What is a General Ledger?

A General Ledger is one of the most important components of accounting. But what is it, and how does it work? This article will discuss the General Ledger in detail, including its functions and purposes. We will also list the main types of General Ledgers. Let’s get started!

General Ledger Definition

The General Ledger is a vitally important accounting tool that tracks all financial transactions for a company. It includes all revenue and expenses, as well as assets and liabilities. This information is used to track a company’s overall financial health and performance.

The General Ledger can be kept in either a manual or electronic accounting system. In a manual system, they are kept in a book. The transactions are tracked electronically using spreadsheets or accounting software in an electronic system.

General Ledger Process

The General Ledger works by recording all financial transactions for a company in one place. This information is then summarised in financial statements and used to track a company’s overall financial health and performance.

The accounts in the general ledger are used to produce the financial statements, including the balance sheet and income statement. The figures can also be used to create a cash flow statement.

The general ledger can be used to track a company’s income, expenses, assets, liabilities and equity.

Double Entry Bookkeeping

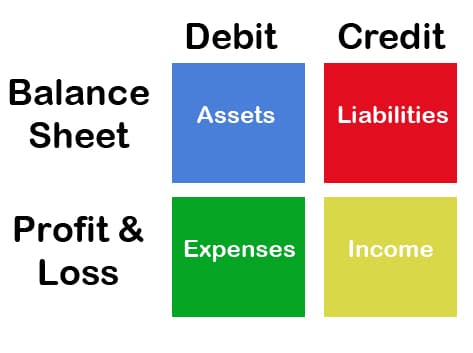

To better understand the general ledger, it is essential to understand double-entry bookkeeping. Double entry bookkeeping is a system where every financial transaction is recorded twice. This ensures a balance of debits and credits in the accounting records.

The general ledger uses this double entry accounting method to track all financial transactions for a company. Every entry into the General Ledger is recorded as a debit and credit. It ensures that it is always in balance.

General Ledger Accounts vs Journal

The general ledger account differs from a journal – Journal entries are a record of individual transactions, while the general ledger is a summary of all financial transactions. The general ledger includes every transaction for a company, while the journal contains only selected transactions.

How is the General Ledger Account Organised?

The general ledger account is divided into Balance Sheet Accounts and Income Statement Accounts.

Balance Sheet Accounts

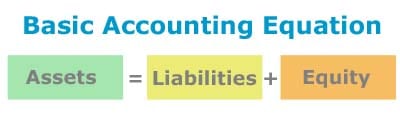

Balance sheet accounts are a company’s assets, liabilities, and equity. The balance sheet is a snapshot of a company’s financial position at a point in time.

The company owns the assets and can use them to pay its liabilities. The liabilities are what the company owes to others. The owner’s equity is the difference between assets and liabilities.

Below is the basic accounting equation that is the heart of the accounts.

Income Statement Accounts

The income statement summarises a company’s revenue and expenses for a period of time, usually a fiscal year. The income statement shows how well or poorly a company performs financially over time.

It lists all the income, cost of goods sold, gross profit, expenses and net profit.

We’ll now go through some of the main individual general ledger accounts to better understand how it works.

Assets Accounts

Inventory or stock

They are used to track the inventory or stock of a company. The inventory accounts are used to calculate the cost of goods sold and a company’s net income.

Fixed Assets

Fixed assets are long-term assets of a company. They are used to generate revenue over a period of time. The most common types of fixed assets are property, plant, computers and equipment.

Cash Account

Cash is an asset because it is a valuable resource that a company can use to pay its bills and expand its operations. The cash account includes both bank accounts and credit card accounts, which are both considered assets.

Accounts Receivable

The accounts receivable account is a record of money that is owed for products or services that have been delivered but have not yet been paid. When a company sells products or services on credit, the accounts receivable account increases, and when the debt is repaid, the account decreases.

Here is an example of a general journal for a sales invoice:

(Dr.) Accounts Receivable (at sales price) ……… 100

(Cr.) Sales Revenue (at sales price) ……… 100

Liabilities Accounts

Accounts Payable

Accounts payable is a liability account representing the amount of money a company owes to its suppliers for goods and services that have been delivered but not yet paid for. The account is updated as invoices are received from suppliers and payments are made to them.

Loans

They are money that a company has borrowed from a bank or another lender. The business loans account increases when the company borrows money and decreases when the company pays back the loan.

Income Accounts

A business may have several different income sources and use a separate account to track each one. The most common types of income are sales revenue, interest income, and dividend income. Sales revenue may have several different accounts, e.g. consulting, products and support.

Expenses Accounts

An expense account is a record of the business expenses incurred by a company during a specific accounting period. The expense account is used to calculate the net income for the period.

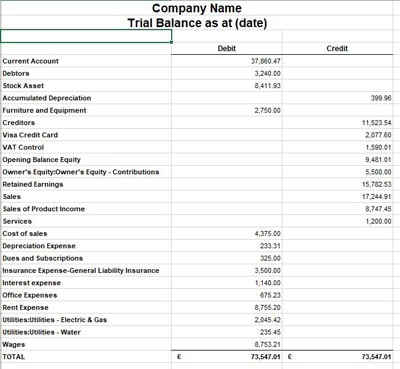

Trial Balance

A trial balance is a report that lists the balances of all the accounts in a company’s general ledger. It is used to determine if the total of the debits equals the sum of the credits. If they do not, it indicates that there is an accounting error.

Below is an example of a trial balance report:

Conclusion on the General Ledger Accounts

The general ledger is a record of all the company’s financial transactions. It includes accounts for assets, liabilities, owner’s equity, income and expenses. The General Ledger is used to create the key financial reports.

It is the foundation of accounting, and it is vital to accurately understand how it works to track a company’s financial position.

Thank you for reading! I hope this article was helpful.

To understand the general ledger further take a look at the chart of accounts article.