Frequently Asked Accounting Questions and Answers

We aim to address some of the accounting questions you may have, whether as a small business owner or preparing for an interview.

There are many accounting questions you may have for your small business. Here, we have tried to answer as many as possible. Our topics include everything your business may need to get up and running, from producing financial statements to completing year-end returns.

We have split the questions into five sections:

- Basic Accounting Questions

- Registering a Business

- VAT Questions

- General Business Questions

- Accounting Interview Questions

Basic Accounting Questions

What is accounting?

Accounting is the process of recording, classifying and summarising financial transactions to provide helpful information in making business decisions. Accounting also includes information about a company’s financial position, performance and cash flow statement.

What are the Financial Statements?

The financial statements are the three primary reports that summarise a company’s financial position, results of operations and cash flows. The accounting statements include the balance sheet, profit and loss (or income statement), and cash flow statement.

What is the Easiest Way to Produce the Financial Statements?

Using accounting software is by far the most efficient way to process transactions and prepare financial statements. The software will automate various tasks for you, including recording transactions, generating reports, and calculating totals. This leaves you more time to focus on running your business.

What is the Balance Sheet?

The accounting balance sheet is an accounting report that summarises a company’s assets (what the business owns), liabilities (the debts of the business), and equity (the value of shareholders’ ownership in the company). Assets include items such as buildings or equipment used by the business to generate revenue or provide services. Liabilities can include loans from banks or other creditors, as well as unpaid bills from customers for goods or services received but not yet paid for. Equity includes shares of stock owned by investors in addition to any retained earnings on hand.

What is the Profit and Loss (Income Statement)

The accounting profit and loss statement, also known as an income statement, is an accounting report that summarises a company’s revenues (income) and expenses for a specific period, usually for one month, one quarter, or one year. The accounting profit and loss statement is also called the income statement or P&L.

What is the Cash Flow Statement?

The accounting cash flow statement is an accounting report that summarises a company’s inflows and outflows of cash for a specific period, typically one month, one quarter, or one year. The accounting cash flow statement shows where the company’s cash will come from (inflows) and where it will go (outflows).

A cash flow statement is helpful in seeing how much cash a business will have at any time. It lets the company know when they have money to invest or have a shortfall and might need an overdraft.

What are Fixed Assets?

Fixed assets are long-term assets that a company uses to generate revenue or provide services. These assets typically have a lifespan of more than one year and include items such as land, buildings, equipment, vehicles, and patents. The depreciation of a fixed asset is the process of allocating its cost over its useful life.

What are Current Assets?

Current assets are short-term assets of a business that are expected to be converted into cash within one year. The most common types of current assets are cash and cash equivalents, accounts receivable, inventories and prepaid expenses.

What is a Liability?

Liabilities are a company’s debts or obligations. The most common types of liabilities are loans from banks or other creditors and unpaid bills from suppliers for goods or services received but not yet paid for.

What is an Accounting Journal?

An accounting journal is used to adjust the figures in the income statement or balance sheet. An accounting journal can be used for various purposes, such as recording the depreciation of an asset over its useful life, documenting a one-time accounting event, or correcting accounting errors.

What is an Accounting Ledger?

An accounting ledger is a book where all business transactions are recorded. The accounting ledger is also referred to as the general ledger.

What is an Accounting Period?

An accounting period is a time frame used to prepare financial statements. The most common accounting periods are monthly, quarterly and annually.

How do I Calculate Depreciation?

Depreciation is the accounting process of allocating the cost of a fixed asset over its useful life. The profit and loss statement recognises the depreciation expense in each period. There are several methods for calculating depreciation, including the straight-line and reducing balance methods.

How do I Account for Inventory or Stock?

Inventory is a current asset representing the goods and materials that a business has on hand to sell to customers. Accounting for inventory is done at cost, which is the original purchase price of the inventory plus any additional costs incurred to prepare the inventory for sale.

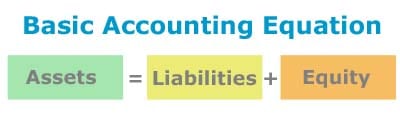

What is the Basic Accounting Equation?

The basic accounting equation is a fundamental principle that states the total assets of a company must equal the total liabilities plus the company’s equity.

What is Credit Control?

Credit Control is the process of collecting accounts receivable payments. Procedures may include sending out supplier statements, making telephone calls, sending reminder letters, and issuing final demands.

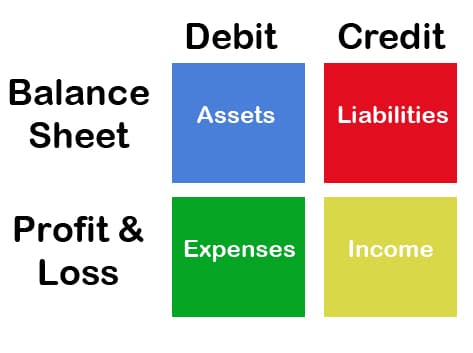

What is Double Entry Bookkeeping?

In accounting, the double-entry system refers to the recording of transactions with debits (left) and credits (right), a method that has been used for centuries to measure financial performance. For each transaction, an equal and opposite transaction is made.

