As a self-employed business owner, maintaining accurate financial and business records is crucial for your annual self-assessment tax return. Falling behind on bookkeeping can lead to complications, potentially requiring the assistance of a professional bookkeeper or accountant.

However, if you are confident, you can complete your return yourself. This blog post will discuss the basics of self-employed bookkeeping and how to do it yourself.

Business Accounting Basics has free bookkeeping templates to assist in the process. One template we have received requests for is a cash book from April for the taxation year. The self-employed cashbook template is available for free download below.

Excel templates are an excellent way for self-employed individuals to manage their finances. However, we recommend using accounting software such as Sage UK, Xero or QuickBooks to manage your finances, as they offer more features and benefits than Excel templates.

At the end of this post are a few frequently asked questions.

What is Bookkeeping?

Bookkeeping is the process of recording and managing your business’s financial transactions. This includes tracking income, expenses, invoices, and payments to ensure your financial records are accurate and up to date. For self-employed individuals, bookkeeping is a cornerstone of maintaining a healthy business. It helps you monitor your cash flow, prepare for tax season, and make strategic decisions based on your financial data.

Choosing the Right Bookkeeping System

Choosing the right bookkeeping system depends on the size and complexity of your business. Here are some factors to consider:

- Ease of Use: Select a user-friendly system, even if you have limited accounting experience. This will make it easier to keep your records accurate and up to date.

- Features: Consider the features you need, such as invoicing, expense tracking, and time tracking. These features can streamline your bookkeeping process and save you time.

- Integration: Choose a system that integrates with other apps and software you use, such as payment providers, CRM and payroll. This can enhance your workflow and ensure all your tools work seamlessly together.

- Cost: Evaluate the cost of the system, including any subscription fees or hidden charges. Ensure it fits within your budget while providing the necessary features.

- Support: Opt for a system that offers good customer support, including phone, email, and live chat. This can be invaluable if you encounter issues or have questions about using the software.

Online bookkeeping software — or even using Excel spreadsheets — can make managing your business finances much easier and more efficient. The key is choosing a system that fits your business needs and comfort level. Whether you use a simple Excel template or a cloud-based tool like Sage, QuickBooks, or Xero, setting up a proper bookkeeping system helps you stay organised and accurate. By understanding the basics of bookkeeping and keeping your records up to date, you’ll have a clear picture of your business finances and be able to make informed decisions that support growth and long-term success.

Self Assessment, Income Tax and NI

If you’re self-employed, you’re responsible for reporting your income and paying tax through the Self Assessment system. Each tax year runs from 6 April to 5 April, and you’ll need to submit your tax return by 31 January the following year. This return includes all your income and allowable business expenses to calculate how much income tax and National Insurance you owe. Keeping good bookkeeping records throughout the year makes completing your Self Assessment much easier and helps you avoid mistakes or penalties.

Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA)

Making Tax Digital (MTD) for income tax is a government scheme designed to help self-employed people manage their taxes more easily. It means keeping your records digitally and sending updates to HMRC every quarter using approved accounting software, rather than filing a single yearly tax return. From April 2026, MTD will apply to self-employed individuals and landlords with income over £50,000, and from April 2027, to those earning over £30,000. Anyone earning less can still join voluntarily.

To get ready, start using MTD-compatible software such as Sage, QuickBooks, or Xero.

- Sage UK offers simple plans for sole traders, from a FREE plan for income and expenses for MTD reporting to invoicing, expense tracking and full VAT.

- QuickBooks Self-Employed automatically tracks income, expenses, and mileage, with easy tax summaries.

- Xero provides beginner-friendly tools for invoicing, bank feeds, and real-time financial tracking.

Getting started with one of these systems now will make the move to MTD much smoother and keep your business records accurate and organised.

Separate Bank Account

Having a separate business bank account is important when you are self-employed. It will help you separate personal finances from business expenses. You can also keep track of your expenses and profits, making it easier to calculate the figures to file your taxes.

A separate bank account will also make it easier to obtain a loan or line of credit if needed. Although having a separate business bank account is unnecessary, it is considerably easier to keep track of your business finances if you do.

Self-Employment Business Expenses

You can claim business expenses on your tax return as a self-employed individual when you run your own business. It can help keep your tax bill low, and knowing what you can claim in tax-allowable expenses is essential.

