Understanding Work in Progress Accounting

Introduction If you run a business that takes on longer projects — such as building services, manufacturing goods, or providing consultancy — you’ve probably heard…

Business Accounting is at the heart of all businesses. Businesses produce accounting reports for either self-employed or Limited companies.

Introduction If you run a business that takes on longer projects — such as building services, manufacturing goods, or providing consultancy — you’ve probably heard…

If you’re a small business owner, freelancer, or sole trader in the UK, you’ve likely heard about Making Tax Digital (MTD). But with so many…

If you run a small business in the UK, understanding your fiscal year (also known as your financial year) is crucial. It affects your taxes, reporting…

Introduction to Fixed Asset Management If you run a small business, you probably wear many hats — from sales and customer service to managing finances….

Managing finances is essential for any business, but choosing the right tools can be tricky. Many rely on spreadsheets like Excel or Google Sheets, while…

Imagine having a clear picture of your small business’s financial future. What if you could anticipate potential cash flow shortages or identify opportunities for growth…

Running a small business requires more than just focusing on income generation. To ensure those sales translate into profit, you must have a firm grasp…

What are the key differences between bookkeeping and accounting? All businesses will use both bookkeeping and accounting to produce financial reports. Depending on your time…

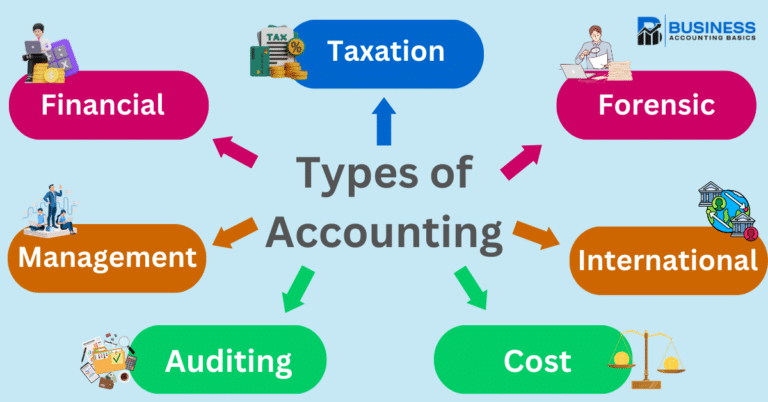

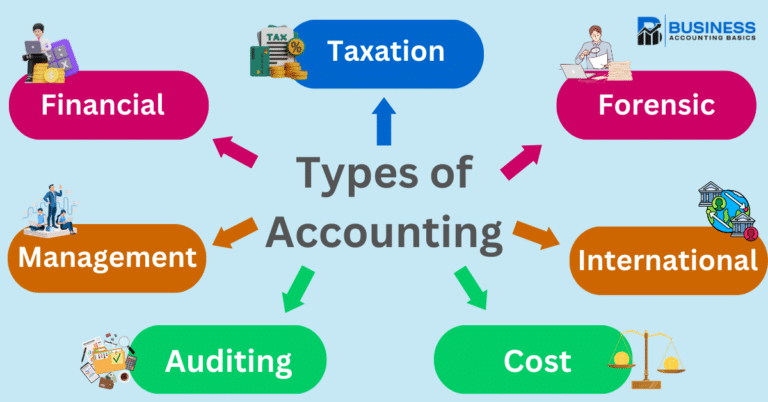

When exploring the types of accounting, you’ll find a range of methods tailored to various reporting, compliance, and management functions. This article explores these methods,…

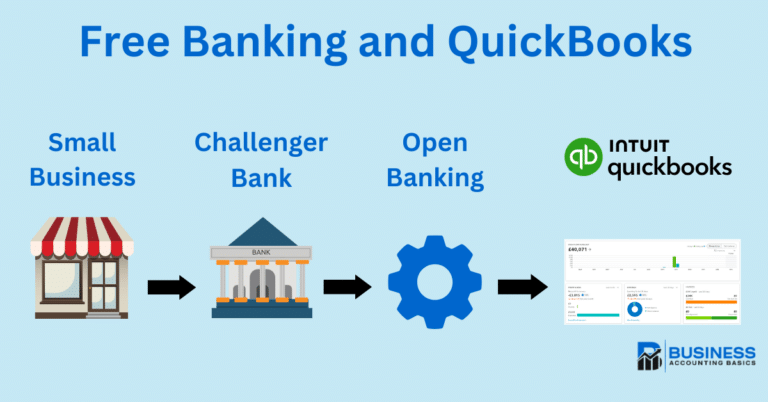

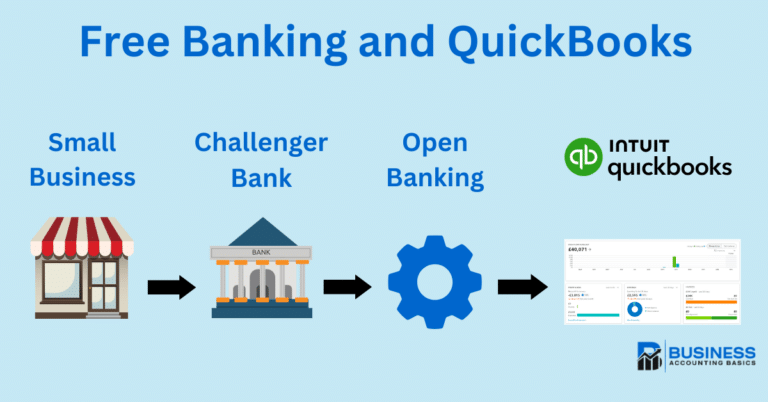

Integration for Easy Bank Reconciliation Staying on top of your finances is vital as a small business owner. One essential task is managing and reconciling…

