Free Bookkeeping Forms

Bookkeeping Forms for small businesses are an excellent tool for various tasks in your accounting. We have produced valuable forms to assist with petty cash, cash receipts, journal entry, sales invoice, new client and cash book.

Each can be printed in Microsoft Word or Excel and then completed by hand. They are helpful to some people who do not have access to a computer at all times or prefer to complete their bookkeeping using a manual system.

We also offer a variety of free Excel bookkeeping templates for download and use.

If you cannot find the form you are looking for, please contact us, and we may be able to produce one or direct you to the right information.

All our forms are easy to use, free to download, and suitable for both business and personal use. Some links will start the download of the form. Others will take you to a page with further information and a download link. By clicking on the links, you agree to our licence agreement.

Bookkeeping Journal Form

When completing your accounts, journals are required to move figures from one account to another.

There are many reasons why an accounting journal is required. It includes recording depreciation, posting to the wrong nominal account, accruals, prepayments, adjustments, bad debts and more. A simple way to verify the accounts is by preparing a trial balance.

Below is an example of your journal accounting form.

Cash Receipts Form

If, as a business, you make cash sales, the best way to have a record of the transaction is to complete a cash receipt. You may make sales for cash for several reasons, including selling at a show where customers only use cash.

Mileage Log

Do you travel for business? It is important to keep records of each journey. Our mileage log form will enable you to record each journey, including a description and the number of miles travelled. If you are VAT registered, the VAT element will be calculated automatically.

You may also find our business expenses template helpful for recording both mileage and other expenses.

[maxbutton id=”4″ url=”https://www.businessaccountingbasics.co.uk/simple-mileage-log/” text=”Mileage Log” ]