Some of the most common business expenses include:

- Business insurance

- Equipment and tools used in your work

- Vehicle expenses

- Travel expenses, including mileage

- Office supplies and stationery

- Professional fees and subscriptions

- Advertising and marketing costs

- Office premises and running costs

- Home office expenses

It’s essential to track all your business expenses throughout the year to make filing your tax return easier. A bookkeeping package can help you stay organised, or you can keep all your receipts in a folder or electronic document.

How to Complete Accounts for Self-Employed

One of the most critical aspects of bookkeeping is organisation. You must keep all your own financial records, whether paper-based or electronic. This will help you maintain your finances and ensure accurate accounts. If your business requires an accountant, our free tool can help you find one quickly.

Accounting software packages can upload receipts directly into the software to ensure your bookkeeping is accurate and up-to-date. This way, all your documents are in one place, and you can easily keep track of your spending.

Several great bookkeeping packages offer free trials, so take some time to research which one would be the best fit for you. Try out a few options and discover which streamlines your accounting process. To help, we have written a QuickBooks vs. Xero comparison with a free PDF.

Accounting Software Best Deals

Sage UK – 90% Discount for 6 Months – FREE plan for Sole-Traders, AI tools for bookkeeping automation

XERO – 90% Discount for 6 Months + Amazon Gift Card – Cloud accounting, unlimited users, smart bank feeds

QuickBooks – 90% Discount for 7 Months – Invoicing, expense tracking, payroll, financial reports

Self-employed Accounting Software

When you’re self-employed, keeping accurate financial records is essential. It might be tough to handle on your own, which is why accounting software may be helpful. Accounting software can help you issue sales invoices and keep track of your income and expenses, as well as your assets and liabilities. It can also help you prepare for self-assessment tax returns and invoices.

Some providers offer plans for self-employed individuals. This software can prepare all the figures for the self-assessment tax return and track mileage and time. One of the best choices is Sage UK, which offers both a FREE plan for individuals and a paid version with invoicing.

As software develops, it is easier for businesses to complete their accounts. Some of the most popular packages include Xero or QuickBooks; which all cost monthly. If you are looking at software, sign up for a free trial and see if the package suits your business.

We have reviewed some of the best accounting software for the self-employed and how to choose the best package.

Advantages of Self-Employed Accounting Software for a Sole Trader

There are several advantages of using accounting software for sole traders.

- Saves time – automates invoicing, expense tracking, and bank reconciliation.

- Reduces errors – calculations and reports are more accurate than manual records.

- Keeps you organised – all your income, expenses, and receipts in one place.

- Prepares you for MTD – most software is already compliant with Making Tax Digital.

- Gives real-time insights – see how your business is performing at any time.

- Simplifies Self-assessment tax returns – quickly generate the figures needed for HMRC.

- Accessible anywhere – cloud-based systems let you manage accounts on any device.

Excel Spreadsheets

Excel spreadsheets or an equivalent free spreadsheet package give you the flexibility to design your spreadsheets and get the information you need.

There are many free templates available online. Business Accounting Basics has developed many templates, including profit and loss, balance sheet, cash book, expenses, creditors, debtors, budgeting and invoices. All our templates are available for free download without signing up.

Our cash book for the self-employed is available below, along with an example.

Paper Based

If you are a small business and do not like technology, you can keep your records on paper. Stationery shops and places like Amazon sell books and paper with columns for recording income and expenses.

The government has long-term plans called “Making Tax Digital.” This means that future tax returns must be submitted using approved software. Choosing the best way to complete business bookkeeping is one consideration.