What is a Purchase Invoice?

A purchase invoice is a document that a company receives from its suppliers, listing the products and services provided to the company. The purchase invoice also includes the price and any discounts offered. The company uses the purchase invoice to calculate the amount it owes to the supplier.

How to Create a Sales Invoice?

A sales invoice is a document issued to customers that lists the products and services provided to them. The sales invoice also includes the prices of the products and services, as well as any discounts the company may have offered. The customer uses the sales invoice to calculate the amount they owe to the company.

There are many different ways to create a sales invoice. One way to do this is to use accounting software, such as QuickBooks or Xero. Another way is to use an Excel sales invoice template.

What is a Trial Balance?

The trial balance is a list of all the accounts in a company’s accounting system, with each account’s debit balances and credit balances listed separately. Bookkeepers and accountants use the trial balance to verify that the total of the debit balances equals the total of the credit balances. It ensures that the accounting records are accurate.

Accountants and bookkeepers use a trial balance to gain a comprehensive view of the accounts.

How do you Complete Stock Control?

Stock control is the process of accounting for and managing a business’s inventory. The accounting for inventory is done at cost, which is the original purchase price of the inventory.

There are two primary methods for managing stock control: using accounting software or a manual system. Accounting software is the most common method for managing stock control. Accounting software such as QuickBooks or Xero can automate much of the stock control process, including creating purchase orders, receiving goods, and issuing sales invoices.

What is the Difference Between Gross and Net Income?

The main difference between gross and net income is that gross income includes all the income a company has earned, less the cost of sales, while net income includes only the income left after all the company’s expenses have been paid. It means that gross income is always higher than net income.

What is the Difference between Accrual Accounting and Cash Accounting?

There are two main types of accounting: accrual accounting and cash accounting. The main difference between the two is when income and expenses are recorded. Accrual accounting records income and expenses when they are earned or incurred, regardless of when the cash is received or paid. Cash accounting records income and expenses when the cash is received or paid, irrespective of when the transactions are earned or incurred.

The main advantage of accrual accounting is that it provides a more accurate picture of a company’s financial position. It is because income and expenses are recorded when they are earned or incurred, not when the cash is received or paid. The main disadvantage of accrual accounting is that it can be more complex than cash accounting.

Registering a Business: Questions

Why Form a Limited Company?

When you form a limited company in the UK, you become the owner of a legal entity that is separate from yourself. It means that the company is responsible for its debts and liabilities, and you are not personally liable for them. This can be particularly important if the company faces financial difficulties, as it limits the amount of money you could potentially lose.

How to Register a Company in the UK

To register a limited company in the UK, you need to submit several documents to Companies House. You can submit the documents online or by post.

You can also choose to register your company using a registration service. A registration service will assist you in completing all the required documents and submitting them on your behalf.

How to Register as Self-Employed

To register as self-employed with HMRC, you need to have a Government Gateway account and register as self-employed.

How to Form a Partnership

To form a partnership, you must draft a partnership agreement. The partnership agreement is a contract between partners that outlines the terms and conditions of the partnership.

How to Name Your Business

When naming a business, choosing a unique and memorable name is essential. It would be best to ensure that the name is available for registration as a trademark and that the domain is available.

VAT Accounting Questions

How to Register for VAT?

VAT registration is handled through HMRC; you can either apply yourself or have your accountant do it on your behalf.

What is the UK VAT Threshold?

The UK VAT threshold is the amount of sales that a business must make before it is required to register for VAT. The threshold is currently £85,000 per year. It means that businesses with an annual turnover of less than £90,000 are not required to register for VAT.

What is Flat Rate VAT?

The flat-rate VAT scheme is available to businesses with a taxable turnover of less than £150,000. Under the scheme, businesses can pay a fixed percentage of their taxable turnover as VAT, regardless of the actual amount of VAT they owe.

The primary advantage of the flat-rate VAT scheme is that it is simpler than the standard VAT accounting scheme. A company only needs to calculate VAT on sales.

How do you obtain a VAT number?

HMRC will give you a VAT identification number when you apply for registration.

How do you Deregister for VAT?

When you deregister for VAT, you must submit a deregistration form to HMRC. You submit the form online.

What are the Current VAT Rates?

The current VAT rates are:

- Standard rate: 20%

- Reduced rate: 5%

- Zero rate: 0%

The standard VAT rate is 20% on most goods and services.

What is Annual Accounting VAT?

Under the annual accounting VAT scheme, businesses submit a single VAT return and account for all of their VAT liabilities for the year. This scheme is only available to businesses that have a taxable turnover of less than £1.35 million.

If you complete an annual VAT return, payment is still required each quarter, and the final fee at the end of the year will be adjusted.

What is Cash Accounting VAT?

Cash accounting VAT is a scheme available to businesses with a taxable turnover of less than £1.35 million. Under the scheme, businesses only need to record the cash they receive and pay out. This makes accounting simpler, as businesses only need to track their income and expenses as they occur.