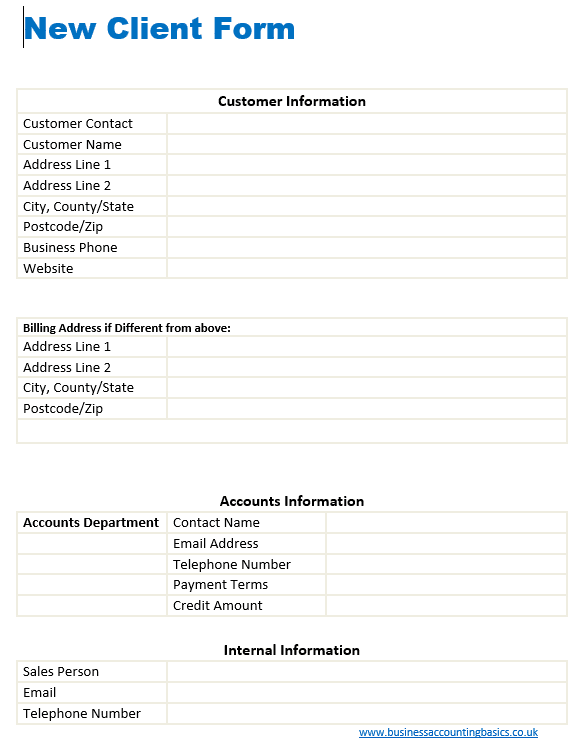

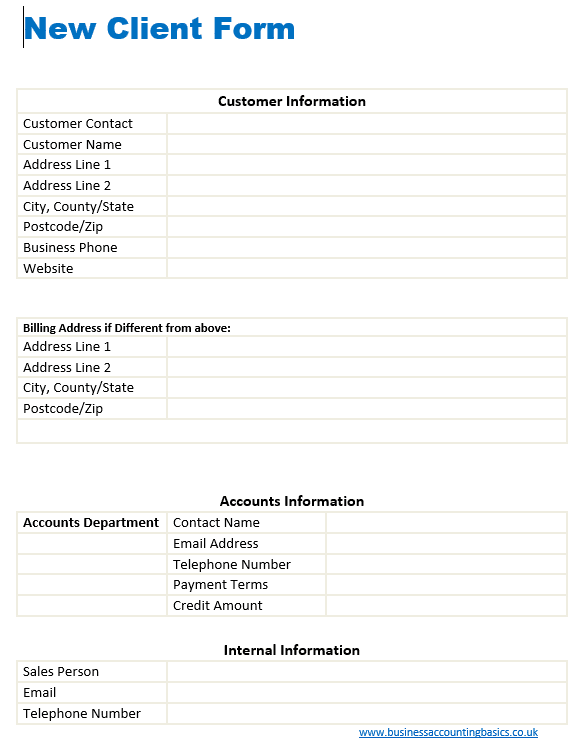

New Client Customer Form

If you have a new client or customer, you may want to keep a record of their contact details on a form. The information includes contact details, address, website, email, phone number, accounts contact, payment terms, credit amount, and internal salesperson. There is space to add your business logo to the top.

Bookkeeping Forms – Petty Cash Log

The petty cash log can record the income and expenditure of the petty cash over a period. Complete the form either by hand or using Excel. After completing the log, the balance of the petty cash should equal the balance of the log sheet. If there is a difference, check the figures for any errors.

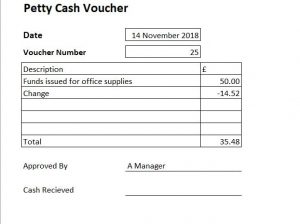

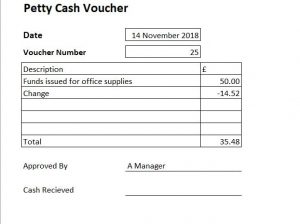

Petty Cash Voucher

If you are running a petty cash system, it is useful to get a petty cash voucher completed as a record of the income or expenses.

Most businesses use petty cash to purchase sundry items. The voucher has space for date, description, amount and signatures.

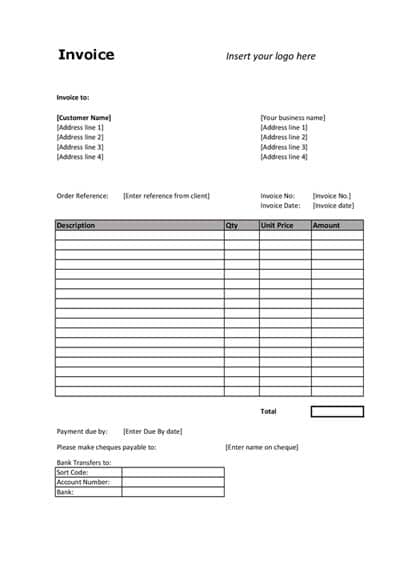

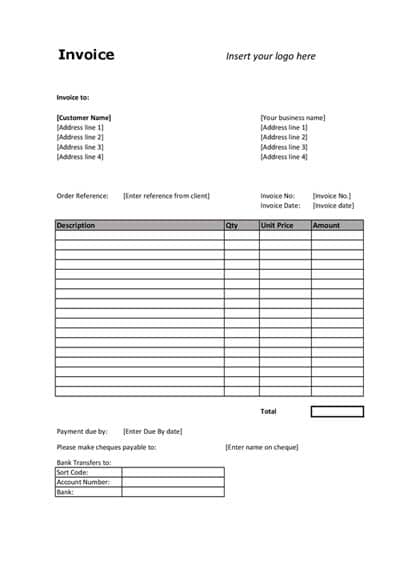

Sales Invoice

A Sales invoice is required if you sell to a customer; some details are needed on an invoice. We have produced a simple template to send to the customer.

Trial Balance PDF

A trial balance is an accounting tool used to determine the accuracy of a company’s accounting entries.

It lists all the individual accounts of a business along with their respective debit and credit balances. The total debits should equal the total credits, which will indicate that the books are in balance. The primary purpose of the trial balance is to ensure that all of the account balances in the ledger have been correctly calculated and recorded.

Bookkeeping forms are suitable for all sorts of accounting tasks for your business. If you can’t find a form you are after look at producing one yourself. There are lots of useful guides on YouTube which will help you design the ideal template.

Return from Bookkeeping Forms to Bookkeeping Basics Page