Supplier Statement and Reconciliation

In this section, we will look at what supplier statements are and how to reconcile them. You will find examples and a free Excel template to complete your reconciliations. Reconciliation is an essential process in accounting because it ensures that both parties have accurate and matching records of their financial transactions.

The easiest way to keep track of how much you owe a supplier is by using accounting software. We will look at how you can use software to reconcile the accounts.

Supplier Statement of Account

A supplier statement is an accounting source document. When suppliers issue goods or services on credit, they issue an invoice. A statement of account shows all the outstanding invoices and credit notes at a given date. Usually, the issue of statements is at a month-end.

It is worth taking the time to check the statements and reconcile them. A reconciliation will show any differences between your accounting system and their statement. This is a simple process for a small company that receives only a few purchase invoices. It may take some time for a large company, especially if there are differences between the two accounts.

Why is it Important to Reconcile Supplier Statements

Some businesses will receive a statement but will not check them until they receive a demand for payment. You may think that completing the reconciliation is not essential, but keeping suppliers onside and keeping credit with them is. Losing credit with a supplier due to late payment may affect the company’s cash flow.

Supplier Statement Reconciliations

Below is a typical supplier statement reconciliation process.

- Using the accounting software, open up the supplier statement and set the dates with the same period as the supplier statement. In Xero , select the supplier bill activity report within the reports section and then select the supplier and dates. Quickbooks has a report of supplier balance details.

- The starting point is to agree with the opening balance on both accounts. You may need to check back to the previous month if there is a difference.

- Check if any credit notes are open on the accounting software; if there are, now is the time to allocate them to the correct invoice.

- Check the end balances on both statements; you have completed the reconciliation if they are the same. If there is a difference between the two, you will need to find the difference.

- To find differences, go down each line and tick off everything on both. Any transactions remaining will need to be listed in the reconciliation.

- Correct any differences that you have and ensure that the two are now balanced. You may have to request a copy of any paperwork from the supplier.

Supplier Statement Differences

There may be several reasons for differences between the two statements, including:

- Invoices not received or posted to the account. If they are not received, request a copy of the invoice.

- Timing difference. You may have made a payment that does not appear on the statement as it is received later. If it is a payment over a week old, it is worth checking with the supplier if they have received it.

- Human Errors. As with most things, it is possible to make a human error. An invoice might be posted for the wrong amount or a discount omitted. Adjust the supplier invoice in the accounting software for any differences. The transaction may have been posted to the wrong supplier; if you think this has happened, complete a transaction search for the amount.

Once you resolve all the differences, recheck the final balance and ensure they are equal. If they are, your reconciliation is complete.

Supplier Statement Reconciliation Template Excel

The supplier statement reconciliation template download is available on this page’s end.

Instructions for use

- Open the spreadsheet in Microsoft Excel or an alternative spreadsheet package.

- Enter the balance as shown in the accounting software.

- In the top section, enter any payments not on the supplier statements.

- Enter any invoices or credit notes not on your accounting software in the bottom section.

- Enter the supplier balance.

- Once complete, check that the end balance equals the balance per the supplier statement. There is a check figure for the difference; this makes it easier to see the amount of any discrepancy.

Below, we have created an example using a demo supplier statement. Here is the statement from the supplier:

The Accounting software shows a balance of £1226.25, so there is a difference of £1639.52.

Now, it is time to use the reconciliation template.

There is an uncleared payment of £1652.52 in the top section – it is a timing issue between when the statement was issued and the customer payment.

In the bottom section, a credit note and an invoice are missing from the accounts. As they were not at the month-end, it is worth requesting copies.

There is a check box at the bottom of the template, which shows a difference of 0.00. You, therefore, know that the account is reconciled.

Licence Agreement

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

Other useful Bookkeeping Templates

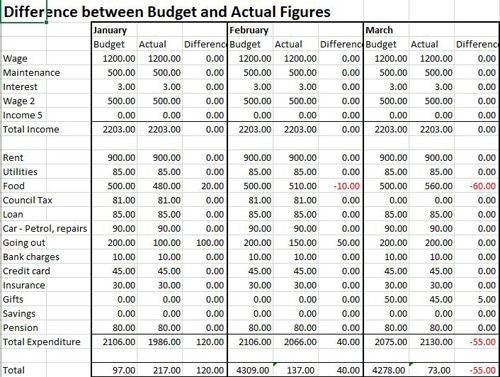

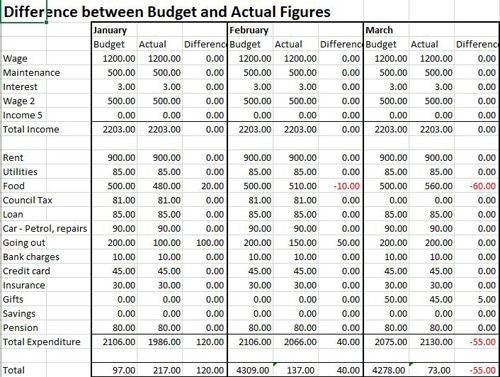

Budget Template

Our Excel budget template is excellent for creating a budget and checking your finances. Once you set the budget, you can record actual figures throughout the year and see the differences.

It is suitable for keeping track of both business and personal finances.

Cashbook Template

The cashbook is our most downloaded template. It enables you to enter the bank’s transactions and produce a profit and loss account.