The main advantage of cash accounting for VAT is that it can be beneficial for businesses experiencing cash flow problems. This is because businesses can claim input tax on expenses as soon as the money is paid out, and pay VAT when they receive the money from the customer.

Cash Accounting is a method where your VAT is calculated when you receive or pay cash.

Accounting Questions – General Business

What is Business Banking?

A limited company is required by law to have a business bank account to operate.

As a self-employed individual, it is best to have a separate business bank account from your personal one, as it makes it easier to have business transactions separate.

What Business Insurance do I Need?

There are several types of business insurance that you may need to consider. If you are unsure which type of insurance you require, speak with a business insurance broker.

The most common types of business insurance are:

- Property insurance

- Employers liability insurance

- Contents insurance

- Public liability insurance

What’s a Business Plan?

A business plan is a document that outlines a business’s goals and objectives, as well as its strategies for achieving them. A business plan is typically required when a company is starting up, looking to expand, or making changes to its operations.

A business plan typically includes the following information:

- The name and contact details of the business

- The business objectives and goals

- A description of the products or services that the business offers

- Details of the target market for the products or services

- A marketing strategy for the products or services

- An outline of the operational structure of the business

- Details of the business’s financial situation, including projected income and expenditure and a cash flow statement.

What is Making Tax Digital?

Making Tax Digital (MTD) is a government initiative that requires businesses to maintain digital records and submit their tax returns electronically. The main aim of MTD is to make it easier for businesses to comply with their tax obligations.

Accounting Interview Questions

Most accounting interview questions will be about your accounting experience, and the interviewer will be looking to see how you think through problems. It is essential to do your research ahead of time. One way to practice is to utilise online resources or seek assistance from accounting professionals. When you are ready for the interview, make sure you are dressed professionally and arrive on time.

Below are 10 accounting questions commonly asked during interviews.

Which Accounting Software Programs have you Used?

This question is designed to assess your comfort level with using various programs and your experience working with specific ones. Be sure to mention any programs you are familiar with and describe how you used them. If you are unsure of a particular program, take the time to research it before your interview. Being knowledgeable about various programs demonstrates that you are versatile and capable of handling multiple tasks.

How do you Ensure Accuracy in Accounting?

When answering this question, be sure to discuss the importance of accuracy in accounting and how you work to maintain it. You can talk about any measures you take to ensure accuracy, such as double-checking calculations or reviewing your work for mistakes. Additionally, you can mention any experience you have had with ensuring accuracy in accounting, such as correcting errors or working with auditors. Demonstrating your commitment to accuracy will show the interviewer that you take your job seriously and produce accurate results.

What Industries have you Worked in?

Discussing your work experience with the interviewer is a great way to demonstrate your capabilities. When answering this question, discuss any industries you have worked in and highlight any accounting experience you have had. It will give the interviewer a better understanding of your skills and how they can be applied to their business.

What Accounting Qualifications do you Have?

Interviewers want to know that you have the necessary skills and qualifications for the job. When answering this question, be sure to list any accounting qualifications you have and describe what you learned from them. If you are currently studying accounting, be sure to mention this.

How Important are the Financial Statements for a Business?

Talking to the interviewer about your understanding of financial statements is a great way to show them your knowledge and skills. When answering this question, be sure to discuss the importance of financial statements for businesses and explain why they are essential. Additionally, you can mention any experience you have had with reading or creating financial statements. It will show the interviewer that you have a comprehensive understanding of financial statements, which is integral to any accountant.

What’s the Difference Between Accounts Payable and Accounts Receivable?

Hiring managers want to know that you understand the basics of accounting. When answering this question, be sure to explain the difference between accounts payable and accounts receivable.

How have you Helped a Business to Improve its Accounting Procedures?

Discussing a specific example of how you have helped a business improve its accounting procedures is a great way to demonstrate your capabilities to the interviewer. When answering this question, be sure to discuss the steps you took to help the business and highlight any results you achieved. Additionally, you can mention any experience you have had with coaching or training employees.

What is your Accounting Knowledge?

When answering this question, be sure to discuss your understanding of bookkeeping, financial statements, and tax laws. Additionally, you can mention any experience you have had with auditing or consulting businesses.

Why do you want to Work in Accounting?

When answering this question, be sure to discuss your reasons for wanting to work in accounting. It will show the interviewer that you are passionate about the industry and have a genuine interest in the job. Additionally, you can mention any skills or qualifications you have that make you a good fit for the role.

Accounting Questions Conclusion

As a small business owner, you’re likely to encounter various accounting issues. We’ve addressed some of the most common accounting questions and provided brief answers for each.

Remember that these are just general guidelines. To gain a more comprehensive understanding of accounting, it’s essential to conduct thorough research.

The accounting interview questions listed in this article will help you prepare for your next interview. By practising your answers to these questions, you can improve your chances of getting the job. The interviewer wants to know that you have the skills and knowledge required for the role, so be sure to highlight any accounting qualifications you have. Additionally, discuss your understanding of financial statements and basic bookkeeping principles. If you are currently studying accounting, be sure to mention this. Finally, explain why you want to work in accounting and discuss any experience you have had with coaching or training employees.

Return from accounting questions to the Business Accounting Basics page.