Common Accounting Errors Small Businesses Make and How to Avoid Them

Small businesses often struggle with accounting tasks, mainly because of the lack of financial literacy and resources, which can lead to accounting errors.

However, accounting mistakes can harm the business’s financial health and growth. Inaccurate bookkeeping or failure to comply with tax laws can lead to penalties, late payment fees, and even legal litigation.

In this blog post, we’ll discuss some common accounting errors small businesses make and practical advice on how to avoid them. We also provide some valuable resources.

Types of Accounting Errors

Here is a list of accounting errors that a business can make:

Failing to separate business and personal finances

One of small businesses’ most common accounting errors is mixing personal and business finances. Co-mingling funds can lead to tax complications and legal repercussions. It also makes it challenging to accurately determine the business’s actual financial performance.

To avoid this, business owners should open a dedicated business checking account and use it exclusively for business transactions. Also, get a business credit card to make it easier to separate personal and business expenses.

Not Keeping Proper Records

Proper record-keeping is essential for any business to track its financial performance and make informed decisions. Unfortunately, many small businesses don’t prioritise good record-keeping practices. They fail to keep detailed records of transactions such as income, expenses, and receipts, while others use outdated manual bookkeeping processes.

This can cause accounting errors and make it challenging to identify financial trends and areas of improvement. Solution? Use bookkeeping software alongside the manual bookkeeping process to simplify the entire process. Implement a digital filing system for documents and receipts to make it easy to retrieve information when needed.

Remember that most records must be kept for a minimum of six years.

Failing to reconcile accounts

Account reconciliation refers to comparing financial transactions in a business’s books with corresponding transactions from external sources such as credit card and bank statements or supplier statements.

Reconciliation is crucial in identifying discrepancies or accounting errors, such as undetected fraud or missing income. Many small business owners often fail to perform regular account reconciliations, leading to inaccurate financial statements.

A possible solution is to automate the reconciliation process using accounting software. Moreover, get an accounting professional to review all transactions and the reconciliation process.

Missing deadlines

Small business owners often miss tax filing deadlines, licenses, and permit renewals, leading to penalties, fines, and negative impacts on the business’s reputation.

Failing to pay taxes on time can result in legal litigation. Besides compliance issues, missing deadlines can affect the business’s cash flow and borrowings. To avoid these issues, set up reminders for tax filings and other deadlines; it will help you stay on top of your compliance responsibilities.

Generally Accepted Accounting Principles (GAAP) Compliance

Many small business owners lack knowledge of Generally Accepted Accounting Principles (GAAP). These standards provide a framework for businesses to record, present and report financial transactions.

Failure to comply with GAAP can lead to accounting errors and result in inaccuracies in the financial statements. The best way to ensure GAAP compliance is by hiring an experienced accountant or investing in online accounting.

Misclassifying employees

Small business owners usually classify workers as independent contractors to save on employment taxes and other benefits. However, misclassifying an employee can lead to expensive lawsuits and hefty fines.

The issue of worker classification may seem insignificant, but misclassification can significantly affect a business’s liabilities, benefits, and legal obligations.

Accounting Errors – Incorrectly Recording Accounting Records

Another common accounting mistake small businesses make is incorrectly recording transactions or data entry errors. This error can be caused by human error or outdated or inefficient bookkeeping processes. Incorrectly recorded transactions can result in inaccurate financial statements, leading to poor decision-making and business performance.

Here is a list of common accounting errors with some examples:

Recording a transaction in the wrong account:

For example, recording a sale in the accounts payable account instead of the accounts receivable account. When entering a transaction, you must check the account is correct.

Recording a transaction for the wrong amount

For example, recording a sale for 100 instead of 1,000.

Transposition Errors

Recording numbers in the incorrect sequence. For example, recording a purchase for 345 instead of 354.

Failure to Record Transactions

One of the most significant errors that can occur is forgetting to record a transaction altogether. This mistake can cause discrepancies in financial statements and lead to inaccurate data.

Recording a transaction twice

This can happen if you don’t have a system to track recorded transactions.

Recording a transaction for the wrong date

This can happen if you’re not careful or don’t have a system in place to track the dates of transactions.

Recording a transaction with the wrong debits and credits

This common accounting error can happen when you’re unfamiliar with accounting principles. If this occurs, you must create a journal for entry reversal.

Recording a transaction with the wrong account types

For example, recording a sale as a liability instead of an asset.

Errors of Commission

An error of commission is when the transaction is recorded correctly but to the wrong subsidiary account. An example is recording a payment to the accounts payable but to the wrong supplier.

How Accounting Errors Affect a Small Business

Incorrectly recording transactions can have a number of negative consequences for your business, including:

Inaccurate financial statements: If your transactions are not recorded correctly, your financial statements will be inaccurate. This can make it difficult to make informed business decisions and lead to problems with tax authorities.

Cash flow problems: If you don’t have an accurate record of your transactions, it can be difficult to manage your cash flow. This can lead to overdrafts, late payments, and other financial problems.

Audit findings: If your business is audited, the auditors will review your financial statements and transactions. If they find any errors, they may issue audit findings. Audit findings can damage your business’s reputation and can also lead to financial penalties.

How can I Help Prevent Accounting Errors?

It is essential to take steps to avoid incorrectly recording transactions. Here are some tips:

Use accounting software: Accounting software can help you automate many of your accounting tasks and reduce the risk of errors.

Have an accounting system to track transactions: Make sure that you have a system in place to track all of your transactions, including the date, amount, and account types involved.

Review your accounting transactions regularly: Review your transactions regularly to ensure they are accurate and complete.