Unlocking the secrets to business growth and financial success often starts with understanding one key aspect: sales revenue. Sales revenue is the lifeblood of any…

How AI is Revolutionising the Accounting Industry Artificial Intelligence (AI) has become the buzzword of the tech world and for good reason. It has the…

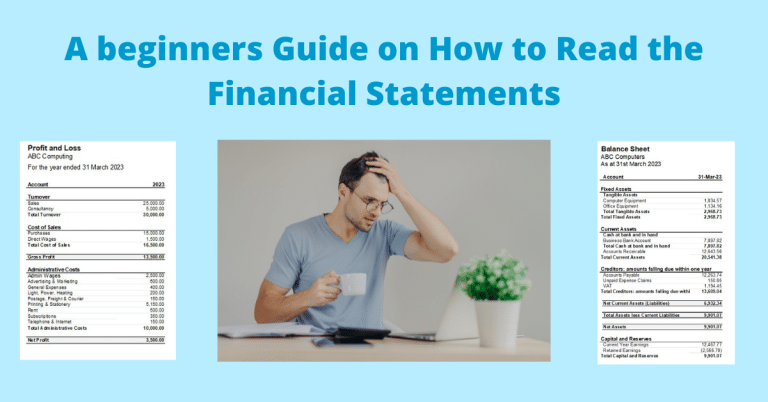

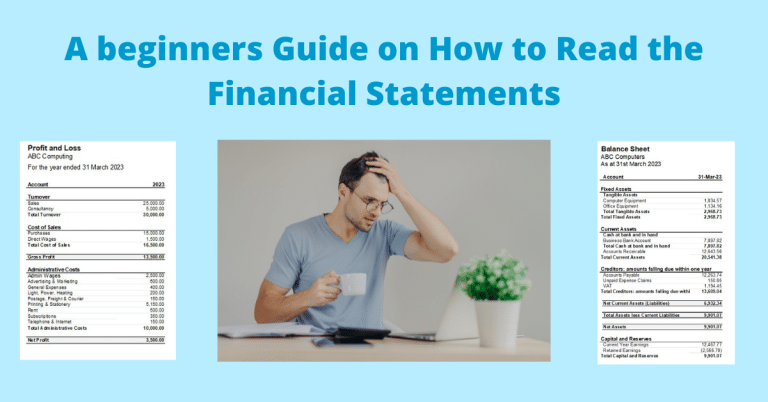

One of the most important things to know when running a business is how to read financial statements. Without this, you might produce reports but…

Are you struggling to keep track of your project expenses and accurately measure the profitability of each job? Look no further! Introducing our free Excel…

Bad debts are a reality for any business that extends credit to its customers. Bad debt is money owed by a customer or client that…

Are you confused about operating profit and its importance to your small business? If the answer is yes, then you’ve come to the right place!…

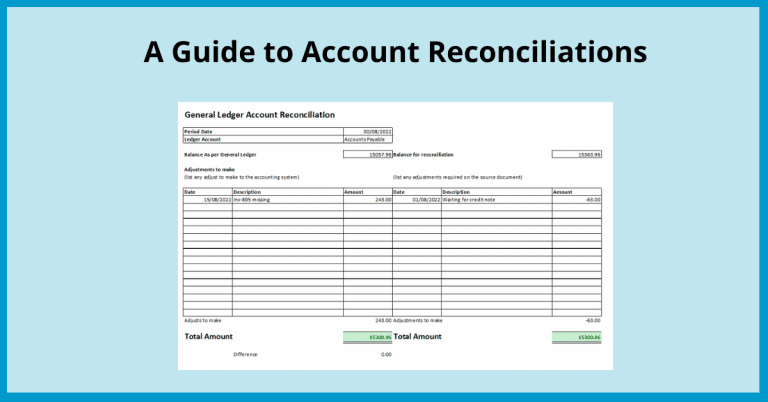

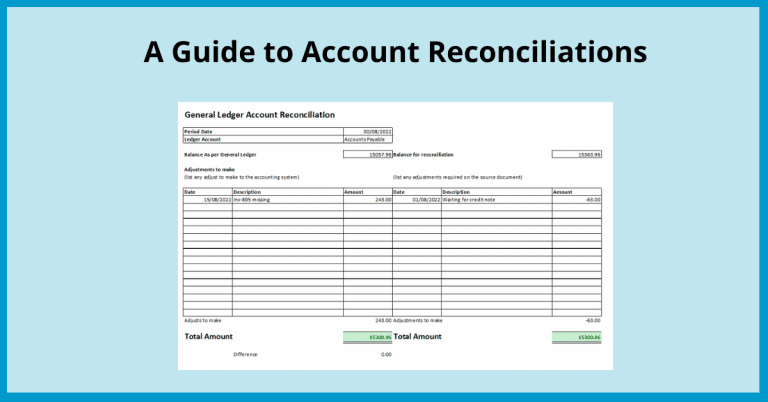

Includes FREE account reconciliation templates Account Reconciliation is verifying and adjusting the balances of two financial statements to ensure they agree. It is used to…

As a small accountancy business owner, there are so many things that require your attention on a daily basis. If you are trying to take…

Small businesses in the UK may feel overwhelmed by the complexities of Value Added Tax (VAT). But, understanding VAT is essential if you want to…

Many small businesses choose to switch accountants for a variety of reasons. Perhaps the current accountant is not providing the needed level of service, or…

Revenue is the lifeblood of any business. It’s what keeps the lights on and the wheels turning. In short, revenue is a company’s income generated…