Self-Employed Bookkeeping Example

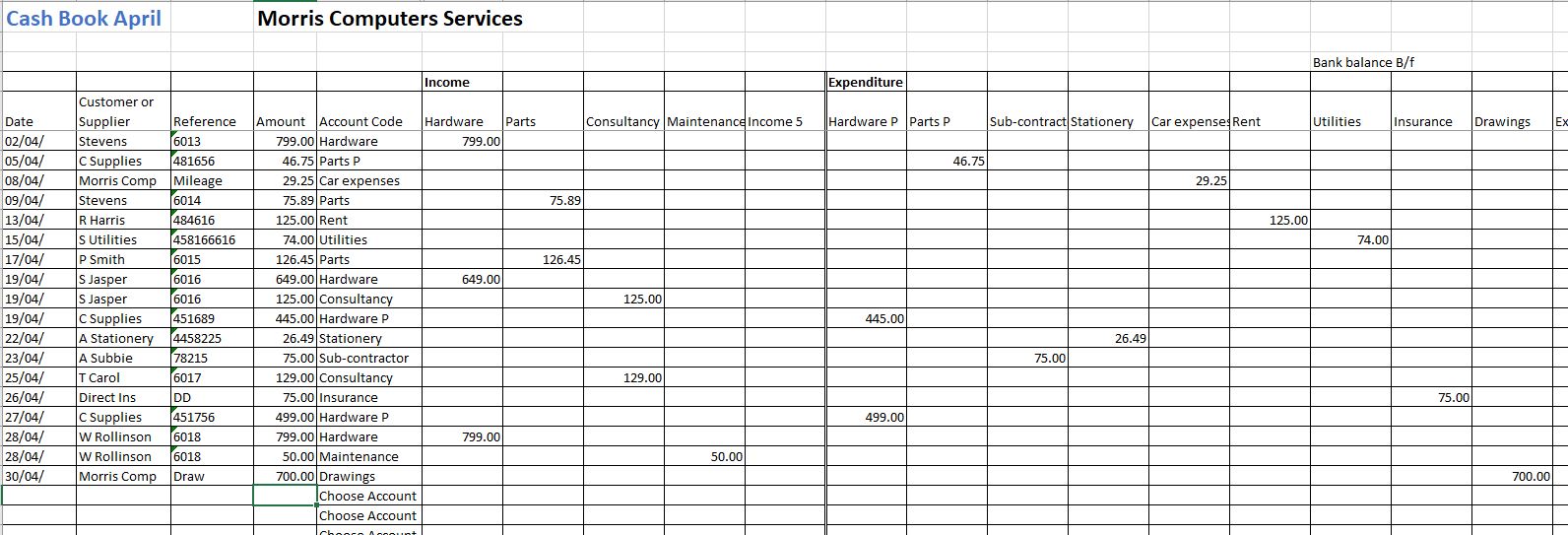

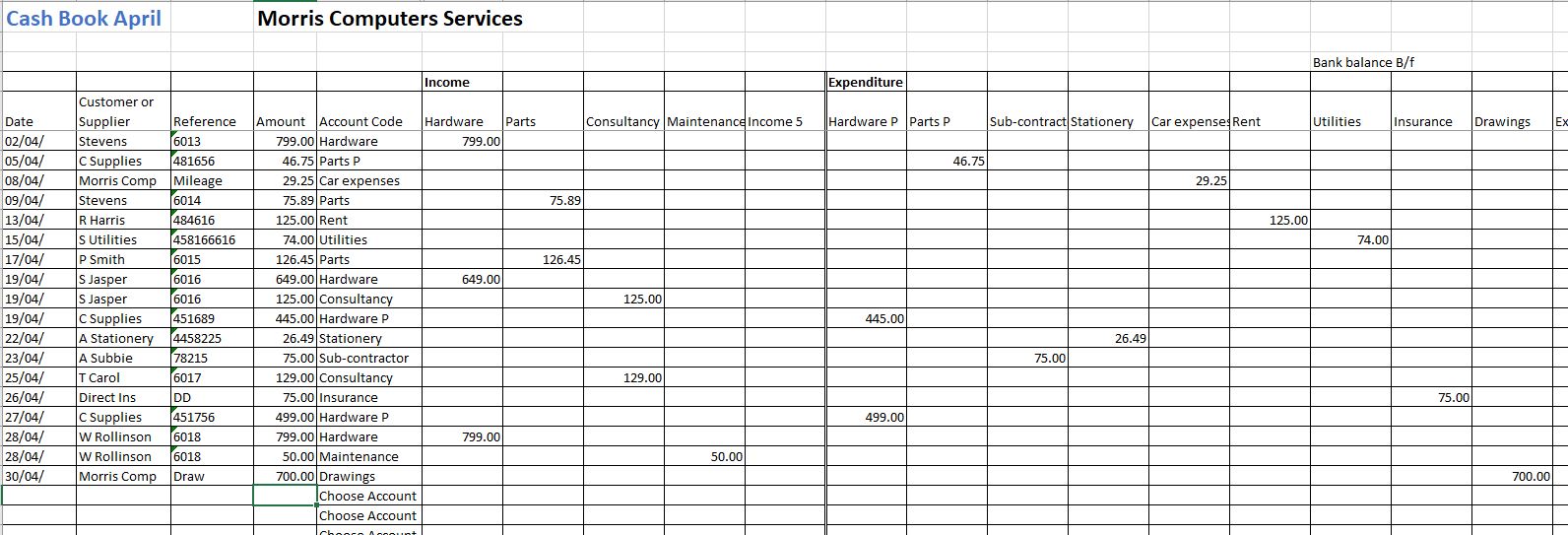

Our self-employed bookkeeping example is based on a computer repair specialist using our free cashbook template. For the business example, they rent small premises, pay utility bills, purchase computer parts and sell their services to repair computers.

All sales are cash; he issues a Word invoice as a receipt. Once the sale appears on his bank statement, record the transaction in the cash book template. Outgoings are paid either by debit card or Direct Debit and are easy to track. A few business expenses are also claimed using an expense claim form and paid by bank transfer.

Our free guide is available if you are unsure what business expenses you can claim.

Below is a one-month income and expenditure for April.