Have a qualified accountant review your financial statements: It’s a good idea to have a qualified accountant review your financial statements at least once a year to identify and correct any errors.

How can Accounting Software Help Reduce Accounting Errors?

One way to reduce accounting errors is to use accounting packages. This software can automate many of your accounting tasks, making it easier to keep accurate records and generate financial statements. Some benefits of using accounting software include:

- Reduced human error: With automated processes, there is less risk for human error.

- Increased efficiency: Accounting systems can save you time by automating repetitive tasks.

- Real-time financial data: You can get an up-to-date view of your finances, which can help you make more informed business decisions.

- Easier reporting and compliance: It includes a reporting section that allows a small business to produce the reports it needs.

- User-friendly interface: It is designed to be user-friendly and intuitive, making it easier for small business owners to manage their finances.

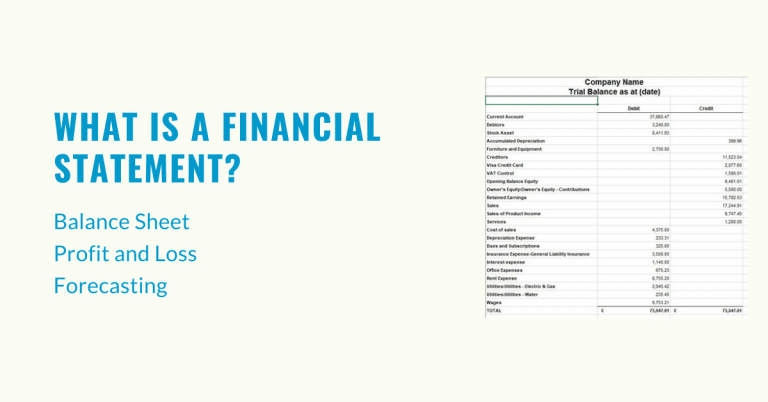

Trial Balance

The trial balance is one feature of accounting software that can help prevent accounting errors. A trial balance automatically checks for accuracy by comparing total debits and credits in your accounts. If there is a discrepancy, it alerts you to potential errors that need to be corrected. This helps catch mistakes before they become more significant issues.

You can use a trial balance to see an overview of all your accounts and quickly identify any missing or incorrect transactions. It also helps ensure that all transactions are recorded in the correct account types.

Read our section on trial balances, including a free template download.

Bank Reconciliation

Completing a bank reconciliation is another important step in preventing accounting errors. This involves comparing your bank statement to your accounting records to ensure they match. Any discrepancies can indicate a mistake, such as an incorrectly recorded transaction or a missed transaction.

Bank reconciliation should be done regularly, ideally every month, to catch any mistakes early on and ensure the accuracy of your financial statements. Use our free reconciliation template to assist with the process.

Check Supplier Statements for Accounting Errors

Another area where errors can occur is in recording supplier transactions. It’s important to regularly check and compare your supplier statements to your accounting entries. This helps ensure that all invoices have been paid and recorded correctly.

If there are any discrepancies, follow up with the supplier to resolve the issue and correct your accounting records as needed.

How to Correct an Accounting Error

If an accounting error does occur, it’s important to take immediate action to correct it. Here are the steps you should follow:

- Identify the error: Identify the specific transaction or account where the accounting error occurred.

- Determine the cause of the error: Understanding why the error occurred can help prevent similar mistakes in the future.

- Edit the transaction: Check if it is possible to edit the transaction. It will depend if the error is identified before or after the financial statements are finalised.

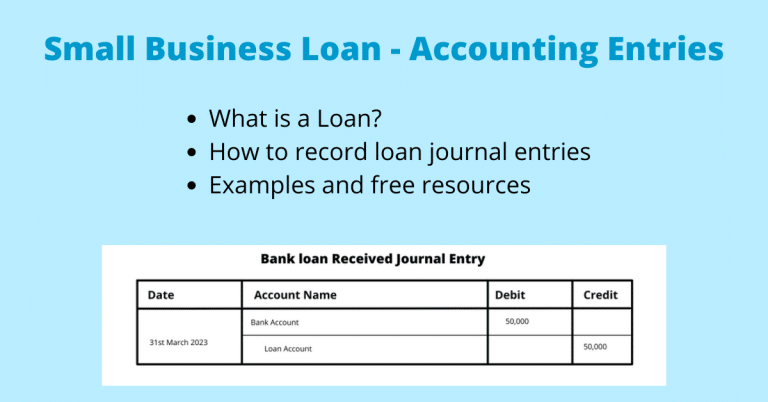

- Create a journal entry: If you can’t edit the transaction to correct accounting errors, use a journal entry to reverse or adjust the incorrect transaction.

- Review and re-run financial statements: After making corrections, review your financial statements to ensure they are accurate.

Journal Entry to the Accounts Receivable Account

If you need to correct a transaction that was recorded to the wrong date, account type, or amount, you can use a journal entry. Here’s an example of an entry to correct a posting:

A journal entry might be used for correcting data entry mistakes, adjusting entries, or duplicate transactions. Download our free journal template.

Conclusion to Accounting Errors

Accounting errors exist in any business, but they can be costly and damaging if not caught and corrected early on. By using accounting software, regularly reviewing transactions, and having a qualified accountant review your financial statements, you can help prevent errors from occurring.

In the event that an error does occur, promptly correcting it with a journal entry can mitigate any potential damage. Remember, accurate financial records are crucial for making informed business decisions and staying compliant with tax laws. So, take the necessary steps to prevent errors and keep your financials in order.

Keep learning about accounting practices and continue to educate yourself on how you can improve your record-keeping processes. With the right tools and knowledge, you can avoid costly accounting errors.