’re looking for a simple and straightforward way to start a business. As the most…

Value Added Tax (VAT) can be a complex accounting aspect, but mastering it is essential for compliance and financial health. Understanding your VAT control account,…

Do you have trouble keeping up with your small business finances? If so, it might be time to set up a bank feed for your…

Intuit QuickBooks Online (QBO) has positioned itself as a top contender in the ever-changing business technology sector, revolutionising how small and medium-sized businesses manage their…

Microsoft Excel isn’t just for accountants and data analysts. Excel is a powerful tool for small business owners to track finances, manage inventory, analyse sales…

While managing expenses is crucial for any business, understanding your income accounts is equally essential for growth and profitability. They provide a vital insight into…

Running a small business requires more than just focusing on income generation. To ensure those sales translate into profit, you must have a firm grasp…

What are the key differences between bookkeeping and accounting? All businesses will use both bookkeeping and accounting to produce financial reports. Depending on your time…

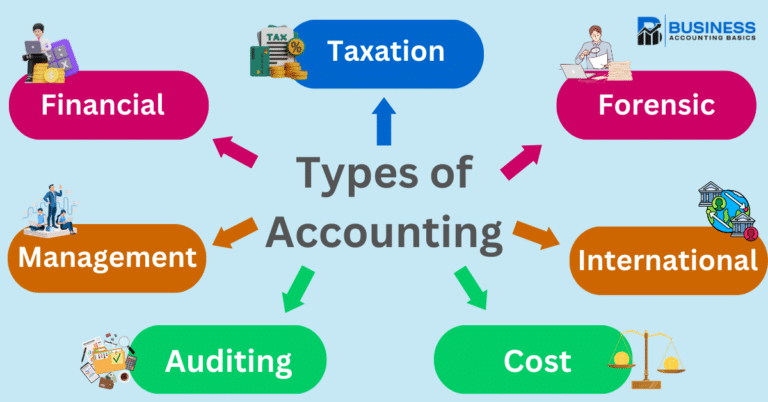

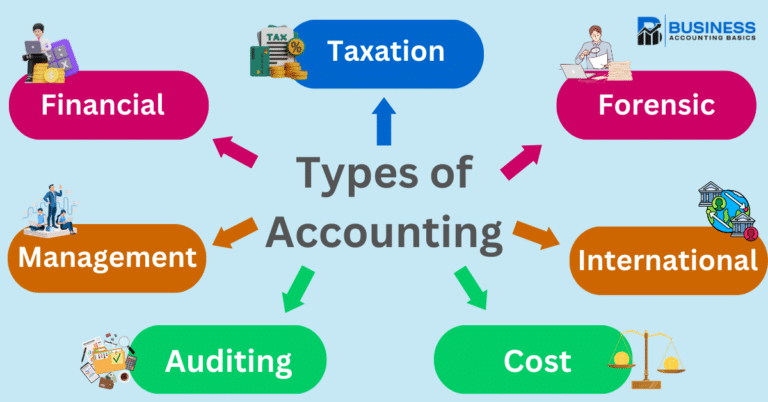

When exploring the types of accounting, you’ll find a range of methods tailored to various reporting, compliance, and management functions. This article explores these methods,…

Integration for Easy Bank Reconciliation Staying on top of your finances is vital as a small business owner. One essential task is managing and reconciling…

Knowing how that income affects your taxes is crucial when your side hustle starts paying off. ‘Side hustle tax’ isn’t just a buzzword—it’s a reality…

As a small business owner, you know first-hand how much goes into running your business. There is never enough time in the day between managing…

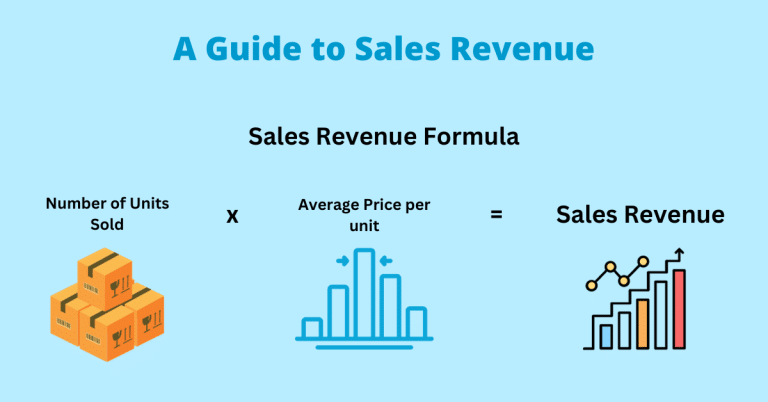

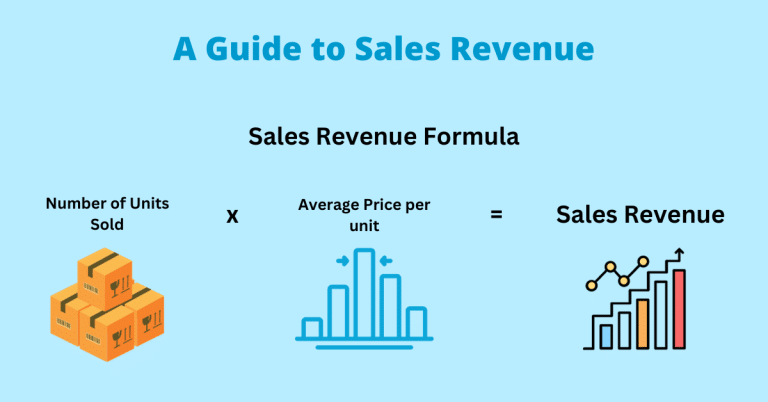

Unlocking the secrets to business growth and financial success often starts with understanding one key aspect: sales revenue. Sales revenue is the lifeblood of any…

Small businesses often struggle with accounting tasks, mainly because of the lack of financial literacy and resources, which can lead to accounting errors. However, accounting…

Introduction Computerised accounting is an efficient and cost-effective way to keep track of your business transactions. By entering data into an automated system, you can…