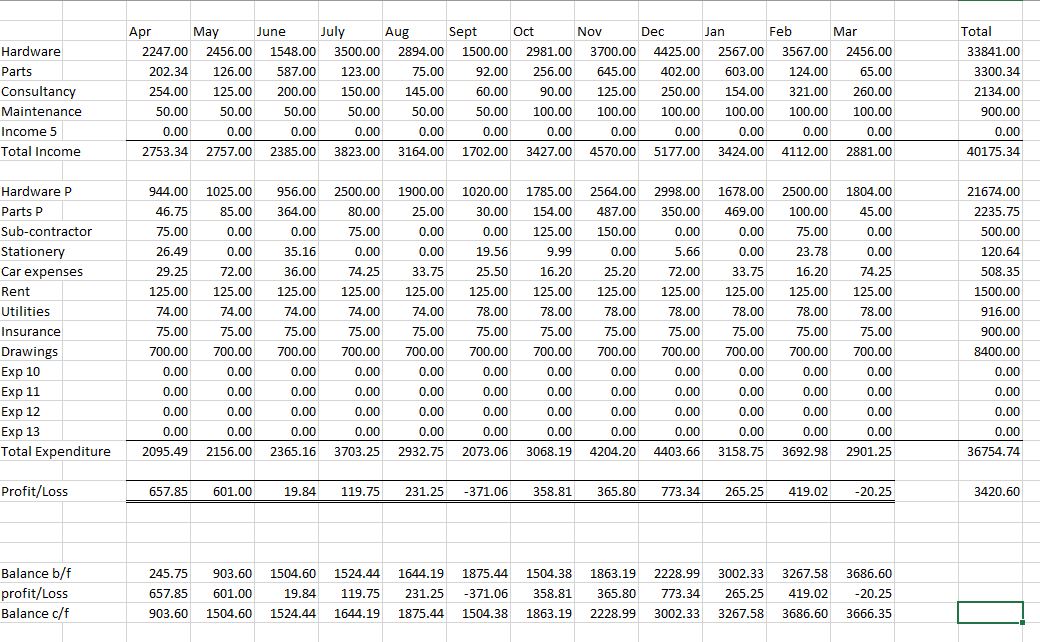

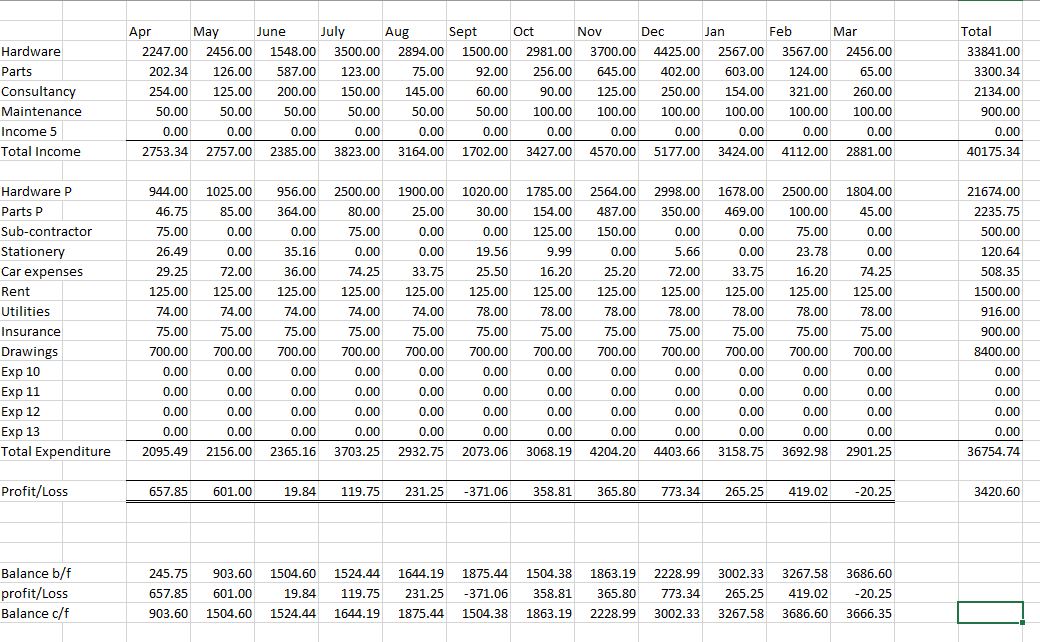

The totals page of the template shows all the figures for April and the end bank balance. You should always ensure that the bank balance equals the bank figure. If there is a difference, you must complete a bank reconciliation.

The totals page will look like this at the end of the year:

Once all the figures for the year are posted, you are ready to submit them to HMRC for self-assessment. One adjustment that needs to be completed is deducting the owner drawings as it is not an expense to the business. In the example, the sales are 40175.34 and expenses 36754.74 – 8400 = 28354.74. The total profit for the company is 40175.34 – 28354.74 = 11820.60.

The business owner must pay taxes on the profit. There are self-employed tax calculators that will calculate the tax due. The best calculator is employed and self-employed.

Self-Employed Bookkeeping Template

Our template uses the cash basis accounting method. This means you record income when you receive it and expenses when you pay them. It’s a simple method often preferred by self-employed individuals and small businesses. The self-employed bookkeeping template runs from April to March. If your accounting period is from 6th April to 5th April, the best advice is to add the April figures to the end-of-year figures in March. It makes checking the bank figures much easier.

Full instructions on using the cash book template are available.

Licence Agreement

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.

How do I keep my books?

There are several ways in which you can complete bookkeeping for the self-employed. The options include online accounting software, Excel spreadsheets and paper-based bookkeeping.

Can I complete my own Bookkeeping?

