Fixed Asset Register for Small Businesses

What is a Fixed Asset Register?

A fixed asset register is a comprehensive list or record of all the fixed assets owned by a company. The register will include, location, purchase price, purchase date, depreciation and useful life.

An asset can include equipment, land, vehicles, fixtures and fittings, trademarks, or copyrights. It is a legal requirement that all limited companies keep a record of fixed assets.

Fixed Asset Management

Fixed asset management is critical for businesses of all sizes. Fixed assets are a company’s long-term property, plant, and equipment investments. They represent a significant portion of a company’s value, so it’s essential to keep track of them carefully.

Fixed asset management starts with tracking the purchase of a new asset. This information is used to generate financial reports that show the value of a company’s fixed assets.

Each year, businesses should audit their fixed assets to ensure they are accurately reflected on the balance sheet. This helps ensure that businesses clearly understand their asset base and can make sound decisions about investing in new assets.

QuickBooks – 90% Discount for 7 Months

Simple, smart accounting software for invoicing, payroll, inventory, expense tracking and producing financial reports, accessible anytime, anywhere.

Visit QuickBooks

Xero – 90% Discount for 6 Months

Xero simplifies your business finances with easy invoicing, expense tracking, payroll, bank reconciliation, and financial reporting in one secure cloud-based platform.

Visit Xero

What Fixed Asset Records Do I Need to Keep?

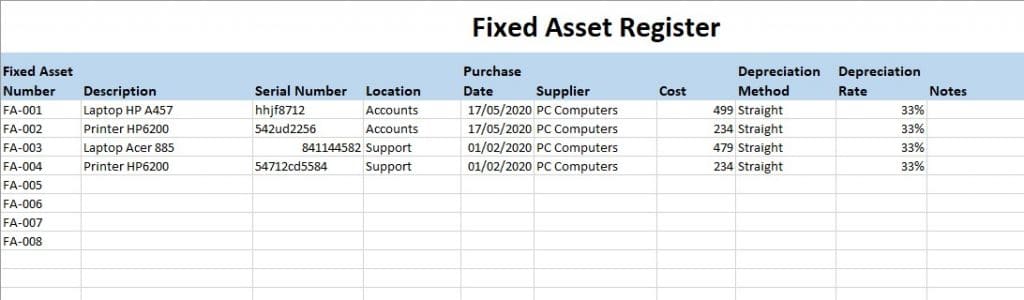

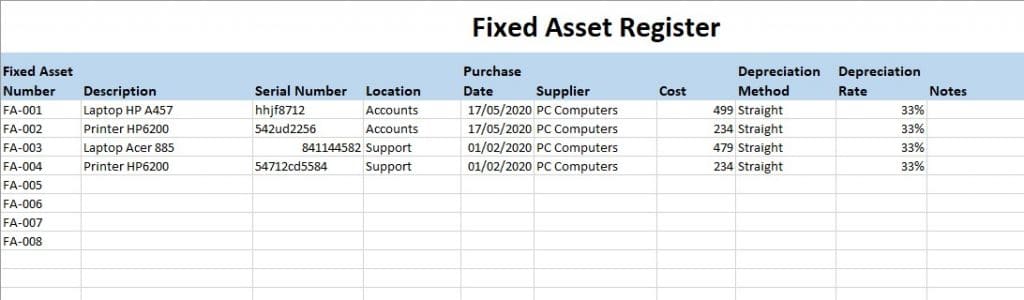

The fixed asset register should be broken down into the different types of assets and will need to include the following information:

- Purchase date

- Purchase price

- Description or asset name

- Location of the asset

It is also helpful to keep the following information:

- Serial number

- Depreciation

- Supplier

- Asset number, if used

There may also be other information on the register which you may find helpful for your company.

You will need to add or remove assets that have either been purchased or removed during the year. It includes assets that are broken, removed from the company or sold.

Keeping a copy of any invoices with the fixed asset register is useful, making it easier for the accountant at the year-end.

The register can also be used for completing your insurance form, as a copy can be attached to your application.

Fixed Asset Depreciation Method

Fixed assets are long-term investments for a business, which means that the fixed asset will be used for more than one year. The value of fixed assets depreciates over time, so companies need to use depreciation methods to calculate how much the value of the fixed asset has decreased.

The most common fixed assets depreciation method is straight-line depreciation, which depreciates an asset by an equal amount each year. Businesses can also use the reducing or declining or reducing balance depreciation method, which accelerates the depreciation of an asset in the early years and slows it down in the later years.

No matter which fixed assets depreciation method a business chooses, it is essential to depreciate an asset so its value is accurate on the balance sheet. If you are unsure which method to use, speak to an accountant or bookkeeper.

Introduction Video for Fixed Asset Register

Maintaining a Fixed Asset Register

There are several different ways to manage fixed assets; the options include the following:

- Fixed Asset software developed for the purpose

- Accounting software – which has it built-in, XERO is a good example

- Setting up an Excel template – we have a free template available

Fixed Asset Management Software

Larger organisations mainly use it due to the reports, keeping track of where assets are located and the additional cost. If, as a business, you are looking to go down this route, it is best to look at reviews on the internet and take a trial of the software that is suitable.

There are advantages of using asset software, which include:

- Being compliant for accounting purposes

- All asset data in one place

- Easy to complete a fixed asset audit

- Most packages integrate with accounting software and will calculate depreciation

Fixed Asset Accounting Software

If you use an accounting software package, fixed assets may be included. Two packages that I use and recommend are QuickBooks and Xero, which have flexible fixed assets included. Xero is one of the top accounting software recommended by bookkeepers and accountants.

Below is an example of a fixed asset register from Xero.

The above fixed asset register example has three assets, showing an asset number, type of asset and financial details.

It is easy to set up new assets; it doesn’t matter if they are computers, plant, machinery or office equipment. You can include as much or as little data as required. Our example below also consists of a location, making it easier to track and audit the equipment. Different depreciation methods are available, and the rate and number of years can be set for each asset.

Once the equipment is set up, it is easy to trace and work out the book value as the depreciation is posted directly to the package. You will need to run depreciation manually for each period.

Fixed Asset Register Template Excel

The cheapest way to track the assets is to set up an Excel spreadsheet. We have two free fixed asset register templates to download.

The first Excel template lists all the assets, asset number, date purchased, purchase price, location and supplier. It is simple to use and allows you to delete or add further columns.

The second fixed assets register template includes the calculation for straight-line depreciation. On set up, you enter the details of the asset. How many years are required for depreciation, and how many months of depreciation are needed in the first year. The figures are then posted to the accounting software each financial year.

Below is an example of a simple-to-use asset depreciation spreadsheet.

Our second Excel spreadsheet is a simple-to-use fixed asset register. It enables you to record all the asset information, location, supplier, serial number, depreciation and value. If you want to add more columns, the template is unlocked to insert additional details.

By downloading the templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

Return from Fixed asset register to fixed asset page.