Bookkeeping is the foundation of every successful business. It involves recording, organising, and maintaining financial transactions, including income, expenses, and invoices. Whether you’re a sole trader or running a growing business, understanding bookkeeping basics is essential for staying compliant with HMRC, managing cash flow, and making informed decisions.

In this comprehensive guide, we’ll break down the key components of bookkeeping in plain English. You’ll learn what bookkeeping involves, the systems available, essential tasks, and how to avoid common pitfalls. Plus, we’ll provide useful templates and tips to help you get started.

Bookkeeping Definition

Small Business bookkeeping is recording and organising a business’s financial transactions. It involves tracking income, expenses, assets, liabilities, and equity to provide a clear, accurate picture of the company’s financial position.

Bookkeeping vs Accounting

Bookkeeping is the first step in managing your business finances. It involves recording all business transactions—every sale, purchase, receipt, and payment. This includes organising bills, receipts, and invoices to ensure every penny coming in or going out is properly tracked. The easiest way to do this is to use bookkeeping software.

Accounting builds on this foundation. It takes the raw data gathered through bookkeeping and turns it into meaningful insights. Accountants analyse business transactions, prepare financial reports such as profit and loss statements and balance sheets, identify trends, and offer strategic advice to support informed decision-making.

In simple terms:

Bookkeeping is the process of accurately recording financial data.

Accounting is about interpreting, analysing, and using that data to guide your business.

What Does Bookkeeping Basics Involve?

Bookkeeping basics is more than just logging receipts. It includes:

- Recording daily business transactions (sales, purchases, payments)

- Managing customer and supplier invoices

- Reconciling bank statements

- Handling VAT returns

- Monitoring assets, liabilities, and equity

These activities help create a clear financial picture of your business and ensure accurate tax filings and financial reporting.

Daily Tasks: Record income and expenses, check receipts

Weekly Tasks: Review bank transactions, follow up on unpaid invoices

Monthly Tasks: Reconcile bank accounts, review financial reports, submit VAT if applicable

Bookkeeping Basics Terms

Understanding bookkeeping terms will make it much easier to stay on top of your business finances:

- Assets: What your business owns (e.g., cash, inventory, equipment).

- Liabilities: What your business owes (e.g., loans, unpaid bills).

- Equity: The value of your business after liabilities are deducted from assets.

- Income: Money your business earns (e.g., sales, services, interest).

- Expenses: Costs incurred to run your business (e.g., rent, salaries, supplies).

- Profit: The amount left over after expenses are deducted from income.

- Loss: When expenses exceed income.

- Invoice: A bill sent to a customer for goods or services.

- Receipt: Proof of payment for goods or services.

- Double-Entry Accounting: A system where transactions are recorded in two accounts (a debit and a credit).

- Ledger: A book or digital record where a business’s financial transactions are organised and summarised by account.

- Chart of Accounts: A list of all the accounts used to record financial transactions.

- Reconciliation: The process of comparing your records with bank or credit card statements to ensure accuracy.

- Financial Statements: Reports summarising your business’s financial performance (e.g., balance sheet, income statement, cash flow statement).

For a complete list, see our bookkeeping and accounting terms.

Different Types of Bookkeeping Systems

There are two bookkeeping systems:

Single-Entry Bookkeeping

- Suitable for very small or cash-based businesses

- Records one side of each transaction

- Example: Log a payment received without noting which account it impacts

Double-Entry Bookkeeping

- Standard for most businesses

- Records two sides of each transaction (debit and credit)

- Helps track where money is coming from and going to

Which to Choose? Most small UK businesses benefit from a double-entry system for better accuracy and reporting.

Accounting Software Best Deals

Sage UK – 90% Discount for 6 Months – FREE plan for Sole-Traders, AI tools for bookkeeping automation

XERO – 90% Discount for 6 Months + Amazon Gift Card – Cloud accounting, unlimited users, smart bank feeds

QuickBooks – 90% Discount for 7 Months – Invoicing, expense tracking, payroll, financial reports

Setting Up Your Bookkeeping System

There are several ways to complete the bookkeeping. Depending on your skills and the size of the business, the best option will vary.