You can complete your own bookkeeping using any method you choose. Online bookkeeping software makes it easier to keep track of your transactions. We also offer free bookkeeping templates that many use.

One advantage of using bookkeeping services is knowing everything the business can claim. If you are unsure about completing the self-assessment tax return, hiring a bookkeeper or accountant is better.

Do I need a Business Bank Account if I am Self-Employed?

You do not need a separate business bank account, but it is better to have one. It enables you to keep your personal and business transactions separate. Most banks offer business accounts.

How do I Know How Much Tax to Pay?

As a self-employed business, you must pay income tax and national insurance. Setting aside money to pay your tax bill and ensure you can pay taxes on time is worth it. You manage taxes through HMRC; they will send statements stating when and how much to pay.

When you complete a self-assessment tax return, the tax is calculated. If you want to calculate tax and national insurance contributions before submitting the tax return, we have created a self-assessment tax calculator.

How do I register as Self-Employed?

To officially become self-employed in the UK, you must register with HM Revenue and Customs (HMRC) through the Self Assessment system. It’s best to register as soon as possible after starting your business, but the deadline is by the 5th of October, following the end of the tax year you started.

Conclusion on Bookkeeping for Self-Employed

Bookkeeping for the Self-employed can be done in various ways, but online accounting software is the most efficient way to keep track of your transactions.

Our free cashbook template makes it easy to post your business income and expenses monthly, and you can use our guide to claim all the business expenses you are entitled to.