Accounting Ratios with Examples

A guide to using financial ratios with calculators and formulas.

What are Accounting Ratios?

Accounting ratios are used by businesses to measure profitability and efficiency. There are lots of different financial ratios. In the article, we will look at some of the most common ones and provide calculators and examples.

A business’s financial statements include many figures and may not make much sense. Using ratios and comparing figures can make the numbers more transparent. Financial ratios can help check the financial health of a business.

The financial statements include the profit & Loss and Balance sheet.

Using the figures will allow you to compare the business performance from one period to another. It is helpful when comparing years, quarters, or months.

Students need to learn ratios as part of their studies and exams.

What are Profitability Ratios?

We will start by looking at profitability ratios. The profitability of a business is reported in the Profit and Loss or Income Statement. It is easy to see how a business performs and compare it to other periods.

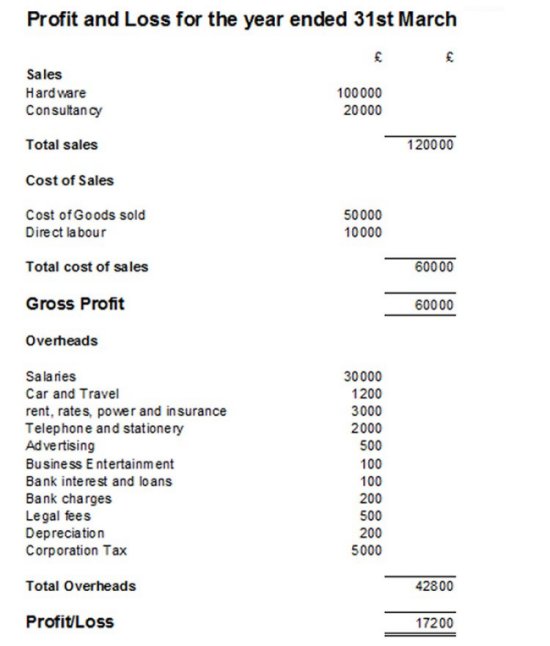

The profit and loss account is split into several sections, including revenue (sales), the direct cost of sales, gross profit, expenses, and net profit. The figures from the example Profit and Loss account below are used to calculate profit ratios using the following formulas:

Gross Profit Ratio

The gross profit ratio or margin ratio measures the revenue and the gross profit and is given as a percentage. Gross profit is revenue less the costs directly related to the production of goods. Direct costs can include materials, labour, and anything else calculated as a direct cost of producing the product or service.

As with all accounting ratios, you can use the above calculation to compare it with a different period.

Net Profit Margin

The Net profit margin ratio measures the net profit from the profit and loss account against revenue. The Net profit is calculated by taking the gross profit and deducting the expenses. Expenses include other running costs of the business, which do not relate directly to sales. It includes items such as advertising, utilities, post, rent, and wages.

As you can see from the examples of accounting ratios above, the gross profit margin is much higher than the net profit margin.

Net and Gross Profit Margin Calculator

Use our profitability ratio calculator below for your own figures. By entering different period figures into the calculator, it is easy to compare two periods.

Gross Profit Markup Ratio

The gross profit markup ratio looks at the gross profit compared to the cost of producing the product. The ratio can be used for both an individual product (if you have the figures) or from the Profit and Loss Account.

Break-Even Point

A helpful formula for a business is to know its break-even point. It is the point where a business’s sales equal both the fixed and variable costs. Our guide also includes an Excel template and an example.

What is the Current Ratio?

The current ratio is a liquidity ratio that measures a business’s ability to pay its debts. The figures are from the balance sheet and include the current assets and current liabilities.

A current asset is money you own or can convert into cash within a year. Current assets include cash, bank, accounts receivable, stock and prepayments.

Current liabilities are money you owe to others and are due within a year. Current liabilities include accounts payable, wages and taxes payable, accrued expenses and overdrafts.

Below is the formula showing how to calculate the current ratio:

An example of a current ratio is a business with current assets of 6000 and current liabilities of 1500. It is measured in numbers; the closer to 1, the less able a business is to pay its debts.

Acid Test Ratio

The acid-test ratio goes beyond the current ratio; it is also known as the quick ratio. Investors use it to measure how their short-term assets can cover their liabilities or debts. The acid test excludes stock and prepayments. It looks at the immediate cash available to cover the liabilities. The reason for using this ratio is that some businesses have stock that can’t be sold, or it takes a long time to sell.

Using the same figures as the current ratio but also including a figure for stock of 1000, the equation looks like this:

Gearing Ratio

Another accounting ratio is the gearing ratio. The gearing ratio measures the company’s financial leverage or the amount of business funding that comes from borrowing. Lenders or investors mainly use the ratio.

Further accounting ratios are available on the Investopedia website.

Accounting Ratios Conclusion

Accounting ratios are powerful tools for analysing a company’s financial health and performance. By providing insights into profitability, liquidity, solvency, and efficiency, these ratios enable stakeholders to make informed decisions. However, it’s crucial to remember that ratios are most effective when compared with industry benchmarks, historical data, and a thorough understanding of the company’s circumstances.

Return from accounting ratios to balance sheet page.