Paper Records or Ledger Books

A ledger book is a physical record book where you manually enter every financial transaction. It typically includes columns for the date, description, and debit and credit amounts.

- Pros: Simple and straightforward, requires no special software or technology.

- Cons: Time-consuming, prone to human error, and difficult to search and analyse data.

Microsoft Excel

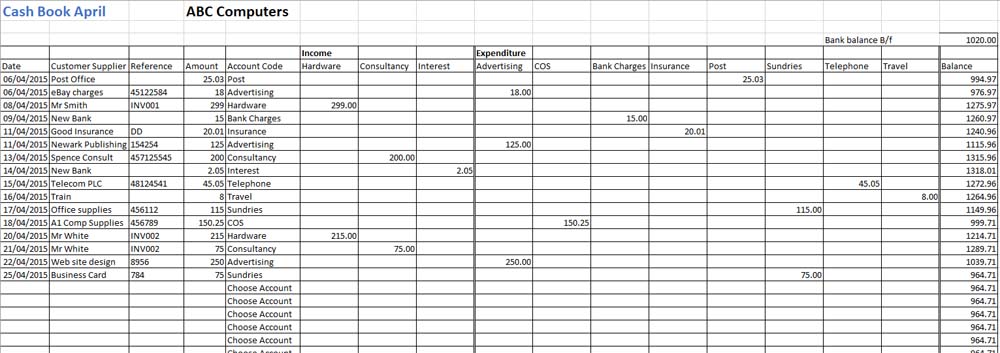

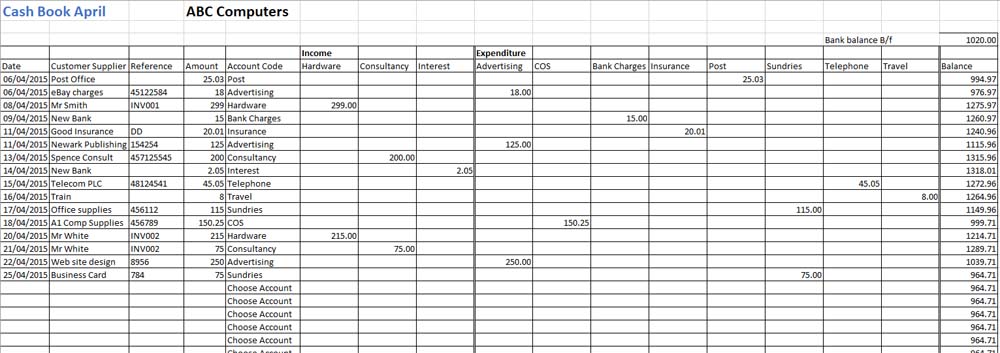

Excel spreadsheets offer a more flexible and convenient way to digitally record business transactions. You can create custom templates, formulas, and charts to organise and analyse your financial data.

- Pros: Relatively easy to use, familiar to many, allows for customisation and calculations.

- Cons: It can become complex quickly, requires some spreadsheet knowledge, and has the potential for formula errors.

We have created a basic bookkeeping template to record your income and expenses for the year.

See also our list of other helpful bookkeeping templates.

Accounting Software (Streamlined Solution):

Accounting software solutions, such as Sage UK, Xero or QuickBooks, automate many bookkeeping tasks, making it easier to record business transactions, prepare financial statements, and reconcile bank accounts.

- Pros: It is efficient and accurate, offering a wide range of features and often including cloud storage for easy access.

- Cons: It can be more expensive than other options and may require a learning curve for new users.

Top Tip: When choosing the best way to record financial transactions, consider the long-term implications to ensure your choice is suitable if the business expands. Accounting software can grow with your business.

Essential Bookkeeping Tasks

A good bookkeeping system covers all financial activities within your own business. Below are the key tasks that bookkeepers typically handle regularly.

1. Recording Income and Expenses

At the heart of bookkeeping is the accurate recording of business transactions. This includes all income (such as sales and interest received) and expenses (including supplies, rent, utilities, and subscriptions).

Best practices:

- Record transactions as they happen (don’t leave it to the end of the month)

- Keep digital or paper copies of all receipts

- Use software to automate categorisation where possible

2. Invoicing Customers (Accounts Receivable)

Creating and managing customer sales invoices is vital for maintaining healthy cash flow. Bookkeepers must issue clear, professional invoices with payment terms and due dates. Just as important is tracking when payments are received and following up on overdue accounts.

Tips:

- Number invoices sequentially for easy tracking

- Use automated reminders for unpaid invoices

- Regularly reconcile what’s owed with what’s been paid

3. Paying Suppliers (Accounts Payable)

Bookkeepers are responsible for accounts payable, logging supplier invoices, tracking due dates, and ensuring timely payment of outstanding amounts. This helps maintain good supplier relationships and avoids late fees or service disruptions.

Tasks include:

- Verifying supplier invoices against purchase orders or delivery notes

- Scheduling payments to meet due dates

- Maintaining a record of paid and unpaid bills

4. Bank Reconciliation

Bank reconciliation is the process of comparing your bank statements with your bookkeeping records to ensure they match. Any discrepancies—like missed transactions or bank fees—must be identified and corrected.

Why it matters:

- Prevents errors and fraud

- Ensures your records are complete and up to date

- Helps with accurate financial reporting

5. VAT (for VAT-registered businesses)

If your business is registered for VAT, you must track VAT on sales and purchases. This includes issuing VAT-compliant invoices, keeping proper records, and submitting returns through Making Tax Digital (MTD)-compliant software.

Key tasks:

- Apply the correct VAT rate on invoices

- Separate VAT from net amounts in records

- Submit returns on time to avoid penalties

6. Payroll Expenses

If you employ staff, payroll expenses are a crucial part of bookkeeping. This involves calculating wages, PAYE, National Insurance, and pension contributions. You’ll also need to submit reports to HMRC under Real Time Information (RTI) rules.

Includes:

- Recording employee hours or salaries

- Issuing payslips

- Submitting FPS (Full Payment Submission) to HMRC

- Handling holiday pay, sick pay, and statutory leave

7. Petty Cash

Petty cash is used for small, day-to-day expenses, such as postage, snacks, or taxi fares. Bookkeepers must keep track of every petty cash transaction, retain receipts, and reconcile the fund regularly.

Good practice:

- Keep a petty cash log or use a spreadsheet template

- Set a fixed amount and top up as needed

- Always get receipts for purchases

8. Maintaining Financial Records

A key bookkeeping duty is organising and storing financial records. This includes receipts, bank statements, tax returns, and invoices. HMRC requires most business records to be kept for at least six years.

Records to maintain:

- Sales and purchase invoices

- Bank statements

- VAT records

- Payroll records

- Annual accounts

9. Journal Entry

A journal entry records a business transaction by showing the affected accounts, the amounts, and a brief note. It’s used for adjustments, corrections, or transactions that your software doesn’t automatically capture.

10. Preparing Financial Reports

Bookkeepers often generate basic reports to help business owners understand their performance. These might include:

- Profit and Loss statement (Income Statement)

- Balance Sheet

- Cash Flow report

10. Budgeting and Forecasting Support

While the business owner or accountant often leads budgeting, bookkeepers provide the real data behind forecasts. Clean, up-to-date records allow for more accurate budgeting.

11. Compliance Monitoring

Bookkeepers help ensure the business meets important financial deadlines, such as:

- VAT return submission dates

- Payroll filing deadlines

- Corporation tax and self-assessment timelines

Common Bookkeeping Mistakes to Avoid

Avoiding these mistakes can save time and money:

- Mixing business and personal finances: Always keep separate accounts

- Skipping reconciliations: Leads to errors and missed entries

- Not backing up data: Risk of losing vital records

- Poor invoice tracking: Delayed payments hurt cash flow

- Ignoring tax deadlines: Can result in fines from HMRC

Benefits of Good Bookkeeping

Proper bookkeeping isn’t just a legal requirement—it brings significant business benefits:

- Improved Cash Flow: Know exactly when money is coming in or going out

- Better Decision-Making: Base choices on accurate data

- Simplified Tax Filing: Easy access to financial reports and records

- HMRC Compliance: Meet statutory requirements with confidence

- Investor/Loan Readiness: Clear records boost your credibility

When to Hire a Bookkeeper or Accountant

You might start with DIY bookkeeping, but as your business grows, hiring help can be a smart move.

Signs you need help:

- Lack of time to manage records

- Struggling with VAT or payroll

- Preparing for a funding application or audit

Bookkeeper vs Accountant:

- A bookkeeper manages daily records

- An accountant focuses on tax, strategy, and financial statements

Costs vary depending on location and the services required, but many UK small businesses benefit from part-time or freelance support.

Financial Reporting: Understanding the Profit and Loss and Balance Sheet

Financial reports provide a clear snapshot of your business’s financial health. Two of the most critical reports every small business should understand are the Profit and Loss Statement and the Balance Sheet.

Profit and Loss Account (P&L)

Also known as the income statement, this report shows how much money your business earned and spent over a specific period, usually monthly, quarterly, or yearly.

Key parts of a P&L:

- Revenue (Sales): Total income from selling products or services

- Cost of Goods Sold (COGS): Direct costs of producing goods or services

- Gross Profit: Revenue minus COGS

- Operating Expenses: Overheads like rent, salaries, and marketing

- Net Profit: What’s left after all expenses (this is your “bottom line”)

Why it matters:

The P&L shows whether your business is profitable and where you might be overspending.

Balance Sheet

The balance sheet provides a snapshot of what your business owns and owes at a single point in time.

Key components:

- Assets: What your business owns (e.g. cash, stock, equipment)

- Liabilities: What your business owes (e.g. loans, unpaid bills)

- Equity: The owner’s share of the business after liabilities are deducted from assets

Why it matters:

It helps you assess financial health, shows your net worth, and is crucial when applying for loans or investments. Meet financial obligations. Consider this a map of your cash flow, revealing where money is coming from and where it’s going.

Accounting Equation

The accounting equation is the foundation of double-entry bookkeeping. It ensures that your books are always balanced by showing the relationship between your business’s assets, liabilities, and equity.

The Basic Formula:

Assets = Liabilities + Equity

Why It Matters:

Every business transaction affects this equation. For example:

- If you take out a business loan, both your assets (cash) and liabilities (loan) increase.

- If you purchase equipment with your own money, your assets increase, and so does your equity.

This equation ensures that your books remain balanced after every transaction—an essential part of accurate bookkeeping.

Basics of Bookkeeping – Free Resources and Templates

To help you get started, we’ve created free tools:

- Bookkeeping Checklist – A weekly and monthly task list

- Excel Bookkeeping Template – Track income and expenses – used by many small businesses

- Invoice Template – Ready to send to clients

- Bookkeeping examples – for small businesses

Download these from our Free Templates page.

FAQs

Do I need bookkeeping if I’m a sole trader?

Yes. Regardless of business size, even if you’re a sole trader, you must track income and expenses for HMRC.

What’s the difference between bookkeeping and accounting?

Bookkeeping records transactions; accounting interprets and reports on them.

How long should I keep bookkeeping records?

HMRC requires records to be kept for at least 6 years.

Should I hire a Professional Bookkeeper?

If you feel confident, you can complete your own bookkeeping, but there are times when hiring a professional bookkeeper will save time for other tasks.

Conclusion

Bookkeeping doesn’t have to be complicated. With a clear system in place and the right tools, you can stay organised, make wise decisions, and avoid surprises at tax time.

Whether you handle your own records or hire a professional, mastering the basics of bookkeeping will set your business up for long-term success.

Next step: Download our free bookkeeping templates and explore our other beginner-friendly guides to take control of your business finances.